Average rent in Tokyo takes a dip in January

February 18, 2016average rent tokyoReal Estate News,Rental Market,Market Information,All,Osaka,Nagoya,Tokyo

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,567 Yen/sqm in January 2016, down 2.3% from the previous month but up 0.9% from January 2015. This is the first time in 5 months that the average rent has fallen below the 2,600 Yen/sqm line, and is due to both a smaller share of listings in the Tokyo metropolitan area, as well as a softening of the rental market. The average apartment size was 59.70 sqm and the average building age was 19.9 years.

In the Tokyo metropolitan area, the average monthly rent was 3,128 Yen/sqm, down 1.2% from the previous month but up 2.6% from last year. The average apartment size was 56.46 sqm and the average building age was 18.1 years.

In Tokyo’s 23 wards, the average rent was 3,280 Yen/sqm, down 0.9% from the previous month but up 3.1% from last year. The average apartment size was 55.79 sqm and the average building age was 17.5 years.Read more

Local group wants to curb speculative investment in Kyoto apartments

February 17, 2016KyotoReal Estate News,All,Kyoto

A citizen’s group in Kyoto is campaigning for the city to introduce regulations to curb the recent speculative buying of apartments in the history city. On January 22, the Kyoto Community Development Citizen Association submitted a proposal to Kyoto City’s Town Planning Department seeking counter-measures against an overwhelming increase in real estate prices.Read more

Nakagin Capsule Tower to undergo earthquake-resistant inspection

February 16, 2016Kisho Kurokawa,Nakagin Capsule TowerReal Estate News,Redevelopment & Reconstruction,All,Tokyo

The results of an earthquake-resistant inspection could soon determine the fate of Ginza’s Nakagin Capsule Tower.

At an owner’s association meeting in early December 2015, the majority voted in favour of carrying out an earthquake-resistance inspection to determine the structural integrity of the building. If the building does not meet earthquake codes, the owners will consider demolishing the 44-year old metabolist landmark.Read more

Only 1 applicant for Ota-ku’s new short-term letting license system

February 15, 2016Airbnb in JapanReal Estate News,Rental Market,All,Laws and Lawsuits,Tokyo

On January 29, Tokyo’s Ota Ward introduced relaxed rules for short-term letting that allows ordinary homes and apartments to be rented to tourists. Licensing requirements still apply, however, although the terms are not as strict as they are under the hotel licensing law.

In the lead up to the regulation change, Ota’s city office received over 120 inquiries from companies interested in opening accommodation facilities under the new system. Information sessions held in January were attended by over 200 people at a time. Since January 29, they have handled an additional 220 inquiries.

Despite the strong interest, there has only been one applicant, a Tokyo-based company called Tomareru. Read more

Temple to demolish 100+ yr old historic villa in Kyoto

February 12, 2016Historic properties in JapanDemolition,Historic Properties,All,Kyoto

The former holiday villa of the head priest of the Nishi Hongan-ji Temple is going to be demolished this month.

Sanya-so, located in Kyoto’s Fushimi Ward, is a 10,000 sqm estate dating back the the late 1800s. In 1876, 21st head priest / Abbot Koson Otani (1850 - 1903) built a single-storey wooden house to be used to host guests. It had seven rooms and a tea house, and was situated on an elevated block of land overlooking Uji River.

In 1900 a new wing was built with four rooms. The new house was also single storey and had a total floor area of 360 sqm. It also featured floor heating, with steam piped through pipes that were installed under the floors.

The villa hosted several notable guests throughout the years, including Tokugawa Yoshinobu (the last shogun of the Tokugawa shogunate), Prince Ito Hirobumi (samurai and four time Prime Minister), and Field Marshal Prince Yamagata Aritomo (two time Prime Minister).Read more

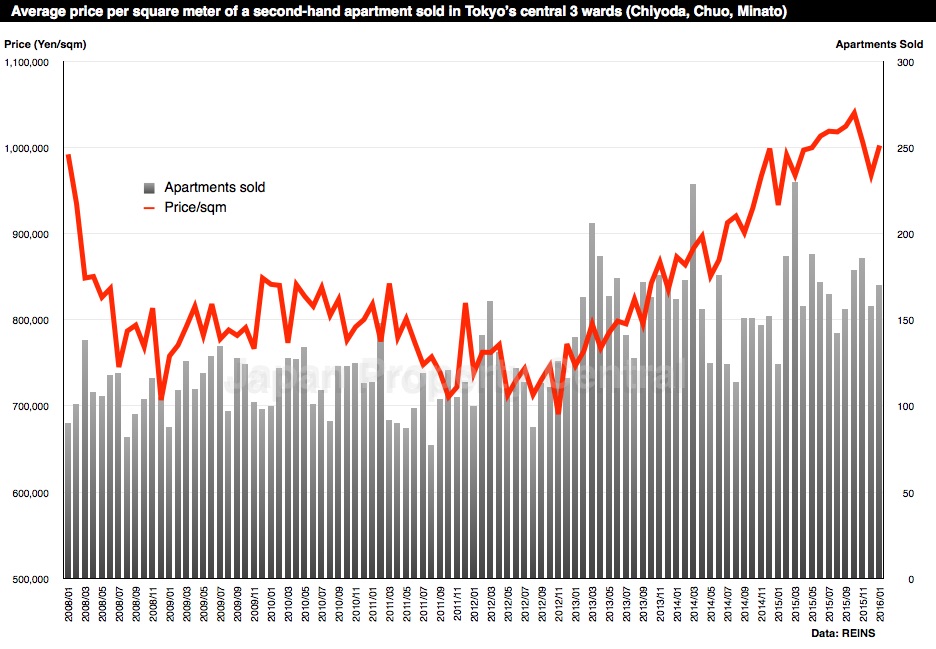

Transactions of secondhand apartments in central Tokyo surge in January

February 11, 2016Real Estate News,Market Information,All,Tokyo

According to REINS, 2,655 second-hand apartments were sold across greater Tokyo in January, up 4.4% from the previous month and up 8.8% from last year. The average sale price was 29,870,000 Yen, up 4.3% from the previous month and up 6.7% from last year. The average price per square meter was 468,400 Yen, up 3.1% from the previous month and up 7.1% from last year. This is the 37th month in a row to see a year-on-year increase in reported sale prices. The average building age was 20.26 years.

In the Tokyo metropolitan area, 1,292 second-hand apartments were sold, up 0.4% from the previous month and up 8.3% from last year. The average sale price was 37,120,000 Yen, up 3.8% from the previous month and up 11.7% from last year. The average price per square meter was 633,300 Yen, up 3.8% from the previous month and up 11.6% from last year. This is the 40th month in a row to see a year-on-year increase in sale prices. The average building age was 19.08 years.

Central Tokyo’s 3 wards

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 170 second-hand apartments were sold, up 7.6% from the previous month and up 37.1% from last year. This is the highest number of transactions for the month of January since record-keeping began in 2008.Read more

Apartment construction boom around Nagoya Station area

February 10, 2016Real Estate News,Market Information,All,Nagoya

The area around Nagoya Station has been seeing a surge in apartment construction from developers in recent years. The construction has been spurred by the the construction of the Chuo Shinkansen maglev line which will connect Shinagawa Station in Tokyo with Nagoya Station in Nagoya City in 2027. The high-speed rail will reduce the travel time between Tokyo and Nagoya from the current 94 minutes down to 40 minutes.

The station area, which has suffered from flood damage in the past, has not always been a desirable place to live, but the new construction is sparking a gentrification of the old neighbourhoods.Read more