Tokyo apartment sale prices increase for 59th consecutive month

September 13, 2017Japan real estate,japan real estate market,tokyo real estate,Tokyo apartment prices,Tokyo real estate market,Japan Real Estate News,Tokyo Real Estate NewsReal Estate News,Market Information,All,Tokyo

According to REINS, 2,265 second-hand apartments were sold across greater Tokyo in August, down 31.4% from July and down 5.0% from last year. August is one of the hottest months in the year and often a time when Japanese take a vacation, so sales are typically slower than in July or September.

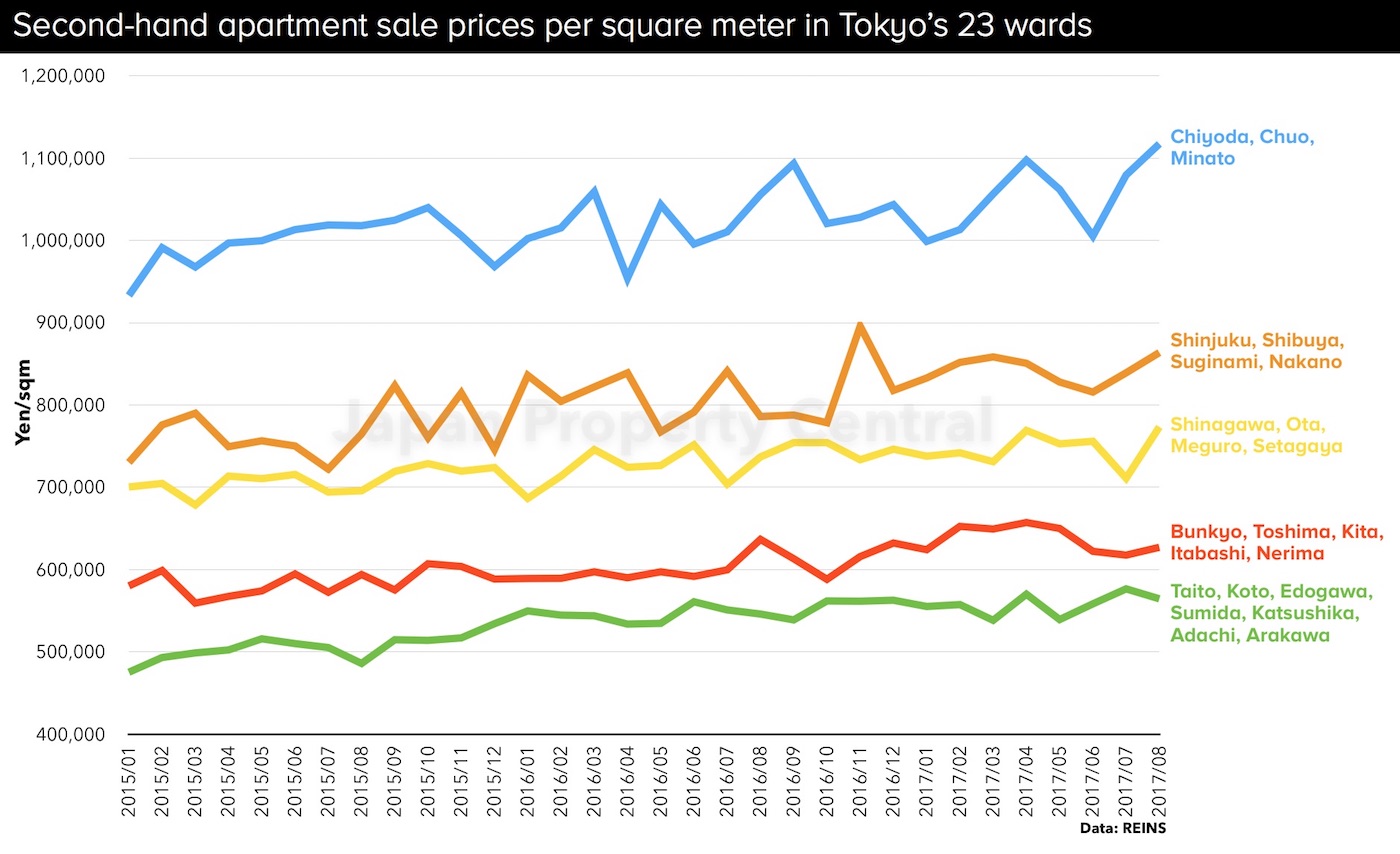

The average sale price was 32,380,000 Yen, up 2.5% from the previous month and up 7.6% from last year. The average price per square meter was 505,000 Yen, up 2.1% from the previous month and up 5.9% from last year. This is the 56th month in a row to record a year-on-year increase in sale prices. The average building age was 20.69 years.

In the Tokyo metropolitan area 1,141 second-hand apartments were sold, down 33.7% from the previous month and down 4.8% from last year. The average sale price was 40,350,000 Yen, up 4.4% from the previous month and up 7.4% from last year. The average price per square meter was 684,200 Yen, up 4.3% from the previous month and up 7.4% from last year. This is the 59th month in a row to record a year-on-year increase in sale prices. The average building age was 19.39 years.

Price growth in Tokyo more subdued than the 2007 mini-bubble

September 12, 2017Japan land values,Japan real estate,japan real estate market,Tokyo Land Prices,tokyo real estate,Koji-Chika Land Values,Tokyo real estate market,Ginza land prices,Tokyo land values,Japan Real Estate News,Tokyo Real Estate NewsReal Estate News,Market Information,All

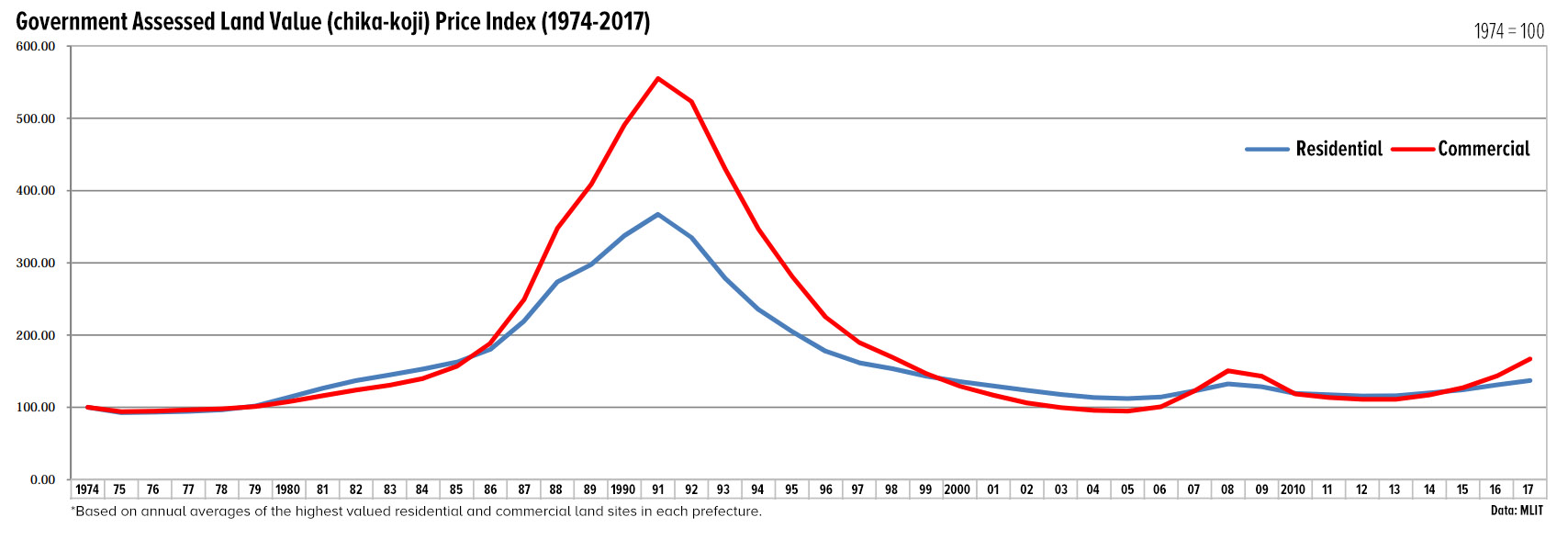

Earlier this year, rosenka tax values at a section of ultra-prime commercial land in Tokyo’s Ginza district increased by 26% from the previous year to a record high of 40,320,000 Yen per square meter, exceeding the previous high of 36,500,000 Yen/sqm in 1992 and causing some to warn of an impending bubble and overheating of the property market in the nation’s capital.

There is valid cause for concern in some sectors of the investment-property market due to potential over-construction and over-lending to landowners to build small blocks of 'apaato' type rental flats in suburban areas with low rental demand.

But are current conditions mimicking previous bubbles?

This time around Japan is getting more foreign tourists than ever before, boosting revenues for both hotels and retails shops, making the increase in commercial real estate values much more pronounced than the residential market which relies more on real domestic demand.

Tokyo Midtown Hibiya to open in March 2018

September 11, 2017Japan real estate,japan real estate market,tokyo real estate,Tokyo real estate market,Hibiya,Japan Real Estate News,Tokyo Real Estate News,Hibiya Real Estate,Hibiya Real Estate NewsOffice/Retail News & Information,Real Estate News,Redevelopment & Reconstruction,All,Tokyo

On September 4, Mitsui Fudosan announced that the official name of the large-scale redevelopment opposite Hibiya Park in downtown Tokyo will be Tokyo Midtown Hibiya. The 191m tall building will include office space, the 2,300 seat TOHO Cinemas Hibiya, and 60 stores and restaurants.

The grand opening is scheduled for March 29, 2018.

Banks to reduce home loan rates in September

September 8, 2017All,Home Loans / Mortgages

Four of Japan’s major banks announced that they will be reducing interest rates on new home loans this month.

The Bank of Tokyo-Mitsubishi UFJ will reduce the prime rate on their 10-year fixed-rate home loan by 0.05 points to 0.75%. Mitsui Sumitomo Banking Corporation, Mizuho Bank and Resona Bank will also reduce the rates on their 10-year fixed-rate loans by 0.05 points. Sumitomo Mitsui Trust Bank will leave their rates at their current level of 0.70%.Read more

Japan's short-stay law to be delayed 6 months

September 7, 2017Airbnb in JapanAll,Laws and Lawsuits

Those hoping to rent out their home legally on a short-term basis in Japan may have to wait a little longer as the government has delayed the de-regulation of the home sharing market until June 2018. According to the Japan Tourism Agency, the reason for the delay is to allow more time for local governments to formulate their own rules regarding the maximum number of nights permissible each year.

The government passed a law allowing short-term letting of homes and apartments in June 2017, with the rules initially expected to go into effect from January 2018.

Read more

Supply of new apartments shrinking as developers struggle to secure land

September 6, 2017Real Estate News,Market Information,All

In the midst of a recovering property market, Japan’s top real estate developers are struggling to find suitable plots for residential projects, causing supply to shrink and sales volumes to fall.

The total value of real estate available for sale by the country’s top five developers as at the end of June 2016 was 3.107 trillion Yen (approx. 28 billion USD), down 0.4% from March and the first time in 9 quarters to record a decline. Increasing land prices and intense competition has meant that even though demand for real estate remains high there are fewer projects on offer.Read more

Onsen and retail complex near new Toyosu Fish Market in jeopardy

September 5, 2017Japan real estate,japan real estate market,tokyo real estate,Toyosu,Tokyo real estate market,Toyosu Fish Market,Japan Real Estate News,Tokyo Real Estate NewsOffice/Retail News & Information,Real Estate News,All,Tokyo

The operator of a planned onsen, hotel and retail center to be built next-door to the Toyosu Fish Market in Tokyo has announced that they may withdraw their plans due to concerns about feasibility. The proposed ‘Senkaku-banrai’ center would include a 24hr hot spring bath, hotel and 200 restaurants and stores, with a forecast for 1.9 million annual visitors.