Yamaha Resort Tsumagoi sold to Kobe-based hotel operator

January 16, 2017Shizuoka PrefectureReal Estate News,All,Hotel News

Hotel Management International (HMI Hotel Group) will acquire the Yamaha Resort Tsumagoi in Kakegawa City, Shizuoka, in March. The seller is Yamaha Corporation. The sale price has not been announced.Read more

65-story building with 1,000 sqm penthouse apartment planned for Toranomon

January 13, 2017Azabudai,Toranomon,Toranomon-Azabudai District RedevelopmentNew Construction,Office/Retail News & Information,Real Estate News,Redevelopment & Reconstruction,All,Tokyo

Long-awaited plans for the Toranomon-Azabudai District in central Tokyo have finally been released. The development, which will be carried out by Mori Building, will include a 65-story mixed-use building that will contain mostly office space, as well as apartments and an international school. Construction is scheduled to start in 2018 with a completion date in 2022.

The 330 meter tall building will be Japan’s tallest building when complete in 2022 and just 2 meters shorter than Tokyo Tower, although it is expected to be overtaken by a 390 meter tall office tower planned for the Otemachi district near Tokyo Station.

The building will have a total floor area of 449,000 square meters (approx. 4.8 million sq ft). In addition to the office space, there will be 80 apartments on the 56th ~ 65th floors of the building. The smallest apartment will be a generously sized two bedroom apartment with a floor area of 125 square meters (1,345 sq ft), while the largest apartment will have a floor area of over 1,000 square meters (10,760 sq ft). This apartment could possibly be the largest apartment ever offered in Japan.Read more

The residential vacancy rate situation in Tokyo

January 12, 2017Real Estate News,Rental Market,Market Information,All,Tokyo

According to the Statistics Bureau and the Tokyo Shimbun, the number of towns, cities and wards within the greater Tokyo area with vacancy rates below 10% has halved in the 10 years since 2003. In 2013, there were 56 districts with vacancy rates below 10% and 65 districts with vacancy rates over 15%.

Growing vacancy rates are caused by a variety of factors, including decline population in regional areas, an increase in the supply of housing, as well as an increase in the number of abandoned or uninhabitable homes that are left to rot instead of being demolished.

Highest vacancy rates

| TOKYO METROPOLITAN AREA | |

|---|---|

| [1] Toshima-ku | 15.8% |

| [2] Ota-ku | 14.8% |

| [3] Musashino City | 14.1% |

| [4] Nakano-ku | 13.7% |

| [5] Chiyoda-ku | 13.3% |

| GREATER TOKYO AREA | |

| [1] Nasu Town, Tochigi | 50.5% |

| [2] Katsuura City, Chiba | 36.8% |

| [3] Yugawara Town, Kanagawa | 33.4% |

| [4] Isumi City, Chiba | 28.6% |

| [5] Kamogawa City, Chiba | 26.3% |

Beware of relying on this data

Investors should not rely on this data as it is far from accurate for the rental market.Read more

Vacancy rates for apaato-type buildings reach 30% in Tokyo

January 11, 2017Real Estate News,Rental Market,Market Information,All,Tokyo

Vacancy rates in Tokyo and Kanagawa have been steadily climbing due to an oversupply of ‘apaato’-type rental buildings (low-rise blocks of rental flats usually built from wood or light-weight steel) in recent years.

According to TAS Corp, vacancy rates for wood-frame or light-steel-frame apartment buildings are over 30% in the greater Tokyo area, and as high as 37% in Kanagawa Prefecture. In other words, 1 in 3 units in ‘apaato’-type rental buildings are vacant.Read more

Tokyo has its own Trump Tower

Tokyo has its own Trump Tower located about 12 kilometers outside of the city center, although the unassuming building may not live up to its Manhattan namesake.

Trump Tower is a rental apartment building located in Kamata, Ota Ward. It is a 3 minute walk from Keikyu-Kamata Station and 4 kilometers west of Haneda Airport.Read more

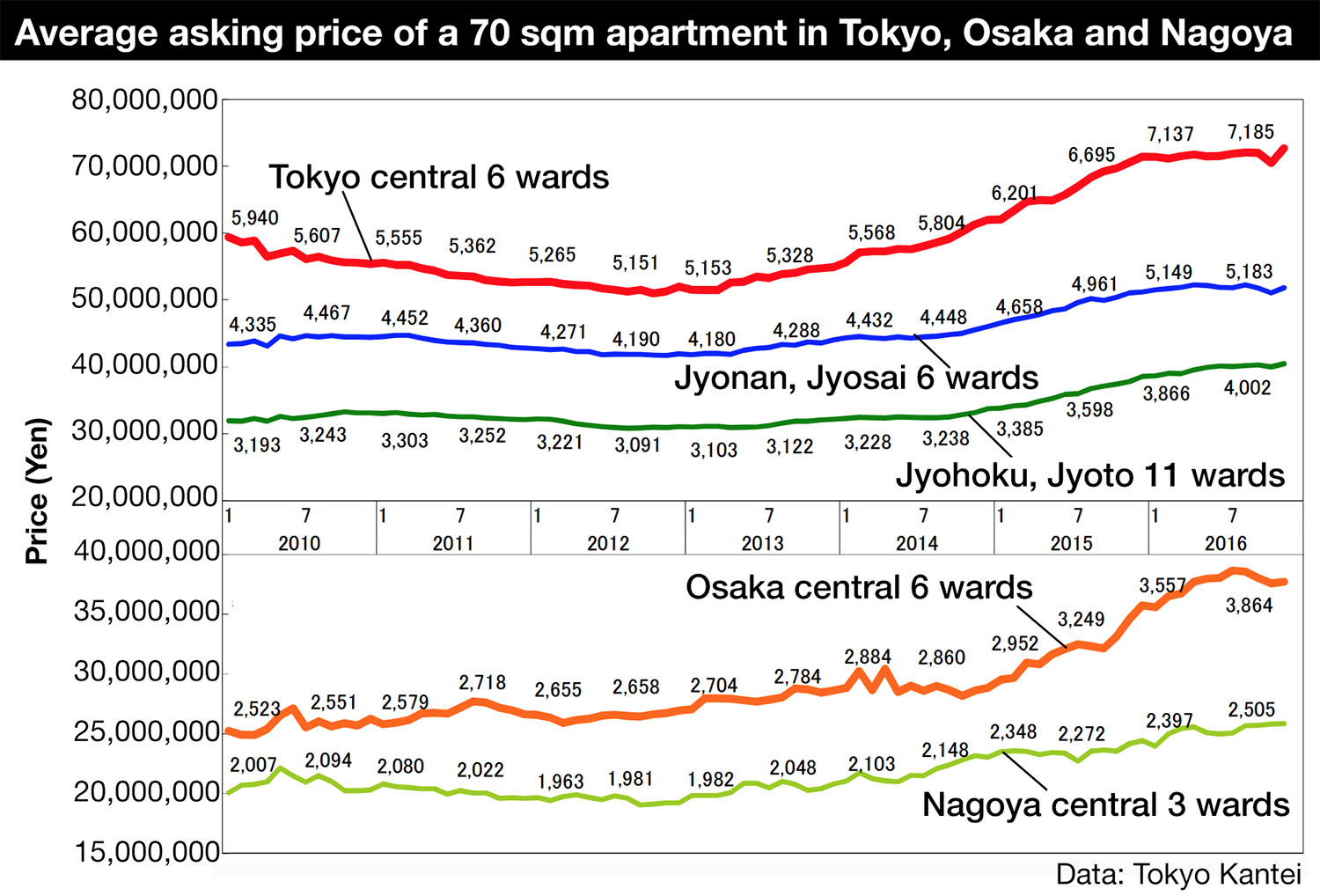

Tokyo apartment asking prices in November 2016

January 9, 2017Real Estate News,Market Information,All,Osaka,Nagoya,Tokyo

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq.ft) second-hand apartment in greater Tokyo was 35,470,000 Yen in November 2016, down 2.0% from the previous month but up 8.3% from 2015. The average building age was 22.5 years.

In the Tokyo metropolitan area, the average asking price was 48,090,000 Yen, down 0.9% from the previous month but up 5.7% from 2015. The average building age was 22.1 years.

In Tokyo’s 23 wards, the average asking price was 52,810,000 Yen, up 0.7% from the previous month and up 4.3% from 2015. This is the first time in 5 months to see an increase in asking prices from the previous month. The average building age was 22.1 years.

In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average asking price was 72,660,000 Yen, up 3.1% from the previous month and up 3.0% from 2015. The average building age was 20.1 years.

Steep increase in house prices in central Tokyo

January 6, 2017Real Estate News,Market Information,All,Tokyo

We are often asked how the Tokyo property market is moving. Is it slowing down or showing signs of steadying? We are still seeing some big price increases occurring, particularly in the detached house market. Compared to apartments, houses in central Tokyo are in extremely short supply and are difficult to find comparisons for, making it easier for sellers to ask bolder prices.

In some cases the properties have been given a quick makeover to justify a higher price, but in other cases the price has been increased to match recent market conditions.

Case 1: A 4-Bedroom house in the Azabu area

In mid-2016 we managed to negotiate a price of 180 million Yen for our client, who passed on the deal. It was re-listed in December 2016 for approximately 240 million Yen, a 30% increase in 6 months.Read more