Secondhand apartment prices in November 2014 - Tokyo Kantei

December 22, 2014Real Estate News,Market Information,All,Osaka,Nagoya,Tokyo

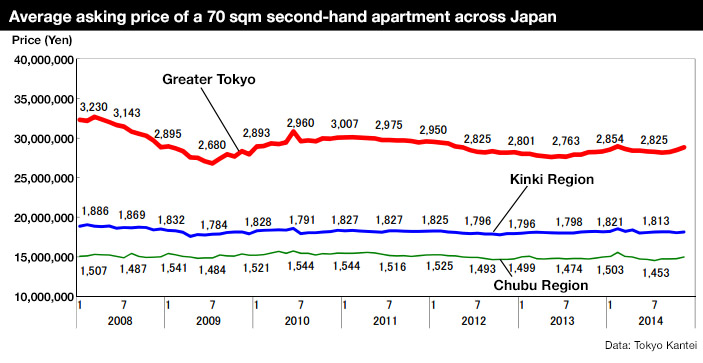

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 43,300,000 Yen in November, up 1.7% from the previous month and up 6.6% from last year. The average building age was 22.3 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 61,280,000 Yen, up 1.8% from the previous month and up 12.0% from last year. The rate of increase has been expanding since August 2014. The average building age was 21.6 years.Read more

1960s Osaka office conversion wins renovation prize

The conversion of a 48-year old small office building into a private residence won best design (open category) in the 2014 Renovation of the Year awards announced on November 2.

The 4-storey office building had a floor plate of 66 sqm and was surrounding by buildings on three sides, limiting natural light. The property was purchased for a relatively low cost due to its age and the difficulty in attracting commercial tenants.Read more

New apartment prices in Tokyo up 10.3%

December 18, 2014New Construction,Real Estate News,Market Information,All,Tokyo

According to the Real Estate Economic Institute, 3,337 brand new apartments were released for sale in greater Tokyo in November, up 6.8% from the previous month but down 33.3% from last year. This is the 10th month in a row to see a year-on-year decline. It is also lower than the Institute’s forecast of 4,000 apartments. This is the lowest level for November since 2008 and is thought to be due to developers postponing sales in major projects until the new year.

2,617 apartments were sold, making the contract rate 78.4%, up 15.1 points from the previous month but down 1.2 points from last year.

The average new apartment price was 52,240,000 Yen, up 14.6% from the previous month and up 5.2% from last year. The average price per square meter was 737,000 Yen, up 15.5% from the previous month and up 6.2% from last year.Read more

Historic Japanese villa in NY looking for new home in Japan

December 17, 2014Traditional Japanese Architecture,Traditional Japanese HomesHistoric Properties,All

The current owner of a historic traditional Japanese house in upstate New York wants to relocate the home to Japan and is seeking a new owner.

The current owner of a historic traditional Japanese house in upstate New York wants to relocate the home to Japan and is seeking a new owner.

The ’Pine and Maple Palace’ was initially exhibited at the St. Louis World Fair in 1904. It was modelled in a style of architecture dating from the Momoyama period (late 1500s), but with some western features. After the fair, Emperor Meiji donated the villa to Dr. Jokichi Takamine, a successful chemist who had emigrated to the US. Takamine relocated the villa to his summer home in upstate New York. In 1909, Prince Kuni Kuniyoshi and Princess Kuni stayed in the villa during a visit to the US. The house was sold upon Takamine’s death in 1922. Read more

November rental data - Tokyo Kantei

December 16, 2014tokyo apartment rentReal Estate News,Rental Market,Market Information,All,Osaka,Nagoya,Tokyo

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,560 Yen/sqm in November, down 1.6% from the previous month but up 0.3% from last year. This is the first time in five months to see a month-on-month decline in rent. The average apartment size was 59.90 sqm and the average building age was 19.5 years.

The average monthly rent in Tokyo’s 23-ku was 3,199 Yen/sqm, down 1.1% from the previous month but up 2.8% from last year. The average apartment size was 56.76 sqm and the average building age was 17.7 years. Although rents across all areas within Tokyo have started to weaken, they are still hovering around the 3,200 Yen/sqm range.Read more

Tokyu Plaza Shibuya to be redeveloped

December 15, 2014Shibuya Station Redevelopment,DogenzakaNew Construction,Office/Retail News & Information,Real Estate News,Redevelopment & Reconstruction,All,Tokyo

The Tokyu Plaza Shibuya building to the west of Shibuya Station will be demolished in 2015 and replaced with a larger mixed and retail development.

The 9-storey multi-tenant retail building, which was originally called the Shibuya Tokyu Building, opened in 1965. In celebration of its 50 year history, a number of stores will be holding special sales from January to March 2015, while some of the restaurants which have been in operation since the building opened will prepare special menu items. A temporary gallery with photos of the Shibuya area over the past five decades is also scheduled to open from the end of January.Read more

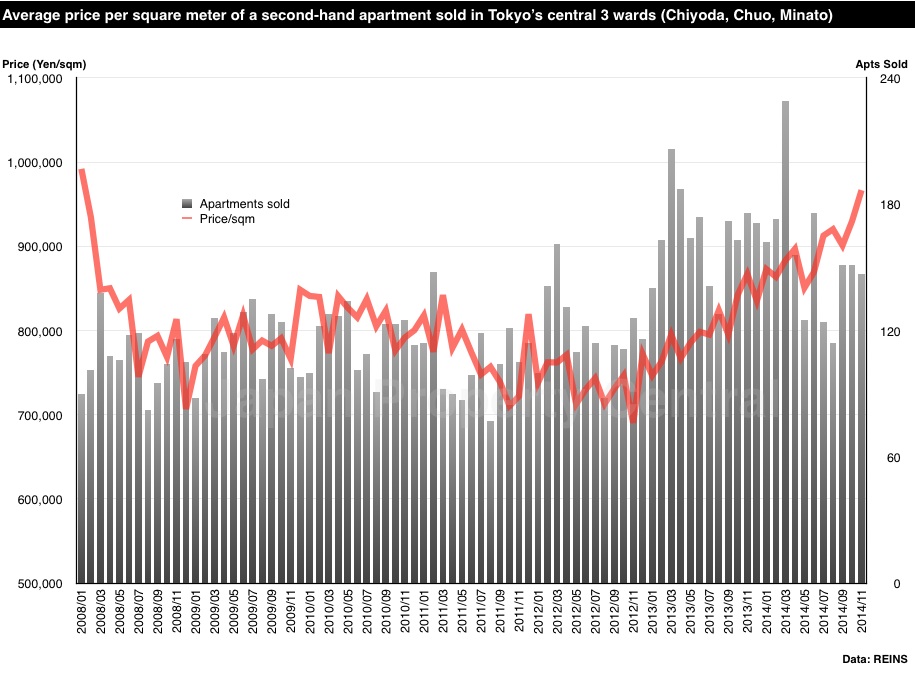

Central Tokyo apartment sale prices reach highest level in 7 years

December 12, 2014Real Estate News,Market Information,All,Tokyo

According to REINS, 2,830 second-hand apartments were sold across greater Tokyo in November, up 6.6% from the previous month but down 9.3% from last year. This is the 8th month in a row to see a year-on-year decline. The average apartment sale price was 28,080,000 Yen, down 0.1% from the previous month but up 5.6% from last year. The average price per square meter was 441,500 Yen, up 1.4% from the previous month and up 7.1% from last year. This is the 23rd month in a row to see a year-on-year increase. The average building age was 20.04 years.

1,431 second-hand apartments were sold in the Tokyo metropolitan area, up 10.2% from the previous month but down 7.1% from last year. This is also the 8th month in a row to see a year-on-year decline. The average sale price was 34,080,000 Yen, down 2.0% from the previous month but up 5.2% from last year. The average price per square meter was 575,800 Yen, down 1.5% from the previous month but up 6.3% from last year. The average building age was 19.20 years.

In central Tokyo's 3 wards (Chiyoda, Chuo and Minato), the average sale price was 966,600 Yen/sqm, up 4.0% from the previous month and up 11.5% from last year. This is the highest price seen since January 2008 when prices were 991,900 Yen/sqm.Read more