Government may lift ban on AirBnb-type rentals

The Ministry of Health, Labour and Welfare, and the Ministry of Land, Infrastructure, Transport and Tourism are considering removing the ban on letting out private apartments and homes to tourists starting as early as next year.

Under the current Hotel Business Law, anyone wanting to provide accommodation for stays of less than 30 days must obtain a hotel license. Properties must meet strict requirements, including zoning, structural codes, safety and hygiene practices. Renting out a room on AirBnb to someone for less than 30 days is essentially illegal without the appropriate license.

The recent influx in foreign tourists, a shortage of hotel rooms, and a growing number of incidents with illegal hotels and AirBnb hosts has caused the government to consider introducing some urgent changes to legislation.Read more

Condo manager accused of 1.1 billion Yen embezzlement

The former chairperson of the owner’s association of a ski resort condominium in Niigata has been accused of allegedly embezzling 1.178 billion Yen (9.6 million USD) from the apartment building’s management and repair fund over the span of sixteen years.

The owner’s association filed a criminal complaint in an attempt to recover the 400 million Yen which falls within the statute of limitations. The former chairman allegedly falsified bank statements after transferring the funds to his personal bank account to purchase shares and make other personal investments. Read more

3,200 unit apartment building for Nishi Shinjuku

A large development site situated between Shinjuku Park Tower/Park Hyatt and Opera City in Nishi Shinjuku may finally see some activity as the redevelopment association move forward on construction plans.

Current discussions call for two 65-storey high-rise residential towers containing around 3,200 apartments. A town planning decision will be made in 2016, and if approved, construction could begin in 2019.

A 60-storey condominium tower is currently under construction in Nishi Shinjuku 5 Chome. The Parkhouse Nishi Shinjuku Tower 60 was advertised as being the tallest apartment building in Japan based on the total number of floors, but if the Nishi Shinjuku 3 Chome Project goes ahead as planned, The Parkhouse won’t keep its title for long.Read more

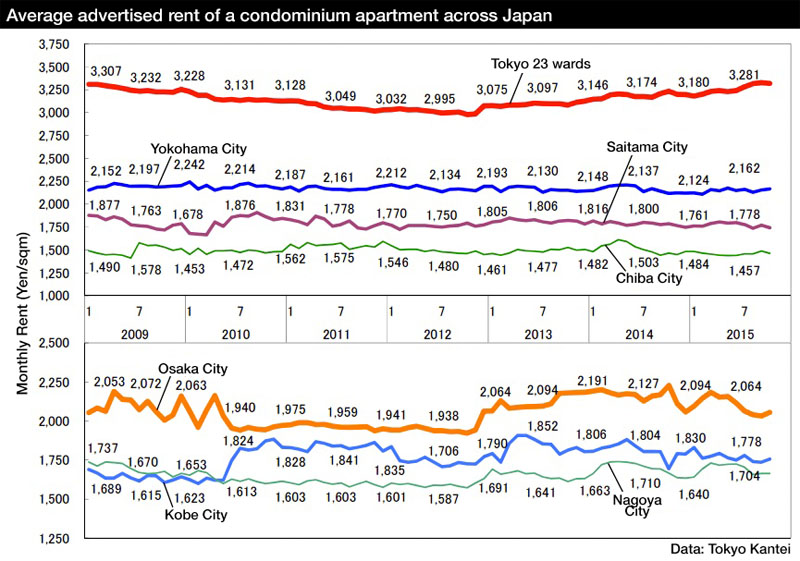

Residential rental growth slows in Tokyo

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,681 Yen/sqm in October, up 1.3% from the previous month and up 3.0% from last year. The increase is due to a larger share of transactions in the Tokyo metropolitan area, which is pulling up the average. The average apartment size was 59.65 sqm and the average building age was 19.2 years.

In the Tokyo metropolitan area, the average rent was 3,184 Yen/sqm, up 0.1% from the previous month and up 2.7% from last year. The average apartment size was 57.08 sqm and the average building age was 17.4 years.

In Tokyo’s 23 wards, the average rent was 3,317 Yen/sqm, down 0.3% from the previous month but up 2.6% from last year. The average apartment size was 56.49 sqm and the average building age was 17.0 years.Read more

Nara Dreamland sold to Osaka real estate company

Nara Dreamland, the long-since closed amusement park modelled after California’s Disneyland, was purchased by an Osaka-based real estate company earlier this month for 730 million Yen (5.95 million USD). The buyer, SK Housing, was the only bidder at the public auction. It is unclear what the new owner plans to do with the site.Read more

Singapore property group opens hotel in Kyoto

Singapore’s Roxy-Pacific Holdings Limited opened their first hotel in Japan on November 16. The ‘Noku Roxy’ is located near the Kyoto Imperial Palace grounds and just above Marutamachi Station.

Singapore’s Roxy-Pacific Holdings Limited opened their first hotel in Japan on November 16. The ‘Noku Roxy’ is located near the Kyoto Imperial Palace grounds and just above Marutamachi Station.

Roxy acquired the existing 21-year old hotel, formerly called the ‘Tokyu Hotel Harvest Kyoto’, in October 2014 and have refurbished the interior and exterior. The property had previously been acquired by Ken Corporation in January 2014. Read more

Construction scandal shakes new apartment sales in October

According to the Real Estate Economic Institute, 2,921 new apartments were released for sale in October, up 20.2% from the previous month but down 6.5% from last year. This is the second month in a row to see a decline in supply from the previous year and has been attributed to both an increase in prices as well as the discovery of a faulty condominium in Yokohama last month which has caused turmoil in the real estate industry. Before news broke of the construction mishap, the Institute were predicting 3,500 apartments to be offered for sale in October. Although Autumn is typically a period of heavy sales activity by developers, the sales of several projects were delayed due to the uncertainty following the Yokohama apartment scandal. Only one large-scale project (a building containing over 100 units) went on sale in October, down from four large-scale projects last year.

A researcher from the Institute said that visitor numbers to apartment show rooms were relatively flat, and it is possible that developers will continue to delay sales until consumer confidence in the new apartment market improves.

2,010 apartments were sold, making the contract rate 68.8%, up 2.8 points from the previous month and up 5.5 points from last year.

475 apartments in high-rise buildings (over 20 storeys) were offered for sale, up 36.5% from last year. The contract rate was 79.8%.

The average price of a brand new apartment released for sale in greater Tokyo was 53,640,000 Yen, down 0.5% from the previous month but up 17.6% from last year. The average price per square meter was 759,000 Yen, down 0.3% from the previous month but up 19.0% from last year.Read more