Iseya Pawnshop sold to University

March 13, 2015Bunkyo,Historic properties in JapanHistoric Properties,Real Estate News,All,Tokyo

The owner of the historic Iseya Pawnshop in Bunkyo-ku, Tokyo, signed a contract of sale with Atomi University on March 11. The price has not been disclosed, although some reports suggest it sold for around 130 million Yen (1.07 million USD).

The property includes a 2-storey warehouse dating from the 1850s ~ 1860s, a tatami room dating from 1890 and a shophouse dating from 1907. The pawnshop operated from 1860 to 1982, and was mentioned in author Ichiyo Higuchi’s writings. The three buildings were registered as Tangible Cultural Properties in 2003.Read more

Central Tokyo apartment transactions reach record high for February

March 12, 2015Real Estate News,Market Information,All,Tokyo

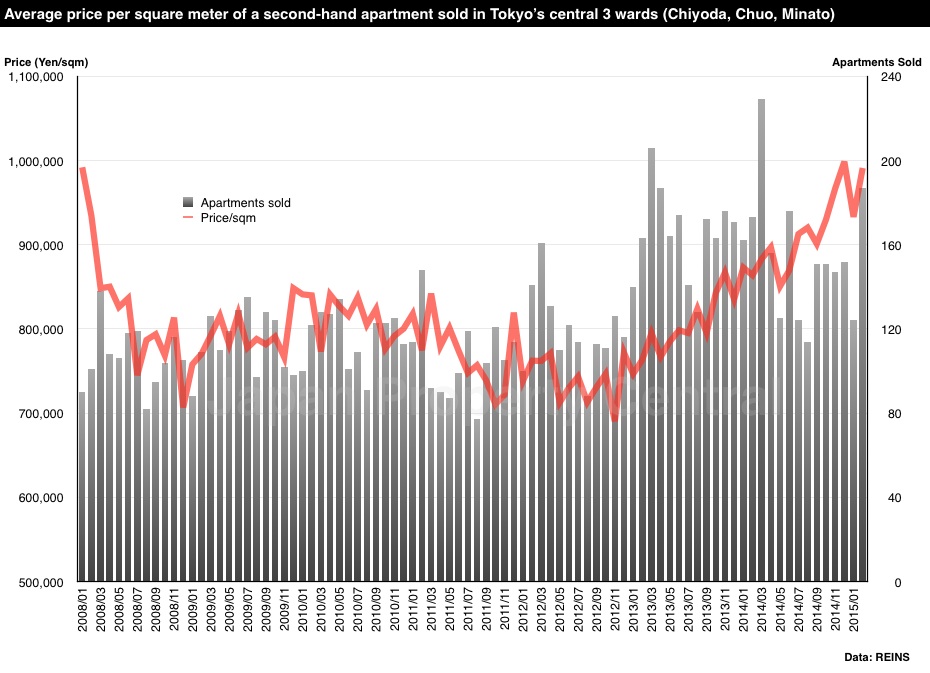

According to REINS, 3,292 second-hand apartments were sold across greater Tokyo in February, up 34.9% from the previous month but down 0.6% from last year. This is the 11th month in a row to see a year-on-year decline, although the rate of decline is the lowest seen so far.

The average apartment sale price was 29,260,000 Yen, up 4.6% from the previous month and up 8.7% from last year. The average price per square meter was 450,000 Yen, up 2.9% from the previous month and up 8.0% from last year. The average building age was 19.33 years.

1,572 second-hand apartments were sold in the Tokyo metropolitan area, up 31.8% from the previous month but down 4.1% from last year. The average sale price was 36,410,000 Yen, up 9.6% from the previous month and up 10.7% from last year. The average price per square meter was 605,900 Yen, up 6.8% from the previous month and up 11.3% from last year. The average building age was 18.37 years.

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 187 apartments were sold, up 50.8% from the previous month and up 8.1% from last year. This is the highest number of transactions in February since REINS began recording data in 2008.Read more

Apartments to be built in historic Kyoto Shrine grounds

March 11, 2015New Construction,Real Estate News,All,Kyoto

Shimogamo Shrine in Kyoto’s Sakyo Ward announced that several condominiums will be built on part of the shrine’s grounds.

The shrine’s main buildings are rebuilt every 21 years. To help raise the 3 billion Yen required to rebuild in 2015, part of the shrine’s land will be leased to a private developer. The shrine has already raised 1 billion Yen and will receive around 800 million Yen in national grants.

A 9,650 sqm parcel of land about 600 meters south of the main shrine will be leased to a private developer under a 50-year term with an annual land rent of 80 million Yen. At the end of the lease, the buildings will be demolished and the land will be returned to the Shrine. The land is currently used as a car park and training hall.Read more

600 billion Yen project announced for Yaesu

March 10, 2015Yaesu TokyoNew Construction,Office/Retail News & Information,Real Estate News,Redevelopment & Reconstruction,All,Commercial Real Estate,Hotel News,Tokyo

Mitsui Fudosan and Tokyo Tatemono have plans for a 600 billion Yen (5 billion USD) redevelopment on the eastern side of Tokyo Station. Two buildings up to 250 meters tall will be built in the Yaesu 1 and 2 Chome districts. The developers are considering including residential, retail, education, cultural and medical facilities with English-speaking staff in the complex. The Yaesu area currently has a resident population of just 110 people, so residential supply has been very limited.

The redevelopment site is located in a National Strategic Special Zone. These zones have been created to encourage the creation of full-service business districts that are internationally competitive. Developers may receive allowances to provide for extra floor-area ratios and foreign companies may receive additional benefits to locate in these areas.Read more

Residential yields in Minato-ku - March 2015

March 9, 2015Rental yield in TokyoReal Estate News,Rental Market,Market Information,All,Tokyo

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in March was 5.0%, down 0.2 points from the previous month and down 0.5 points from last year. The average gross yield across Tokyo was 6.6%, down 0.2 points from the previous month and down 0.7 points from last year.

The average asking price of a second-hand apartment in Minato-ku was 890,457 Yen/sqm as of March 1, up 0.7% from the previous month and up 14.2% from last year. The average asking price for land was 1,246,667 Yen/sqm, down 0.6% from the previous month but up 17.2% from last year.

Residents seek urgent reconstruction of faulty building in Fukuoka

March 6, 2015Buyer Beware!,Real Estate News,All,Laws and Lawsuits

The residents of a condominium in Kurume City, Fukuoka, that was found to have a considerably low level of earthquake-resistance, have filed a lawsuit against Fukuoka City seeking reconstruction of the building within the next 12 months.

The residents of a condominium in Kurume City, Fukuoka, that was found to have a considerably low level of earthquake-resistance, have filed a lawsuit against Fukuoka City seeking reconstruction of the building within the next 12 months.

According to the lawsuit, the 15 storey condominium was constructed by a subcontracting company of Kajima Corporation in 1996. Issues began shortly after completion, with exterior tiles from upper floors coming loose and cracks appearing in the building’s hallways. Since 1997, residents have repeatedly requested that the developer and construction company investigate and repair the building.Read more

Japan’s largest hotel to be built in Yokohama

March 5, 2015Yokohama,Japan Hotel NewsReal Estate News,All,Hotel News

APA Group will be developing a 37-storey hotel on a waterfront site in downtown Yokohama. With 2,400 guest rooms and a total floor area of 58,000 sqm, this hotel will have the highest room count in a single building in Japan.Read more