Apartment asking prices up for 7th month in a row

April 23, 2015Real Estate News,Market Information,All,Osaka,Nagoya,Tokyo

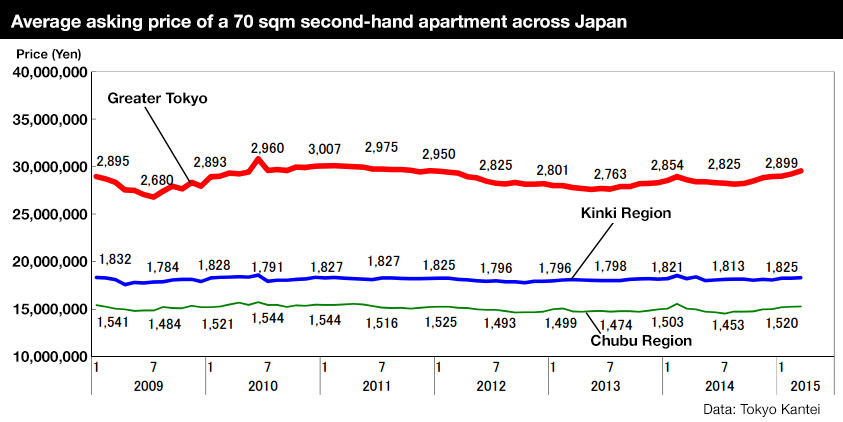

Second-hand apartment prices in greater Tokyo continue to rise this month with the average asking price of a 70 sqm (753 sq ft) apartment up 1.1% from February and up 3.3% from last year. This is the 7th month in a row to see a month-on-month increase. According to Tokyo Kantei, the average apartment asking price greater Tokyo in March was 29,560,000 Yen.

In Tokyo’s 23 wards, the average asking price was 45,360,000 Yen, up 1.7% from the previous month and up 9.4% from last year. The average building age was 22.1 years. The property market in Tokyo is far-outperforming Yokohama City (+1.5% from March 2014), Saitama City (+2.5%), Chiba City (-2.3%) and Osaka City (+3.1%).

Prices continue to reach new highs in central Tokyo’s six wards with the average asking price reaching 64,680,000 Yen, an increase of 2.1% from February and and increase of 13.0% from last year. This is the 9th month in a row to see a month-on-month increase. The gap between price rises in central Tokyo and other wards is becoming more apparent.

Asking prices are being supported by an increase in actual contracted prices. Sellers and real estate brokers are also setting higher and higher asking prices. The market for second-hand properties in Tokyo has been strengthening as a shrinking supply of new apartments is causing buyers to consider older apartments which are typically less expensive. Demand from investors is also strong, and properties that have been set at high prices are starting to sell without any discounting.Read more

Luxury ryokans seeing surge in investment

April 22, 2015Atami,HakoneReal Estate News,All,Hotel News,Tokyo

With expectations of growing demand from travellers and foreign tourists, luxury ryokans (traditional Japanese inns) and hotels across Japan are now a highly sought-after target by funds and major real estate companies. This means foreign investors looking to get into the hotel market in Japan will be facing increasingly tough competition from domestic investors.

This month, real estate giant HULIC will acquire two hotel properties in Hakone and Atami from Kato Pleasure Group. HULIC’s main business is office leasing and management, but with a declining population, they have been expanding their operations to other areas of the property market.Read more

Starbucks opens store in historic former home in Aomori

April 21, 2015Historic properties in Japan,Aomori Prefecture,HirosakiHistoric Properties,All

On April 22, Starbucks will open a store in a heritage listed building in Hirosaki City, Aomori Prefecture. This is the first Starbucks store in the city, and the first Starbucks store to be located in a local government owned property. Starbucks Japan operates over 1,000 stores across the country, including four in Aomori Prefecture.

The Hirosaki Koen-mae Store will open in a building that was built in 1917 as the official residence of the Commander of the 8th Division in the Imperial Japanese Army. It was designed by Hikosaburo Horie, the eldest son of Sakichi Horie who was a carpenter that worked on many of the western-style residences built in Aomori during the Meiji period.Read more

APA Group breaks ground on latest luxury condo

April 20, 2015Azabu Juban,Mita,Mita Tsunamachi,The Conoe Mita TsunamachiNew Construction,Real Estate News,All,Tokyo

On April 7, APA Group held the groundbreaking ceremony for their latest luxury condominium project in central Tokyo. The Conoe Mita Tsunamachi is located on a prime corner block along the same street as the Australian Embassy and the members-only Tsunamachi Mitsui Club.

The 9-storey building will contain 45 one and two-bedroom apartments ranging in size from 73 ~ 216 sqm (785 ~ 2,313 sq ft). Completion is expected by July 2017. Bathrooms will be designed to feel like those found in luxury hotels overseas, with natural wood and stone finishes.Read more

New apartment supply still below 2014 levels

April 17, 2015New Construction,Real Estate News,Market Information,All,Tokyo

According to the Real Estate Economic Institute, 4,457 brand new apartments were released for sale in greater Tokyo in March, up 71.6% from the previous month but down 4.0% from last year. 3,550 apartments were sold, making the contract 79.6%, up 5.1 points from the previous month but down 0.2 points from last year.

The average new apartment price was 51,860,000 Yen, down 9.0% from the previous month and down 0.6% from last year. The average price per square meter was 736,000 Yen, down 9.4% from the previous month but up 0.8% from last year.

410 apartments in high-rise buildings (over 20 storeys) were offered for sale, down 60.3% from last year. The contract rate was 79.0%, up 10.3 points from last year.Read more

March 2015 rental data - Tokyo Kantei

April 16, 2015Real Estate News,Rental Market,All,Osaka,Nagoya,Tokyo

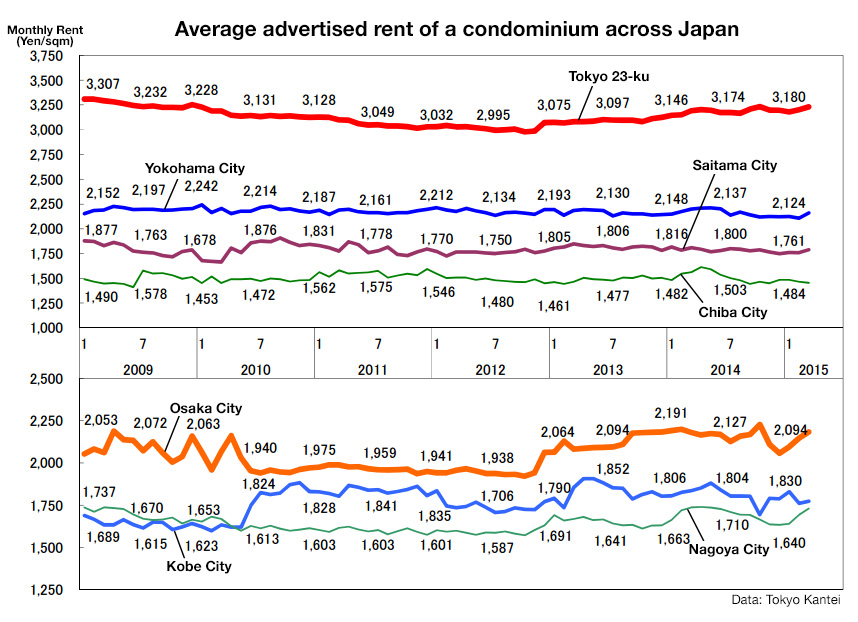

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,613 Yen/sqm in March, down 0.5% from the previous month but up 0.5% from last year. The average apartment size was 59.77 sqm and the average building age was 18.8 years.

In the Tokyo metropolitan area, the average rent was 3,106 Yen/sqm, up 1.2% from the previous month and up 0.9% from last year. The average apartment size was 57.17 sqm and the average building age was 17.4 years.

Details of Akasaka’s 44-storey condominium announced

April 15, 2015Tokyo Midtown,Akasaka 9 Chome North District Redevelopment,Akasaka 9 Chome Tower Project,Park Court Akasaka Hinokicho The TowerNew Construction,Real Estate News,Redevelopment & Reconstruction,All,Tokyo

Details on Park Court Akasaka Hinokicho The Tower (previously the Akasaka 9 Chome Tower Project) have just been released. The 170m tall, 44-storey condominium, which was designed by Nikken and famed architect Kengo Kuma, is currently under construction on the northern side of Tokyo Midtown.

The high-rise will contain 322 apartments, of which just 163 (50%) will be available for sale. The remainder will go to landholders and participants of the development. The two and three-bedroom apartments will range in size from 57.61 ~ 203.96 sqm (620 ~ 2,195 sq ft). Layouts are cleverly designed and do not contain any windowless bedrooms that you may find in cheaper developments. The largest apartment, a 203 sqm penthouse, includes two full bathrooms, while the rest of the apartments have 1 bathroom.

Sales will begin in September October November 2015 . Prices have yet to be announced, but with apartments in other recent high-rises in Akasaka selling for around 2,000,000 Yen/sqm, it is likely that we will see comparative pricing in this new project. There have been rumours that apartments could be priced as high as 3,000,000 Yen/sqm.Read more