Share house investment scam sees bank share price dive 20% in one day

April 20, 2018Japan real estate,japan real estate market,tokyo real estate,Tokyo apartment prices,Tokyo real estate market,Japan Real Estate NewsBuyer Beware!,Real Estate News,All

The scandal surrounding a failed share house developer continues to grow this month as more information about dodgy spruiking tactics and falsified documents comes to light. As many as 700 investors from a single share house developer are facing potential bankruptcy, but the number of victims could easily rise as other investment-spruiking companies are put under the spotlight.

The scandal surrounding a failed share house developer continues to grow this month as more information about dodgy spruiking tactics and falsified documents comes to light. As many as 700 investors from a single share house developer are facing potential bankruptcy, but the number of victims could easily rise as other investment-spruiking companies are put under the spotlight.

A lawyer representing a class action by investors against the Tokyo-based share house company alleges that the inflated price of the share houses sold to investors was determined by the maximum amount that the bank was willing to lend a buyer, rather than the true market price. A gross return was 8 ~ 9% was then applied to the sale price, even if it was higher than the market rent. The buyer would buy under the assumption that they could rely on stable, guaranteed rents that would provide them with a cash surplus each month. The high yield was only possible because the share house operator was providing a rental guarantee that far exceeded the rent they were receiving - causing the operator to lose money each month.Read more

Bidding restarted for Sengaku-ji Station high-rise apartment tower

April 19, 2018Japan real estate,japan real estate market,Takanawa,tokyo real estate,Tokyo apartment prices,Tokyo real estate market,Sengakuji Area Redevelopment,Sengakuji,Japan Real Estate NewsNew Construction,Real Estate News,Redevelopment & Reconstruction,All,Tokyo

A 160m tall apartment tower is planned for a site located above Sengaku-ji Station in Minato-ku, Tokyo. The project covers a 13,000 sqm site located on the eastern side of the Daiichi-Keihin Road, with the Yamanote train tracks running along the western side. This is reclaimed land that was once part of Tokyo Bay.

In February it was announced that a joint venture between Kajima Corporation, Tokyu Land and Keikyu Corporation had successfully bid on the development. On April 4, the Tokyo Metropolitan Government announced that their bid was disqualified after charges were filed against an executive from Kajima Corporation for allegedly colluding on a bid for the new high-speed maglev train. Read more

48-yr old Tokiwamatsu House condo being redeveloped

April 18, 2018Demolition,Real Estate News,Redevelopment & Reconstruction,All,Tokyo

Tokiwamatsu House, a vintage condominium located a 10 minute walk south of Omotesando Station, is being redeveloped into a new apartment building. Demolition of the existing building is expected to be finished by late August.

The former block of apartments was developed by Sumitomo and built in 1970. It included 62 apartments on 8 floors with sizes ranging from 37 ~ 122 sqm (398 ~ 1,313 sq.ft). The most recent reported sale was a large apartment on a low floor that sold early last year for around 770,000 Yen/sqm, which is less than half of what a similarly-sized brand new apartment would cost in this neighbourhood.Read more

Ace Hotel to open hotel in Kyoto’s historic Shinpukan building

April 17, 2018Japan Hotel NewsHistoric Properties,Real Estate News,All,Hotel News,Kyoto

Ace Hotel, a boutique hotel chain headquartered in Portland, is making its first foray in the Asian market with the opening of a hotel in Kyoto next year. The 213-room Ace Hotel Kyoto will be the main part of the historic Shinpukan redevelopment. With architect Kengo Kuma leading the project’s design, the hotel will incorporate the existing building’s early 20th century architectural elements with contemporary styling. The building is the perfect fit for the hotelier’s brand which focuses on reviving and repurposing older and more character-filled buildings.Read more

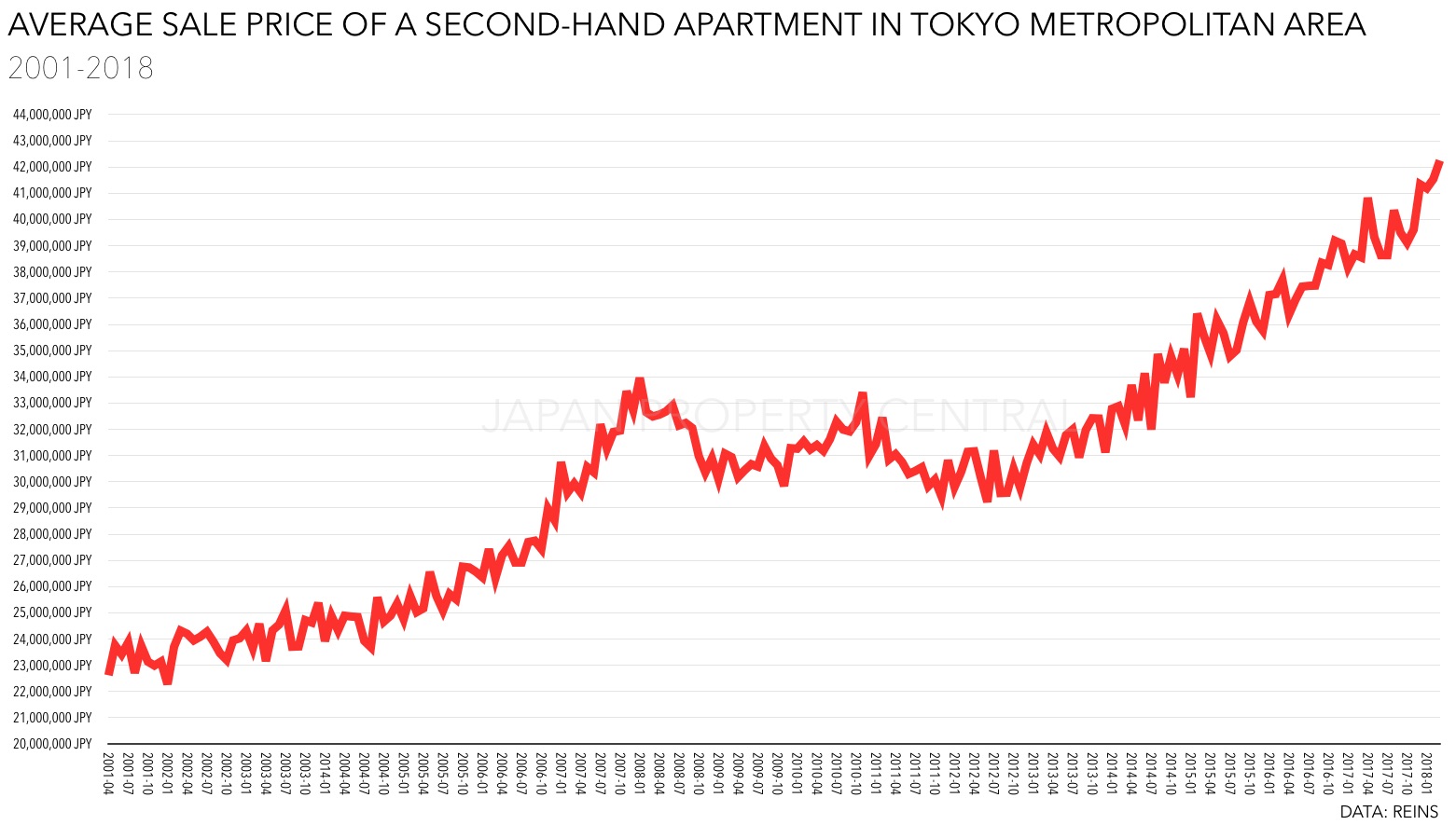

Tokyo apartment sale prices increase for 66th month

April 16, 2018Japan real estate,japan real estate market,tokyo real estate,Tokyo apartment prices,Tokyo real estate market,Japan Real Estate NewsReal Estate News,Market Information,All,Tokyo

According to REINS, 3,819 second-hand apartments were reported to have sold across greater Tokyo in March, up 11.5% from the previous month and up 2.7% from last year. The average sale price was 33,690,000 Yen, up 0.5% from the previous month and up 7.1% from last year. The average price per square meter was 521,100 Yen, up 1.8% from the previous month and up 5.7% from last year. This is the 63rd month in a row to see a year-on-year increase in sale prices.Read more

Two floors in ARK Hills sell for 3 billion Yen

April 13, 2018Japan real estate,japan real estate market,tokyo real estate,Ark Hills,Tokyo real estate market,Japan Real Estate NewsOffice/Retail News & Information,Real Estate News,Sold Properties,All,Tokyo

Two floors in ARK Mori Building - the office tower in the ARK Hills complex located in central Tokyo - have been acquired by Heiwa Real Estate REIT. Heiwa paid 3.085 billion Yen (approx. 29 million USD) for the trust beneficiary rights to the 30th and 31st floors from an unnamed seller.Read more

Chuo-ku to remove floor area ratio allowances to curb population growth

April 12, 2018Real Estate News,All,Tokyo

Tokyo’s Chuo ward is planning to abolish the floor area ratio (FAR) allowances in an attempt to curb the district’s rapid population growth. Up until now, a FAR allowance of as much as 20 ~ 40% could be given to residential developments in certain zones. For example, if a developer chose to build a new apartment building in Tsukiji or Kyobashi, the normal FAR for the land might be increased from its current limit of 500% to 700%, allowing a much larger building. Read more