18,000 m2 Toranomon office building sells for 860 million Yen

Nippon Building Fund (NBF) has sold a 61-year old office building in Toranomon back to its sponsor, Mitsui Fudosan, for just 860 million Yen (US$5.5 million). This may seem like a remarkably low price, considering the REIT paid 13.3 billion Yen for it in 2004, and there’s a good explanation.Read more

Mitsubishi vacating Yokohama office tower

Mitsubishi Heavy Industries is relocating its head office operations from Yokohama to central Tokyo, joining related companies in aggregating its operations in one central location.Read more

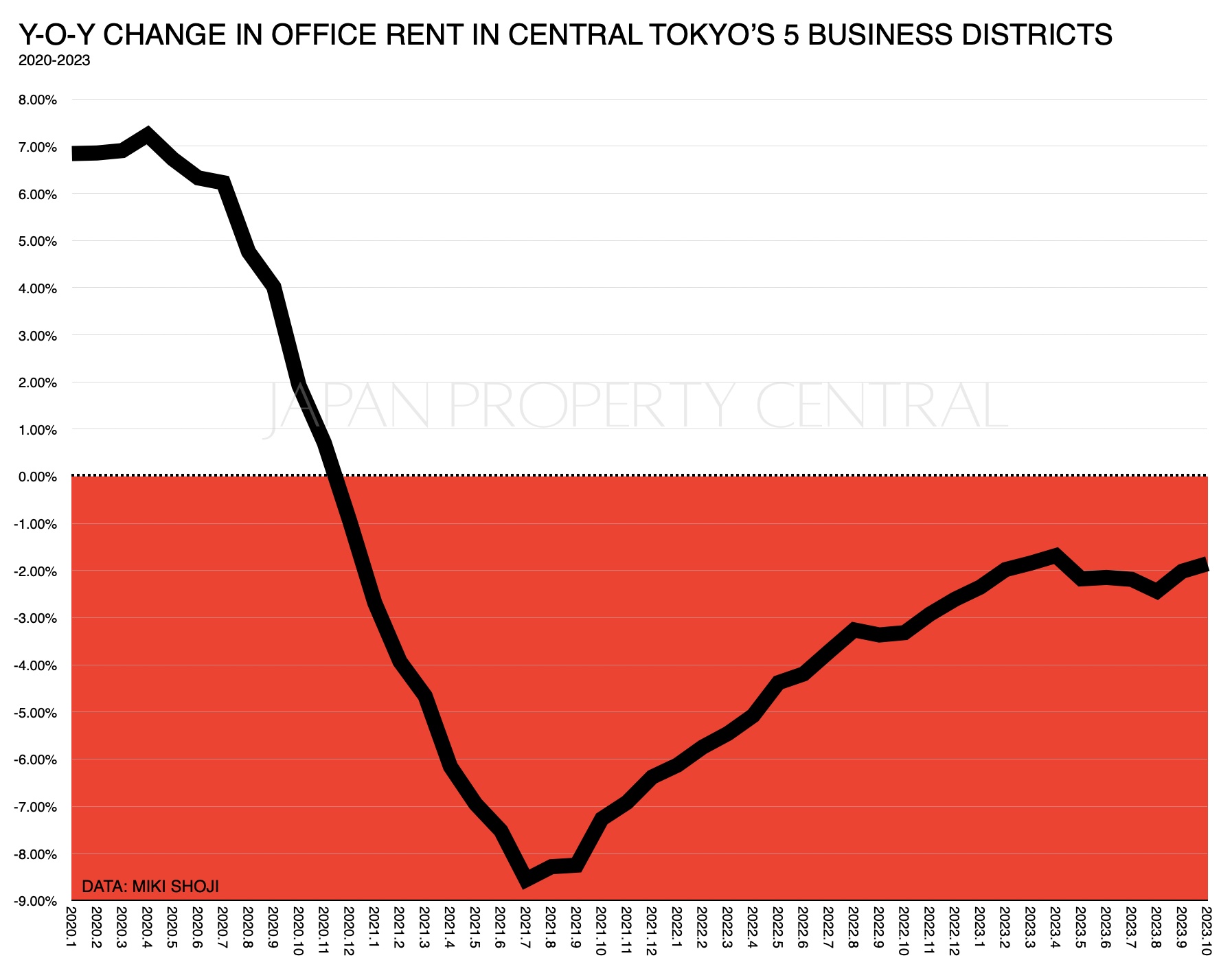

Office vacancy rate in Tokyo hits 33-month low

The office vacancy rate for existing buildings in central Tokyo’s five business districts reached a 33-month low in October. According to office brokerage Miki Shoji, the vacancy rate was 5.36%, down 0.71 points from last year and the 16th month in a row to record a year-on-year decrease. During the month, around 4,000 tsubo (13,220 sqm or 142,000 sq.ft) of space was absorbed thanks to some large-scale leases.Read more

The office vacancy rate for existing buildings in central Tokyo’s five business districts reached a 33-month low in October. According to office brokerage Miki Shoji, the vacancy rate was 5.36%, down 0.71 points from last year and the 16th month in a row to record a year-on-year decrease. During the month, around 4,000 tsubo (13,220 sqm or 142,000 sq.ft) of space was absorbed thanks to some large-scale leases.Read more

Tokyo's compact office market sees some record high rents

How are office rents doing for the compact sector of the office market? According to the latest biannual report by AtHome, the market seems fine. Overall, rents in Tokyo were relatively flat in the first half of 2023 but several areas saw rents hit 10-year highs. Read more

How are office rents doing for the compact sector of the office market? According to the latest biannual report by AtHome, the market seems fine. Overall, rents in Tokyo were relatively flat in the first half of 2023 but several areas saw rents hit 10-year highs. Read more

Nagoya high-rise on hold as construction costs soar and office market concerns rise

Plans for a 180-meter tall commercial building in Nagoya have been put on hold, according to an announcement made by the developer on July 5.Read more

Plans for a 180-meter tall commercial building in Nagoya have been put on hold, according to an announcement made by the developer on July 5.Read more

Chiba City wants more office buildings and is willing to pay for them

Chiba City has been suffering from a lack of quality office buildings in the city center, particularly in front of major stations, and is going to offer financial incentives of up to 2 billion Yen (approx. US$14.3 million) per project to encourage new construction or building extensions.Read more

Chiba City has been suffering from a lack of quality office buildings in the city center, particularly in front of major stations, and is going to offer financial incentives of up to 2 billion Yen (approx. US$14.3 million) per project to encourage new construction or building extensions.Read more

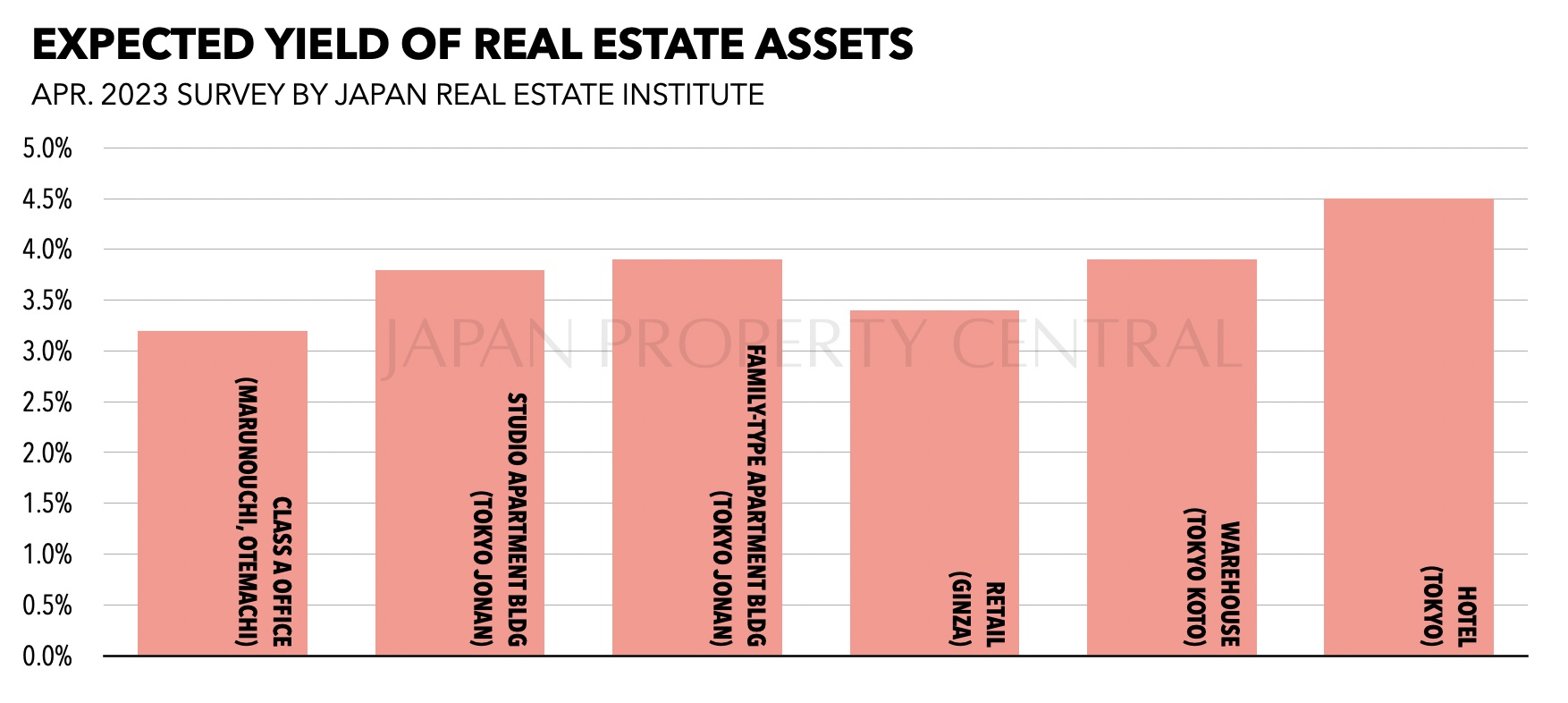

Expected yields on Japanese real estate remain at historic lows

Despite the turmoil happening in some overseas commercial real estate sectors, investors in Japanese real estate continue to anticipate record-low yields. That may be due in part to low interest rates which make it one of the few places with a positive yield spread over government bonds. The latest investor survey by the Japan Real Estate Institute in April shows expected yields have either remained the same or dropped, depending on the asset class and location.Read more

Despite the turmoil happening in some overseas commercial real estate sectors, investors in Japanese real estate continue to anticipate record-low yields. That may be due in part to low interest rates which make it one of the few places with a positive yield spread over government bonds. The latest investor survey by the Japan Real Estate Institute in April shows expected yields have either remained the same or dropped, depending on the asset class and location.Read more