Onsen and retail complex near new Toyosu Fish Market in jeopardy

The operator of a planned onsen, hotel and retail center to be built next-door to the Toyosu Fish Market in Tokyo has announced that they may withdraw their plans due to concerns about feasibility. The proposed ‘Senkaku-banrai’ center would include a 24hr hot spring bath, hotel and 200 restaurants and stores, with a forecast for 1.9 million annual visitors.

REIT acquisitions exceed rosenka values by 2.61 times

The average value of real estate acquisitions made by J-REITs between 2012 and 2017 has exceeded the rosenka tax value by approximately 2.61 times. In 2016 and 2017, office buildings and hotels in central Tokyo, Osaka, Nagoya and around Narita Airport have been purchased by REITS at as much as 5 ~ 15 times their rosenka value.Read more

Hublot moves into historic machiya in Gion, Kyoto

Swiss watch brand Hublot will be opening up a boutique in an old machiya-style townhouse in Kyoto’s famous Gion district on August 26. The previous tenant was Hermes.

The shop will feature custom Japanese washi paper and wickerwork replicating the company’s logo, while customers will receive Japanese-style folding fans as gifts.

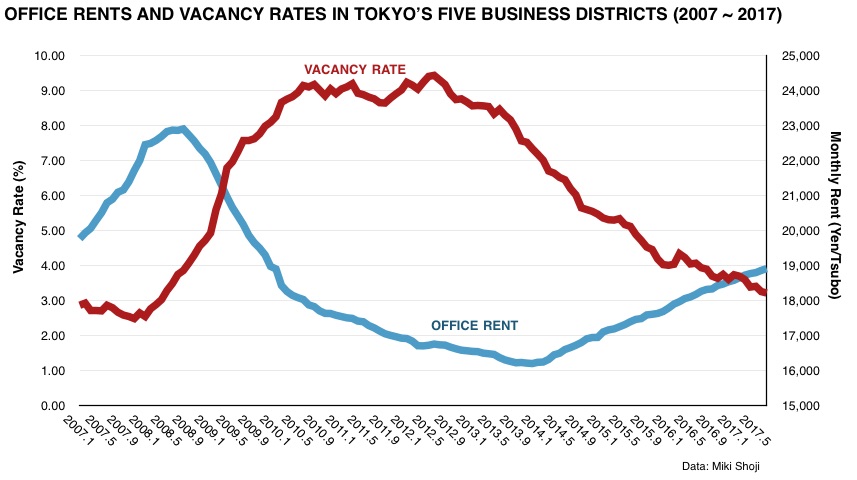

Shinjuku office vacancy rate drops to 1% range

The office vacancy rate across Tokyo’s five central business districts of Chiyoda, Chuo, Minato, Shinjuku and Shibuya dropped to 3.22% in July, down 0.04 points from June and down 0.72 points from July 2016. This is close to the record low of of 3.03% reported in April 2008 and down from a high of 9.43% seen in June 2012.

The vacancy rate in existing buildings (excluding new construction) was 2.87% in July, down 0.74 points from last year.

In Shinjuku ward, the vacancy rate was 1.68%, down 0.06 points from the previous month and down 1.30 points from last year. The vacancy rate dropped to the 1% range in May 2017.

265m tall tower for Toranomon Hills district

More details have been released on the Toranomon Hills Station Tower which will be built on the north-west side of Toranomon Hills in central Tokyo. The building height will be 265 meters, which is 18 meters taller than the neighbouring Toranomon Hills tower and 17 meters taller that Tokyo Midtown.

Construction of the 49-storey tower is scheduled to start in 2019 with completion by 2022 2023.

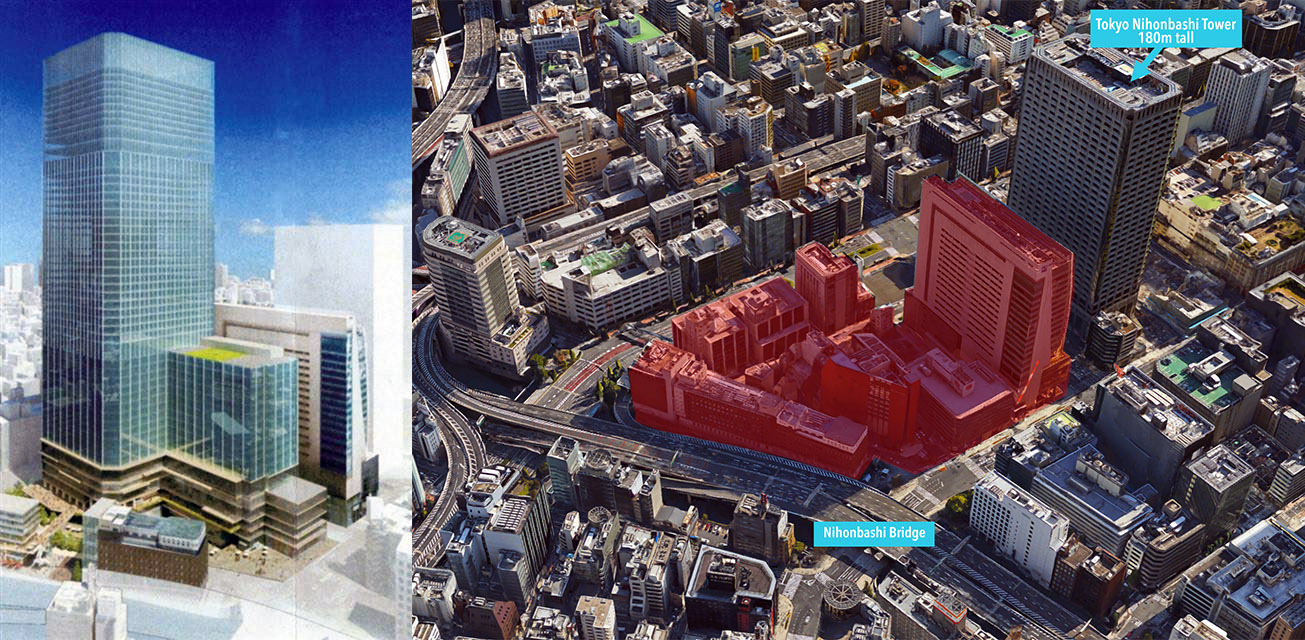

287m tall high-rise planned for Nihonbashi

Details on the Nihonbashi 1 Chome Central District Redevelopment have been announced. The project will include a 287m tall high-rise with office, hotel and serviced apartments, as well as several low-rise retail, office and residential buildings.

Details on the Nihonbashi 1 Chome Central District Redevelopment have been announced. The project will include a 287m tall high-rise with office, hotel and serviced apartments, as well as several low-rise retail, office and residential buildings.

The high-rise tower will be taller than Tokyo Midtown (248m), Toranomon Hills (247m) and the Tokyo Metropolitan Government Building (242m), but shorter than the 390m tall tower planned for the Tokiwabashi Redevelopment Project located 300 meters to the west of the Nihonbashi site.

Kyoto’s tourism boom creates office shortage

With office vacancy rates in the 2% range, commercial tenants in Kyoto are reporting difficulty in finding new office space as the city’s supply of office buildings dwindles.

This year, parts of Higashiyama, Nakagyo and Shimogyo saw rosenka land values increase by over 20%. Rising land values are being supported by the city’s booming tourist industry which is causing real estate companies and hoteliers to aggressively seek sites to develop hotels and high-end apartments. With a scarce supply of vacant sites, office buildings are being torn down and replaced with hotels, shrinking office inventory.Read more