Daikanyama retail to be replaced with residential building

La fuente Daikanyama, a low-rise retail complex in the heard of the Daikanyama district, will soon be demolished to make way for an apartment building. The retail mall will close in July 2018.Read more

Japan land prices increase in 91% of locations - highest share in history

According to the quarterly LOOK report issued by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) in the first quarter of 2018, land prices have increased in 91% of the surveyed locations. This is the first time the percentage has exceeded 90% in the history of reporting.

According to the quarterly LOOK report issued by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) in the first quarter of 2018, land prices have increased in 91% of the surveyed locations. This is the first time the percentage has exceeded 90% in the history of reporting.

The main factors behind the rising land prices include positive conditions for the office market in central Tokyo, Osaka and Nagoya, major redevelopment projects, surging tourism numbers and expenditure, and strong demand for apartments that are close to transport. These factors are also encouraging investment into the office, retail, hotel and residential sector.Read more

Ginza office floor sale sees price more than double within a year

Shioi Kosan, the private asset management company for fast-food bento maker Hotto Motto, has paid 25 billion Yen (approx. 230 million USD) to acquire the 8th floor of the Ginza Six retail and commercial building in Tokyo’s Ginza district. The sale price is more than double the price that the floor sold for 7 months prior.Read more

Kasumigaseki Building turns 50 this month

Kasumigaseki Building, Japan’s first skyscraper, turned 50 on April 12. To celebrate the half-century anniversary, the exterior of the building has been lit up with an art display that runs in the evenings until the end of May. A beer garden has also been set up outside the entrance for the duration of the event.

Built in 1968 and with a height of 147 meters, this was the first building in the country to be over 100 meters tall. Nowadays it is flanked by a taller neighbor - the twin tower Central Government Building No. 7 - which was completed in 2007 and is 156m and 176m tall.Read more

Two floors in ARK Hills sell for 3 billion Yen

Two floors in ARK Mori Building - the office tower in the ARK Hills complex located in central Tokyo - have been acquired by Heiwa Real Estate REIT. Heiwa paid 3.085 billion Yen (approx. 29 million USD) for the trust beneficiary rights to the 30th and 31st floors from an unnamed seller.Read more

Shiba Park Building sells for 150 billion Yen

The Kansai Electric Power Co. and Tokyo Gas have jointly acquired the trust beneficiary rights to Shiba Park Building in central Tokyo on March 20. The acquisition price has not been made public, but insiders suggest a price somewhere in the range of 150 billion Yen (approx. 1.4 billion USD).Read more

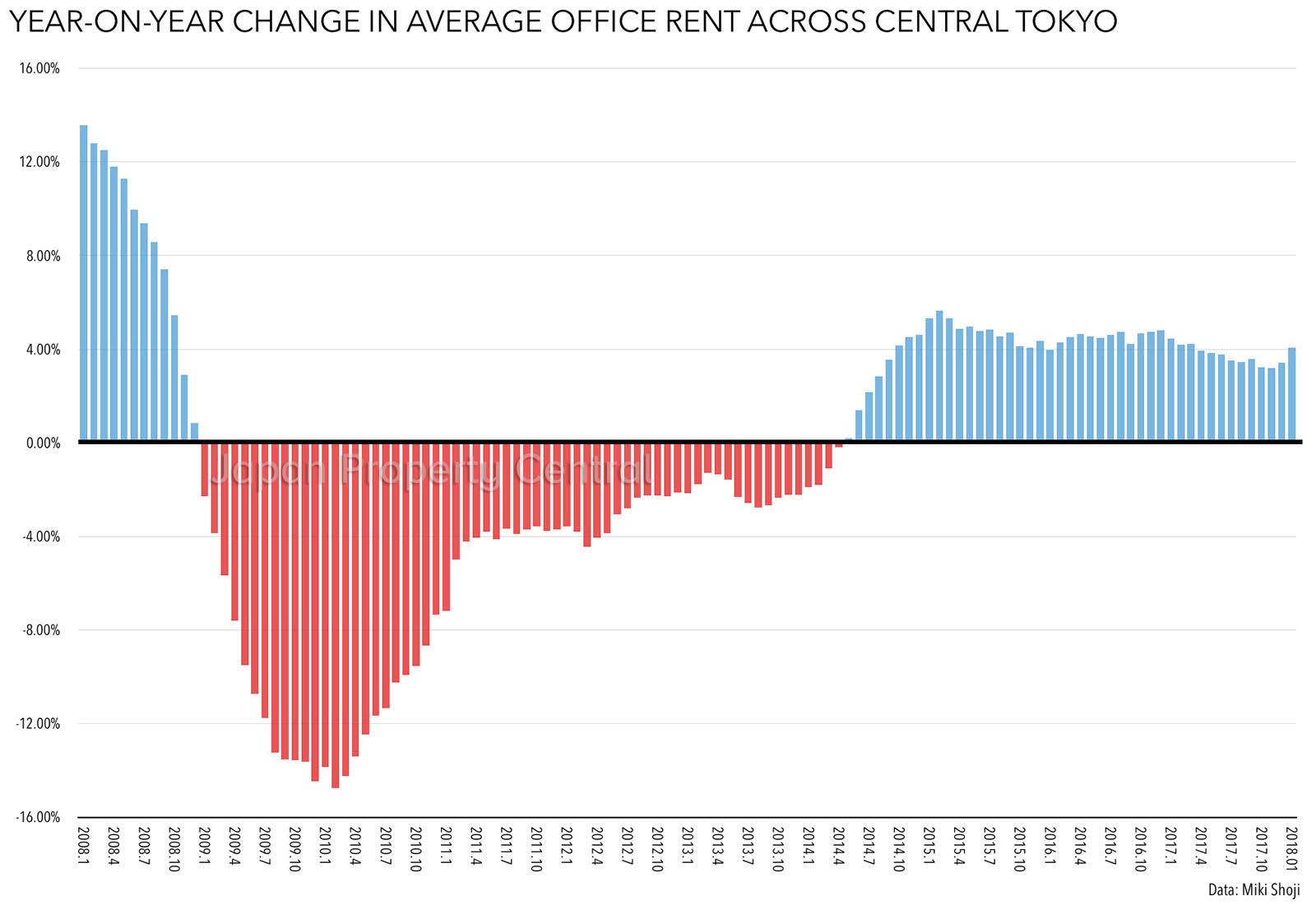

Central Tokyo office rents increase for 49th month in a row

The average monthly office rent in central Tokyo’s business districts was 19,338 Yen per Tsubo (approx. 5,860 Yen/sqm) in January, up 4.1% from last year and the 49th month in a row to see a year-on-year increase. This is the highest level seen since October 2009. Office rents are now up 19.3% from their recent low of 16,207 Yen/Tsubo seen in December 2013, but are still 15.5% below a previous record high in mid-2008.

Vacancy rates were down 0.67 points from last year to 3.07%. This is similar to levels last seen in 2007 and a marked improvement from the average 8 ~ 9% vacancy rate seen between 2010 and 2014.Read more