Google Japan office relocation signals return of Shibuya’s Bit Valley

On November 17, Google Japan announced plans to relocate their head office to a new office tower near Shibuya Station in mid-2019.

Google will be taking up floors 14 to 35 in Shibuya Stream - a 35-storey office tower due for completion in late 2018. The 50,000 sqm (538,000 sq ft) of office space will allow them to double their staff numbers from the current level of 1,300. The lower floors of the Shibuya Stream building will be hotel rooms, making Google the sole office tenant.

16-fold rent increase for shopkeepers at Asakusa’s Sensoji temple

Shopkeepers alongside the Nakamise shopping street, a 250 meters long souvenir shop-lined pedestrian mall leading to Sensoji temple in Tokyo, are reeling after being hit with a potential 16-fold increase in store rents. In September, Sensoji temple informed the tenants of plans to increase the rent from the current level of 15,000 Yen per month for a 10 square meter shop to a new rent of 250,000 Yen per month, making it in line with market rents for the neighborhood and ending years of subsidized rents that had been offered by the previous landlord - the Tokyo metropolitan government.

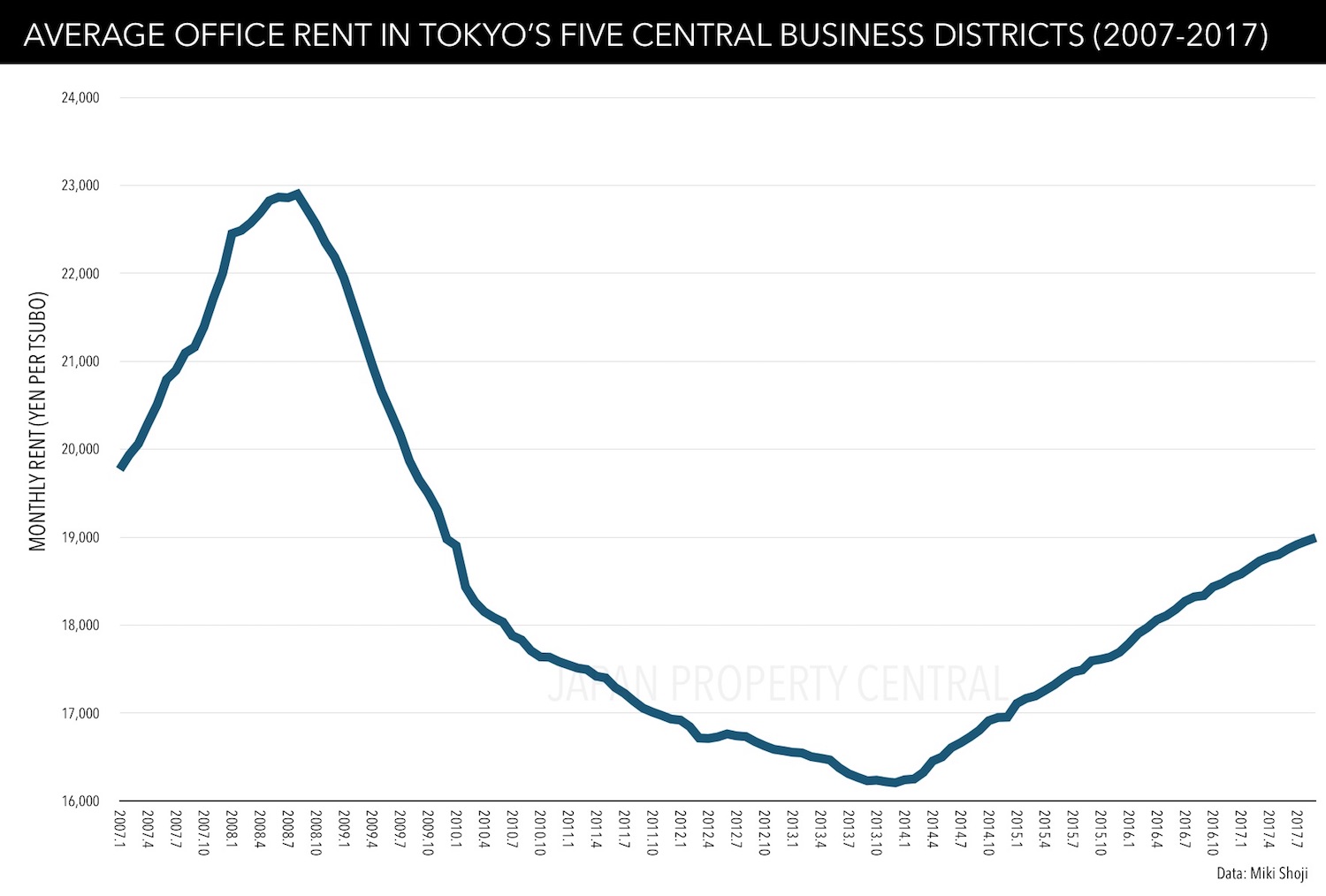

Tokyo office rents increase for 45th consecutive month

According to Miki Shoji, the average monthly office rent in central Tokyo’s five business districts reached 18,995 Yen per Tsubo (approx. 5,747 Yen/sqm) in September, an increase of 3.59% from last year and the 45th month in a row to record a year-on-year increase. The average is still 17% below the recent record high of 22,901 Yen/Tsubo (6,929 Yen/sqm) seen in August 2008.

Land in Ginza to sell for 64 million Yen (570,000 USD) per square meter

Articles appearing in both the Nikkei Business Publication and the Business Journal have suggested that a block of land (with building) alongside Ginza’s main shopping street will be sold for a record price of up to 64 million Yen per square meter (approx. 570,000 USD/sqm or 53,000 USD/sq ft).

Land under Takashimaya Times Square Building sells for 21 billion Yen

Takashimaya has acquired the remaining 60% of the land under the Times Square Building near Shinjuku Station for 21 billion Yen (approx. 185 million USD).

The property is located on the eastern side of Shinjuku Station in Shibuya ward. The main tenants of the building include the Takashimaya department store and Tokyu Hands.

Historic Kudan Kaikan redevelopment plans announced

On September 21st, the Kanto Local Finance Bureau announced that Tokyu Land had won the competitive bidding process for the redevelopment of the Kudan Kaikan building in central Tokyo. The bidding price will be announced after Tokyu signs the contractural agreement in March 2018.

The developer will lease the 8,700 sqm block of land under a 70-year fixed term and will build a high-rise office tower on the site. The north-eastern corner of the original Kudan Kaikan building will be preserved and retrofitted using a base-isolation system (menshin-kozo).

Japan's supply of new office space hits lowest level since 1980

According to the Japan Real Estate Institute, 1.35 million square meters (approx. 14.5 million sq ft) of new office space was supplied across the country in 2016, down 25% from 2016 and the lowest level seen since 1980. 84% of the new supply was centered in Tokyo’s 23 wards.

Sapporo, Sendai, Saitama, Kyoto and Kobe saw no new office buildings supplied last year, although there are several new buildings planned for completion over the next two years. Kyoto City, however, has no new office supply planned for the near future. Kyoto is reportedly suffering from a severe shortage of office space with office brokerage Miki Shoji reporting a current office vacancy rate around 2%, down from 12% seen in 2010.