3-Bedroom apartment for sale in Roppongi Hills

September 30, 2014Roppongi,Roppongi Hills,Roppongi Hills Real EstateAll,Tokyo

Become part of the exclusive Roppongi Hills Tribe.

| Price: SOLD | Size: 121.93 sqm (1,312 sqft) |

*This apartment sold in early December 2014 and is no longer available. It was listed for 67 days and sold at a 0% discount*

A 3-Bedroom apartment on the 41st floor in Roppongi Hills Residence B was listed for sale yesterday. This is a rare corner apartment located on the north-west corner of the building. The estimated rent on this apartment is approximately 1,100,000 Yen/sqm*. It is currently occupied by the owner and inspections are available by advance appointment only.

At the moment this is the only apartment available for sale in Residence B. Since 2012, there have only been 6 apartments listed for sale in this building and only 3 of them were over 100 sqm in size. The most recent sale was a 3-Bedroom 150 sqm apartment on a lower floor which sold for approximately 371 million Yen (2,473,000 Yen/sqm) earlier this year.

While we have recently seen prices skyrocket in other high-rise buildings around central Tokyo, apartment prices in Roppongi Hills have remained at consistently high levels for the past 10 years.Read more

Osaka Waterworks land near Lake Biwa drops to just 2% of original value

September 29, 2014Lake BiwaReal Estate News,All

According a recent valuation, forestry on the western side of Lake Biwa purchased by the Osaka Waterworks Bureau in 1988 for 917 million Yen has dropped in value by almost 98% to just 22 million Yen.

According a recent valuation, forestry on the western side of Lake Biwa purchased by the Osaka Waterworks Bureau in 1988 for 917 million Yen has dropped in value by almost 98% to just 22 million Yen.

To date, the Bureau has spent 18 million Yen managing the land.

Starting this year, regional public enterprises will switch over to private corporate accounting systems which require the reporting of asset values and losses.

In 1985, the Bureau had made 1 billion Yen on the sale of land and were looking to acquire additional land as a way of storing the money. After considering several offerings from real estate agents, they settled on the land near Lake Biwa. The supervisor at the time said they believed the purchase could provide some positive PR since the land was a natural water source and acquiring the land meant they could protect the water quality. Despite the publicity efforts, the Bureau actually had no specific plans for the land.Read more

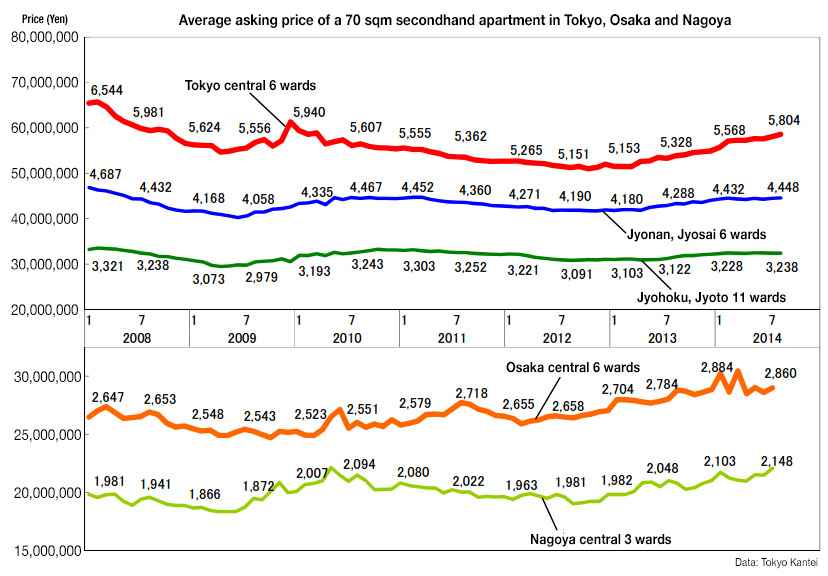

Secondhand apartment prices in August 2014 - Tokyo Kantei

September 26, 2014Real Estate News,Market Information,All,Osaka,Nagoya,Tokyo

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 41,930,000 Yen in August, up 0.5% from the previous month and up 3.9% from last year. The average apartment age was 22.4 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 58,570,000 Yen, up 0.9% from the previous month and up 8.7% from last year. The average apartment age was 24.4 years.

The average price across greater Tokyo was 28,140,000 Yen, down 0.4% from the previous month but up 0.9% from last year. The average building age was 21.7 years.Read more

Chinese fund developing private golf course and resort in Hokkaido

September 25, 2014Real Estate News,Hokkaido,All

Beijing-based fund Ittatsu Kokusai are developing an 18-hole private golf course and resort in Kimobetsu, Hokkaido.

Beijing-based fund Ittatsu Kokusai are developing an 18-hole private golf course and resort in Kimobetsu, Hokkaido.

Located about 30km east of Niseko, the resort will include 380 vacation home sites designed for wealthy Asian buyers. The project is estimated to cost around 10 billion Yen. The golf course has already been completed and sales will begin on the vacation lots from mid-October.

August rental data - Tokyo Kantei

September 24, 2014Tokyo rental marketReal Estate News,Rental Market,Market Information,All,Osaka,Nagoya,Tokyo

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,561 Yen/sqm in August, up 0.1% from the previous month and up 0.5% from last year. The average apartment size was 59.71 sqm and the average building age was 19.2 years.

The average rent in Tokyo’s 23-ku was 3,166 Yen/sqm, down 0.3% from the previous month but up 2.3% from last year. The average apartment size was 56.65 sqm and the average building age was 17.5 years.Read more

Home insurance policies to be shortened to 10 years

September 23, 2014Property Insurance in JapanReal Estate News,All

From late 2015, Japan’s major home insurance companies will reduce the maximum insurance policy term from 36 years to 10 years.

Home buyers looking to take out a mortgage will have fewer insurance companies to choose from as lenders require the borrower to obtain insurance coverage for the full term of the loan.

Major insurers Sompo Japan Nipponkoa Insurance and Mitsui Sumitomo Insurance will limit policies to 10 years from October 2015. They will continue to honour any policies in place before the deadline.

Home insurance, which is typically called fire insurance, covers against damage from fire, strong wind, snowfall, flood and landslides. While it is possible to obtain coverage on a yearly basis, many choose to take out insurance for the maximum term.

The reason for the shorter term is due to the recent increase in abnormal weather such as heavy rainfall and other natural disasters which have led to a rise in insurance payouts.

Insurance premiums for residential properties are also set to rise next year.

Sources:

47 News, September 14, 2014.

The Sankei Shimbun, September 14, 2014.

Office vacancy rates in August 2014 - Miki Shoji

September 22, 2014Tokyo Office Market,Tokyo Office Rent,Japan Office Vacancy RatesOffice/Retail News & Information,Real Estate News,Market Information,All,Osaka,Nagoya,Tokyo

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 6.08% in August, down 0.18 points from the previous month and down 2.14 points from last year.

The vacancy rate in brand new office buildings was 18.17%, up 0.76 points from the previous month and up 0.24 points from last year.Read more