Developer loses 6 billion Yen in fraudulent land sale

August 30, 2017Japan real estate,japan real estate market,tokyo real estate,Tokyo real estate market,Gotanda,Japan Real Estate News,Tokyo Real Estate NewsBuyer Beware!,Real Estate News,All,Tokyo

Major property developer Sekisui House has reported to have lost as much as 6.3 billion Yen (approx. 58 million USD) to scammers in a fraudulent land sale in central Tokyo.

According to a public announcement made by Sekisui earlier this month, they had agreed to purchase the property from a company that claimed to have already signed a tentative sales agreement with the alleged property owner. On the day of settlement, the property title was to be transferred from the original owner to the middle company and then to Sekisui. After the money had changed hands, the registry office (the government agency responsible for recording official changes in property titles) rejected the deed-change application because the title and identification documents from the alleged seller were falsified. By this point the ‘seller’ and associated parties had fled with the money and could not be contacted.

Apartment occupancy rates reach record high in Japan

August 29, 2017Japan real estate,japan real estate market,Residential housing vacancy rates in Japan,Japan Real Estate News,Tokyo Residential Rental Market,Tokyo Apartment Rental Market,Japan Residential Rental Market,Japan Apartment Rental MarketReal Estate News,Rental Market,Market Information,All,Osaka,Nagoya,Tokyo

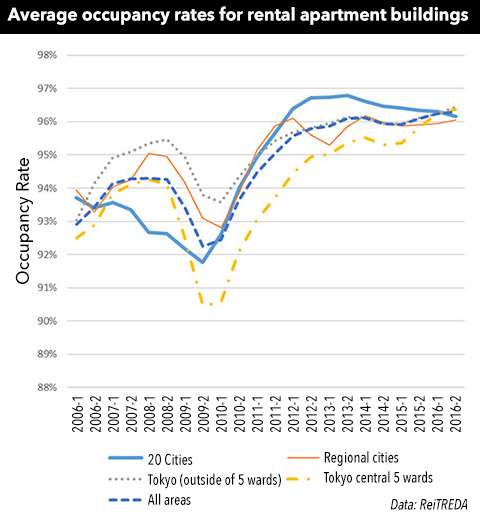

The average occupancy rate of rental apartment buildings acquired by J-REITs has been steadily improving since 2010 and has exceeded levels last seen during the peak in 2008. In the second half of 2016 the average occupancy rate was 96%, a record high.

This is due both to an improving property market and REITS acquiring relatively new buildings in prime, central locations. While occupancy rates remain high in Tokyo, other cities across the country are seeing a reversal with a declining trend evident since 2013.

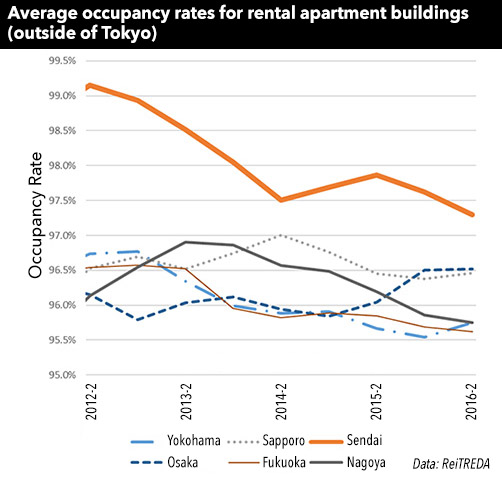

Trends in cities other than Tokyo:

- Sapporo: Although occupancy levels are relatively high, they have been decreasing since late 2014.

- Sendai: Occupancy rates reached record highs due to housing demand following the Tohoku disaster in 2011, but have been slowly falling. Sendai has seen the highest decline of all cities.

- Yokohama: Occupancy has been falling since mid-2013, although there was an improvement in the second half of 2016.

- Nagoya: Occupancy rates have been falling since 2013 and are sitting at a comparatively low level.

- Osaka: Occupancy rates have been improving since late 2015 and are at a relatively high level.

- Fukuoka: Occupancy rates have been steadily falling. The rate of decline has been influenced by a building with an occupancy rate of less than 80%.

*Central Tokyo 5 wards: Chiyoda, Chuo, Minato, Shinjuku, Shibuya.

Source: Mizuho Real Estate Market Report, July 14, 2017.

Tokyo apartment asking prices in July 2017

August 28, 2017Japan real estate,japan real estate market,tokyo real estate,Tokyo apartment prices,Tokyo real estate market,Japan Real Estate News,Tokyo Real Estate NewsReal Estate News,Market Information,All,Osaka,Nagoya,Tokyo

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq ft) second-hand apartment across greater Tokyo was 35,620,000 Yen in July, showing no change from the previous month but up 1.9% from last year. The average building age was 22.9 years.

In Tokyo’s 23 wards, the average asking price was 53,260,000 Yen, up 0.3% from the previous month and up 0.9% from last year. The average building age was 22.3 years.

In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya) the average asking price was 72,860,000 Yen, down 0.4% from the previous month but up 1.4% from last year. The average building age was 20.6 years.

Hublot moves into historic machiya in Gion, Kyoto

August 25, 2017Gion Real Estate Market,Gion Real Estate News,Japan real estate,japan real estate market,Traditional Japanese Architecture,Traditional Japanese Homes,Kyoto Real Estate News,Japan Real Estate News,Kyoto,Kyoto Machiya,Kyoto Real Estate Market,Kyoto Real EstateKyoto,Historic Properties,All,Real Estate News,Office/Retail News & Information

Swiss watch brand Hublot will be opening up a boutique in an old machiya-style townhouse in Kyoto’s famous Gion district on August 26. The previous tenant was Hermes.

The shop will feature custom Japanese washi paper and wickerwork replicating the company’s logo, while customers will receive Japanese-style folding fans as gifts.

Shinjuku office vacancy rate drops to 1% range

August 24, 2017Shinjuku Real Estate News,Shinjuku Real Estate Market,Japan real estate,japan real estate market,Tokyo Office Market,tokyo real estate,Japan Office Market,Tokyo Real Estate News,Japan Office Vacancy Rates,Japan Real Estate News,Tokyo real estate marketCommercial Real Estate,Tokyo,Office/Retail News & Information,All,Market Information,Real Estate News

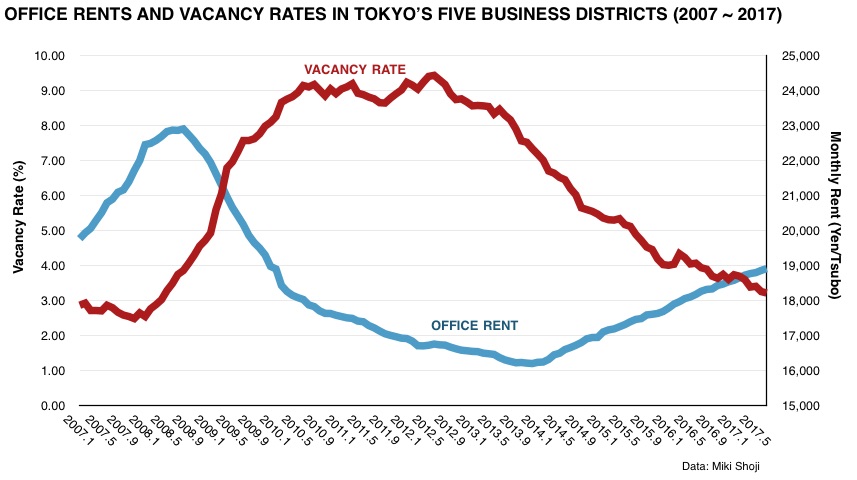

The office vacancy rate across Tokyo’s five central business districts of Chiyoda, Chuo, Minato, Shinjuku and Shibuya dropped to 3.22% in July, down 0.04 points from June and down 0.72 points from July 2016. This is close to the record low of of 3.03% reported in April 2008 and down from a high of 9.43% seen in June 2012.

The vacancy rate in existing buildings (excluding new construction) was 2.87% in July, down 0.74 points from last year.

In Shinjuku ward, the vacancy rate was 1.68%, down 0.06 points from the previous month and down 1.30 points from last year. The vacancy rate dropped to the 1% range in May 2017.

265m tall tower for Toranomon Hills district

August 23, 2017Toranomon Real Estate News,Toranomon Real Estate Market,Japan real estate,japan real estate market,tokyo real estate,Tokyo Real Estate News,Japan Real Estate News,Toranomon Hills Station Tower,Toranomon,Toranomon Real Estate,Tokyo real estate marketTokyo,Office/Retail News & Information,Hotel News,All,Redevelopment & Reconstruction,Real Estate News

More details have been released on the Toranomon Hills Station Tower which will be built on the north-west side of Toranomon Hills in central Tokyo. The building height will be 265 meters, which is 18 meters taller than the neighbouring Toranomon Hills tower and 17 meters taller that Tokyo Midtown.

Construction of the 49-storey tower is scheduled to start in 2019 with completion by 2022 2023.

Desperate sellers in ski resort town forced to pay buyers to offload apartments

August 22, 2017Japan real estate,japan real estate market,Japanese holiday home,Resort Property,Japan Ski Resorts,Yuzawa,Akiya,Japan Real Estate News,Japan's abandoned home issue,Yuzawa Real Estate MarketReal Estate News,All

Some owners, in an attempt to offload their apartments in aging ski resort towns, are paying companies to take the properties off their hands. For companies offering this relatively new service, charging fees to the seller is how they balance the risk of holding a property that comes with high running costs and limited resale potential.

How it works

According to the website of a company that specializes in buying up resort apartments, they ask the seller to pay them enough to cover the following: