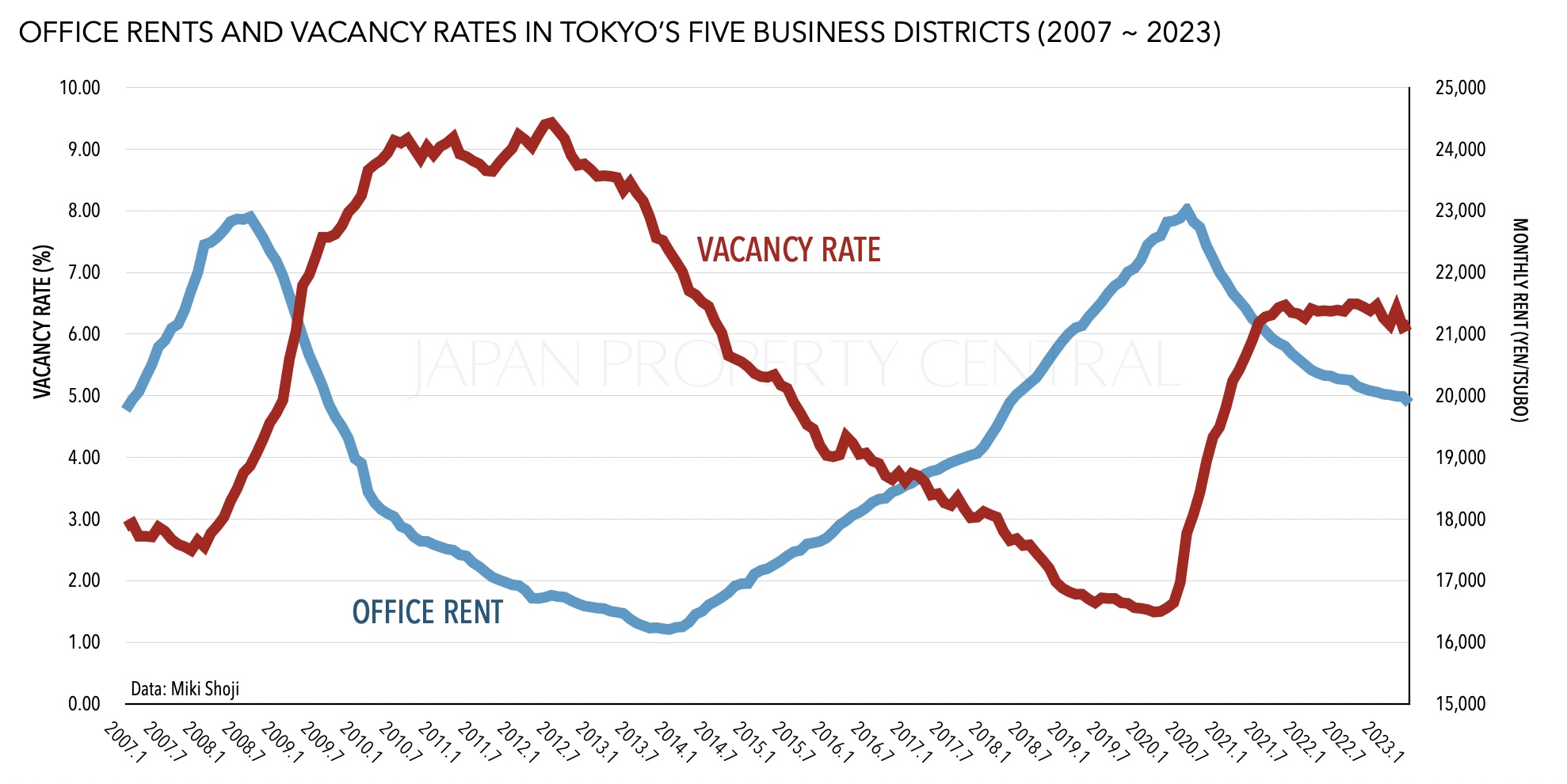

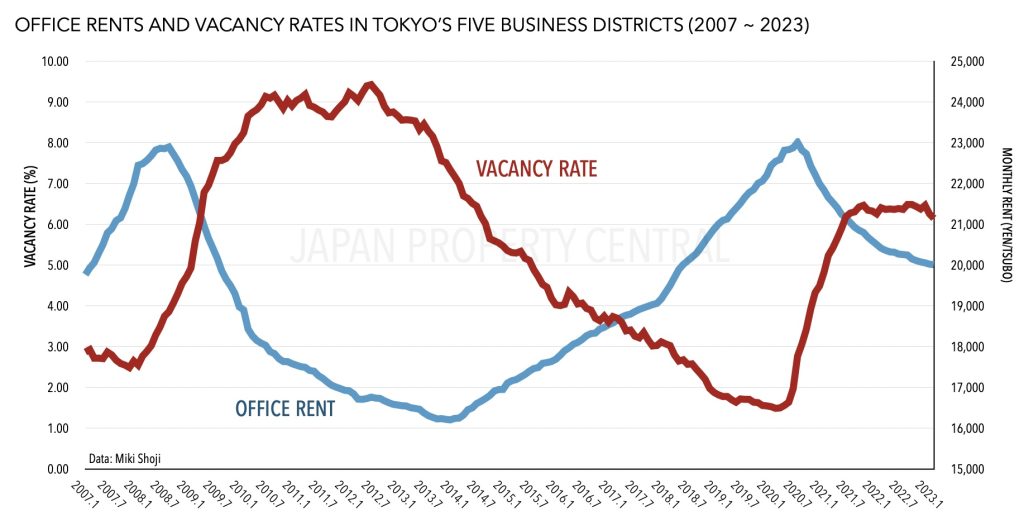

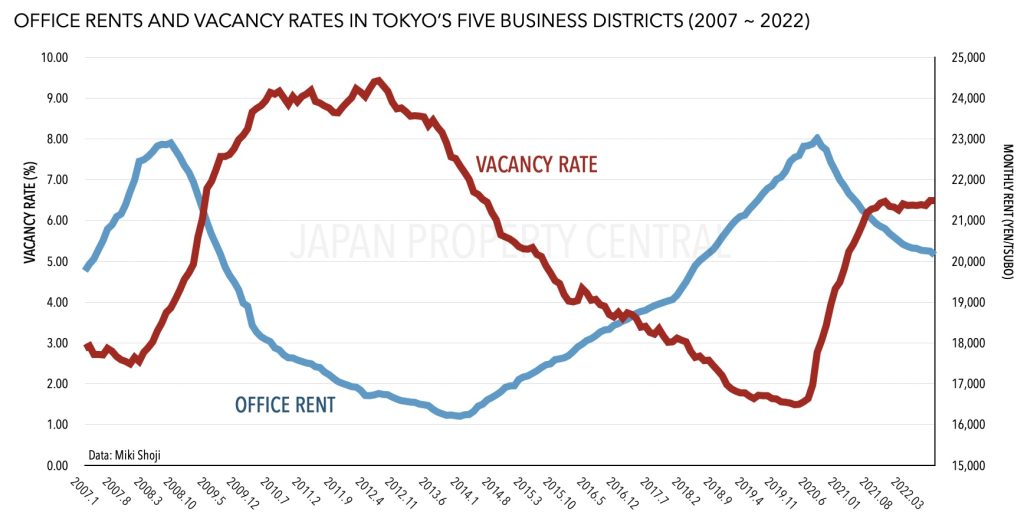

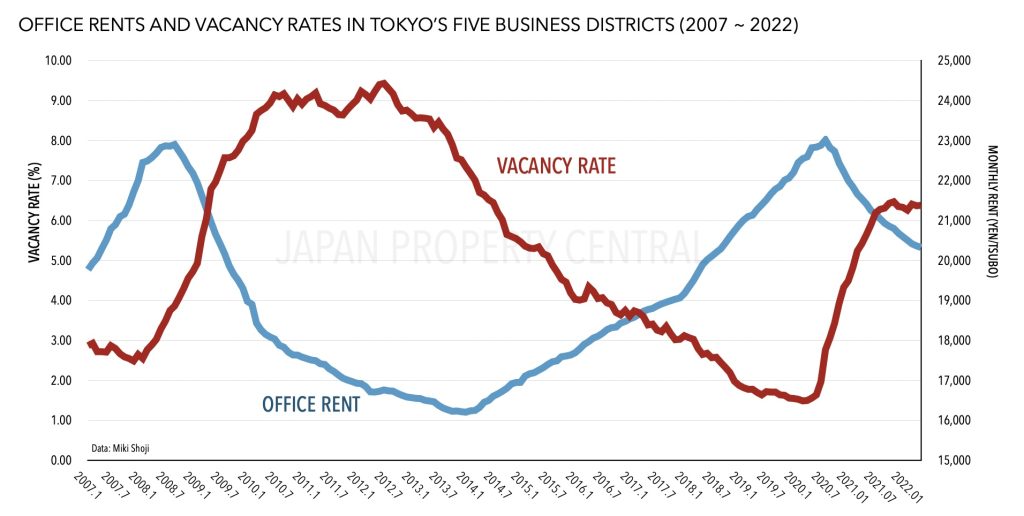

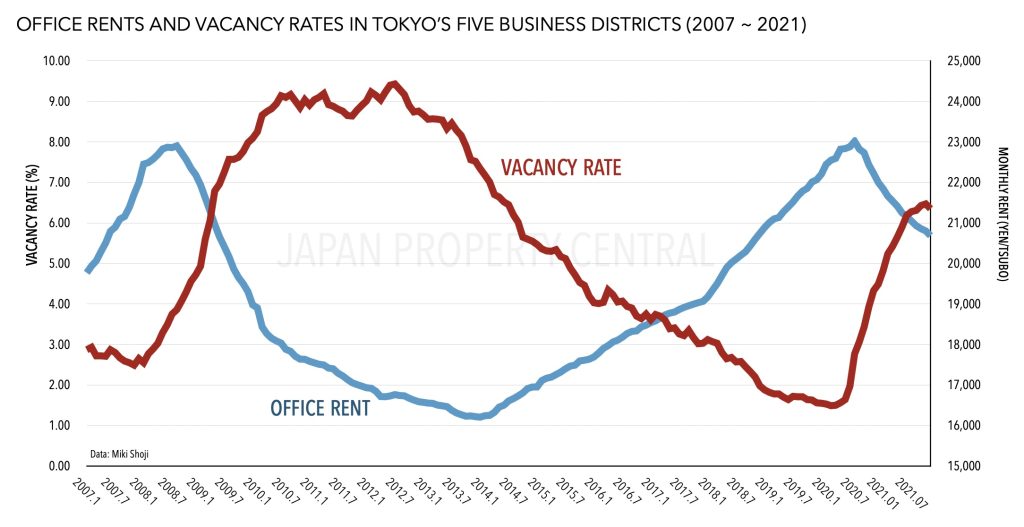

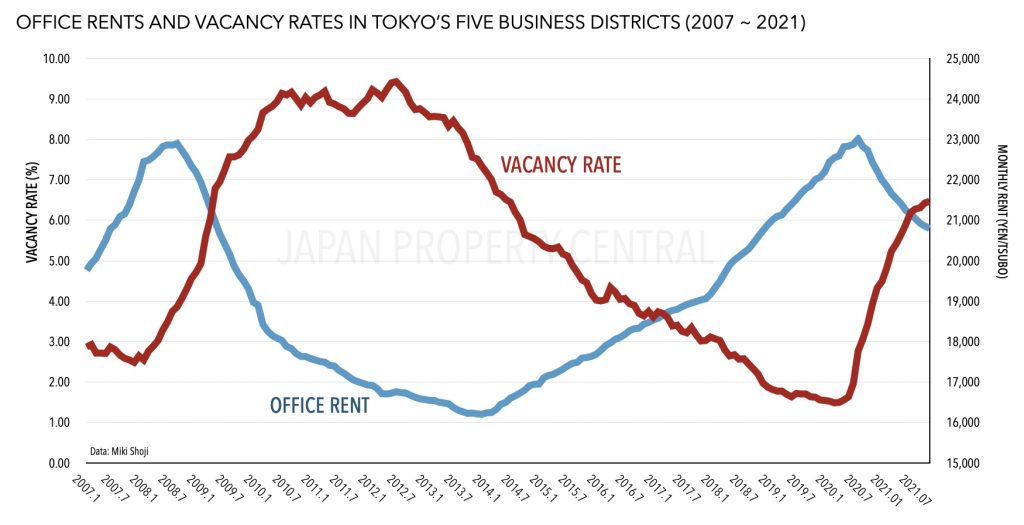

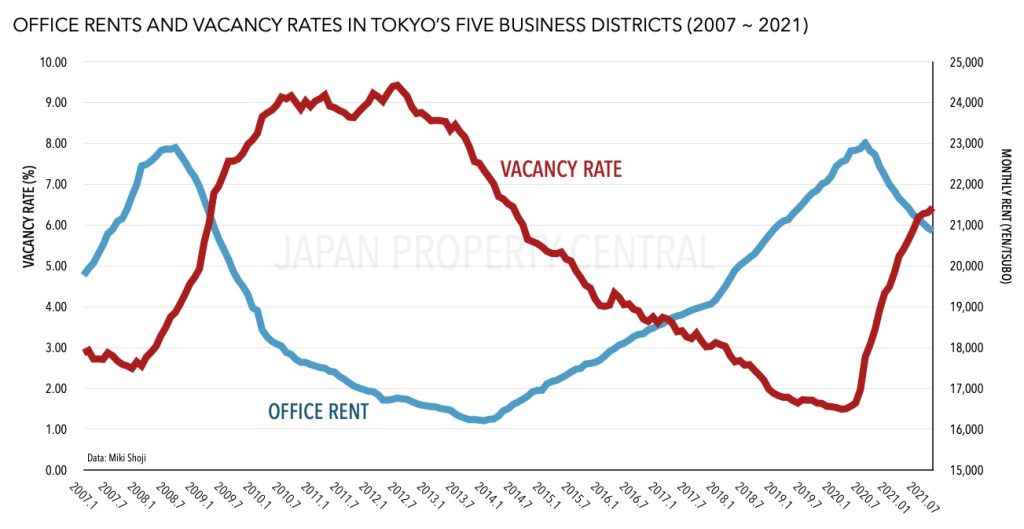

Tokyo office vacancy rates expected to stabilize at the 6% range

According to a report by Mitsubishi UFJ Trust and Banking Corporation, the office vacancy rate in Tokyo is expected to remain around the 6% range for the next five years. Rents are expected to bottom out in 2024, followed by a mild increase.Read more

According to a report by Mitsubishi UFJ Trust and Banking Corporation, the office vacancy rate in Tokyo is expected to remain around the 6% range for the next five years. Rents are expected to bottom out in 2024, followed by a mild increase.Read more

Tokyo's office vacancy rate hits 12-month low

Tokyo’s office vacancy rate saw a slight improvement in February, dropping by 0.11 percentage points to 6.15%, according to office brokerage Miki Shoji.

Office vacancy rate stays flat in Tokyo

The office vacancy rate in central Tokyo remained unchanged at 6.49% in September, according to office brokerage Miki Shoji. Office rents, however, continued to decline with the average rent dropping 94 Yen from August to 20,156 Yen per tsubo (approx. 6,098 Yen/sqm).

Tokyo’s office vacancy rate flattens in April

Tokyo’s office vacancy rate increased only slightly by 0.01 points to 6.38% in April as large-scale leases continued to be filled in existing buildings in the city center. Some tenants were relocating to be better located in Tokyo’s business districts. Vacant office space, too, saw little change from the previous month.

Tokyo's office vacancy rate improves for first time in 21 months

In November, the office vacancy rate in Tokyo improved for the first time in 21 months as concerns over the pandemic’s effects on the workplace seem to have weakened.

Tokyo office vacancy rate climbs for 20th month

According to brokerage Miki Shoji, the average vacancy rate for office space across Tokyo’s five business districts of Chiyoda, Chuo, Minato, Shinjuku and Shibuya reached 6.47% in October, up 0.04 points from the previous month and up 2.54 points from last year. This is the 20th month in a row to see an increase.

Office vacancy rate hits 7 year high

The average office vacancy rate across Tokyo’s five business districts of Chiyoda, Chuo, Minato, Shinjuku, and Shibuya reached 6.43% in September, up 0.12 points from the previous month and the highest level seen since June 2014 when it was 6.45%.