Iconic Nakagin Capsule Tower's final curtain call as decision made to sell

April 27, 2021Kisho Kurokawa,Metabolist architecture,Nakagin Capsule Tower,Ginza,Save Japan's ArchitectureTokyo,Real Estate News,All,Demolition,Redevelopment & Reconstruction

The iconic Nakagin Capsule Tower building in Ginza is reaching the final stages of its saga as the capsule owners have voted in favor to sell off the building and land leasehold rights. The few remaining residents will move out in the coming weeks, leaving the dystopian landmark empty and awaiting an uncertain fate.

Residents of luxury Tokyo high-rise ordered to move out

April 26, 2021Real Estate News,Tokyo,Buyer Beware!,All

A major construction company is writing up a 9 billion Yen (US$83 million) extraordinary loss after a recently-built high-rise condominium in Tokyo was found to have some interior defects. All residents in the several-hundred unit tower will have to temporarily move out while these issues are repaired.

Quick real estate news summary for the week

April 23, 2021Market Information,Tokyo,Real Estate News,All

Tokyo apartment rents reach new high, French restaurant near Tokyo Tower to be demolished, and apartment asking prices hit new record. Below is a quick weekly summary of some of the recent goings-on in the Japanese real estate market.

Listed companies offload real estate holdings in pandemic

April 22, 2021Tokyo,Real Estate News,All,Office/Retail News & Information,Market Information

A total of 76 companies listed on the Tokyo Stock Exchange reported the sale of real estate assets in 2020, up from 59 in 2019 and the first time to exceed 70 in four years. Total capital gains from the sales reached 441.6 billion Yen (approx. US$4 billion), the highest in 20 years.

Shimane hotel sells for 2,000 Yen (US$18)

April 21, 2021Japan Hotel News,Shimane PrefectureReal Estate News,Hotel News,Demolition,All

The town of Tsuwano in Shimane Prefecture has purchased an abandoned hotel and land for 2,000 Yen (approx. US$18). The 50-year old building will be demolished with the grounds turned into a public park.

Village buys abandoned Kengo Kuma-designed building

April 20, 2021Save Japan's Architecture,Kengo KumaAll,Real Estate News

The village of Tamakawa in Fukushima has purchased an abandoned building that had been designed by Kengo Kuma.

March apartment sales hit highest level in history

April 19, 2021Market Information,Tokyo,Real Estate News,All

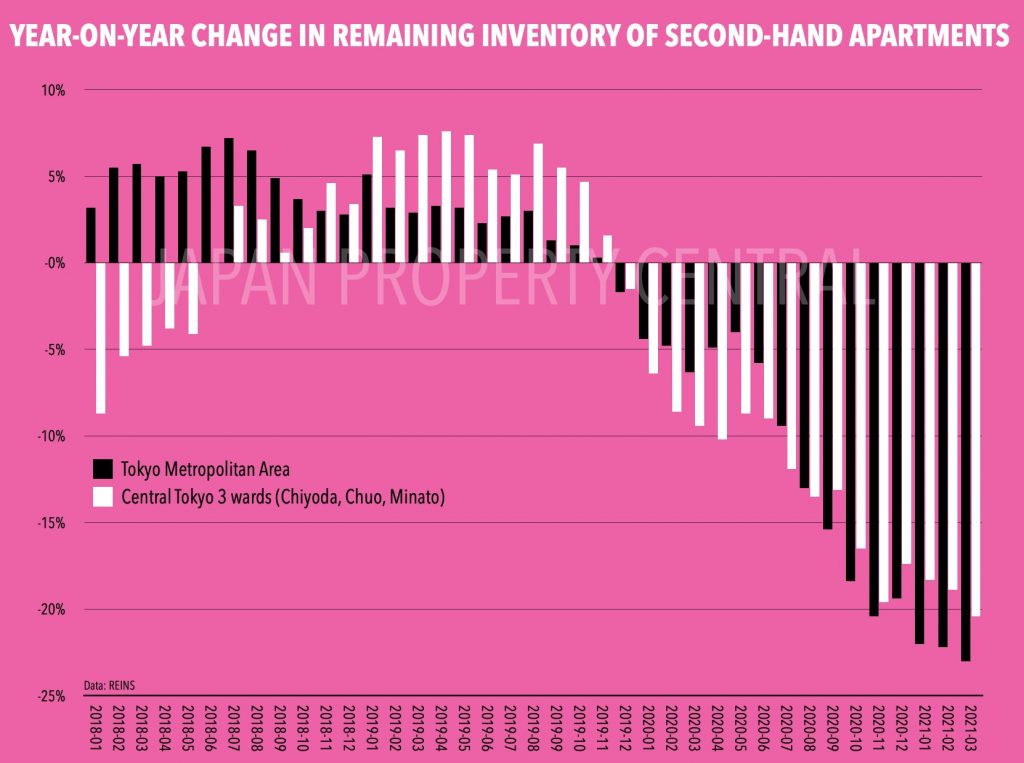

According to REINS, the number of second-hand apartments reported to have sold across greater Tokyo in March reached the highest level for that month since record-keeping began in May 1990. A total of 4,228 apartments were reported to have sold, up 16.1% from last year and up 17.9% from February.