Akasaka Garden City sells for 54.6 billion Yen

Sekisui House Reit is selling its share in Akasaka Garden City to an unnamed domestic special purpose company for 54.6 billion Yen (approx. US$365 million).Read more

Share of Kinshicho office tower to sell for 18.5 billion Yen

Global One Real Estate Investment Corp. is selling its ownership share in the 22-story Arca Central office building in Kinshicho for 18.5 billion Yen (approx. US$124 million). The buyer has not been publicly disclosed.Read more

Nogizaka talent agency HQ sold to real estate company

Real estate giant HULIC has emerged as the buyer of the disgraced former Johnny & Associates (now Smile-Up) headquarters in Akasaka. The sale took place in June 2024 at an undisclosed price.Read more

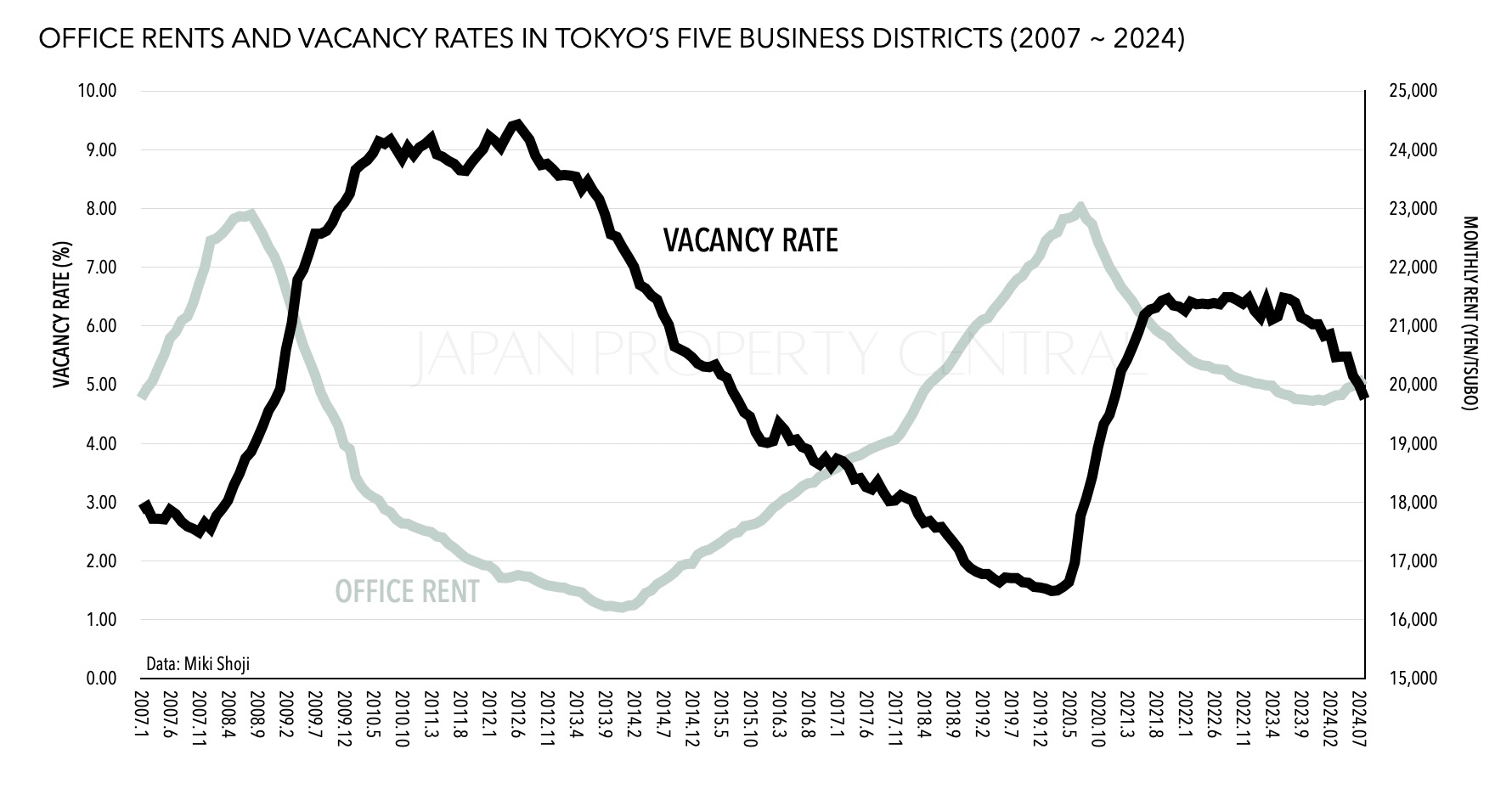

Central Tokyo's office vacancy rate drops to lowest level since Dec 2020

Central Tokyo’s office vacancy rate dropped to 4.76% in August, the lowest level seen since December 2020, according to brokerage Miki Shoji. For existing buildings, excluding new construction, the vacancy rate was 4.53%, down from 5.64% seen this time last year.Read more

Denso sells 10ha former factory site in Nagoya

A developer is acquiring the 10 hectare site of a former factory in Nagoya, with the acquisition price thought to be over 20 billion Yen (approx. US$140 million).Read more

New office building for Sapporo's neon nightlife neighborhood

This November, Tokyu Land Corporation will open a 13-story tenant office building (pictured above) in Sapporo’s Susukino neighborhood, the biggest entertainment district north of Tokyo. Why build an office here?

Susukino is a major shopping and entertainment destination, and not commonly thought of as an office district. Why would a developer build an office here? A representative from the developer, Tokyu Land Corporation, said that as the lines between work life and personal life blur, an office in a more vibrant location with plenty of places to eat, shop and be entertained might make for a more exciting work environment.Read more

44-yr old Osaka office building sells for over 30 billion Yen

Kanden Realty & Development, a subsidiary of the Kansai Electric Power Company, has paid over 30 billion Yen (US$208 million) for the former headquarters of textile manufacturer Toyobo.Read more