81-yr old building in Kamakura sold to sake brewery

March 22, 2016Historic properties in JapanHistoric Properties,Real Estate News,All,Kamakura

The Kumazawa Brewing Company, a Chigasaki-based sake brewery established in 1873, has purchased the former Kamakura Pumping Station for 96.5 million Yen (approx. 860,000 USD). The seller was Kanagawa Prefecture.Read more

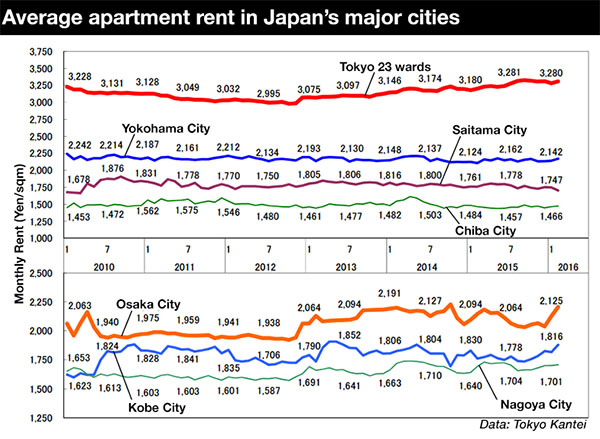

Average apartment rent in February 2016

March 21, 2016Real Estate News,Rental Market,Market Information,All,Osaka,Nagoya,Tokyo

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,528 Yen/sqm in February, down 1.5% from the previous month and down 3.7% from last year. The share of rental listings in the Tokyo metropolitan area dropped by 6 points from the previous month, which may have contributed to the lower rent. The average apartment size was 59.98 sqm and the average building age was 19.9 years.

In the Tokyo metropolitan area, the average rent was 3,161 Yen/sqm, up 1.1% from the previous month and up 3.0% from last year. The average apartment size was 56.33 sqm and the average building age was 17.7 years.

In Tokyo’s 23 wards, the average rent was 3,309 Yen/sqm, up 0.9% from the previous month and up 3.4% from last year. The average apartment size was 55.75 sqm and the average building age was 17.2 years.Read more

The most expensive homes for sale in Tokyo

Let's take a quick look at the most expensive homes currently advertised for sale in Tokyo:

|

|---|

| SOLD Location: Minami Aoyama, Minato-ku House: 7-Bedrooms, 4 Bathrooms, 630 sqm (6,779 sq.ft) *A 10 minute walk from Omotesando Station. |

New apartment supply in February reaches 25 year low

March 17, 2016Real Estate News,Market Information,All,Tokyo

According to the Real Estate Economic Institute, 2,237 brand new apartments were released for sale in greater Tokyo in February, up 49.7% from January but down 13.9% from February 2015. This is the lowest figure for the month February since 1991.

Amidst rising construction costs and increasing apartment prices, developers have been cautious to limit the supply released on the market. The Institute remarked that the Bank of Japan’s recent introduction of negative interest rates appears to have had a negligible effect on new apartment sales as interest rates available to consumers were already at low levels prior to the BoJ’s announcement.Read more

Shrine to demolish 53-yr old building by iconic architect

March 15, 2016Shimane Prefecture,Kiyonori Kikutake (Architect)Demolition,Historic Properties,All

A 53-year old former Shrine Office building in Shimane Prefecture is at risk of demolition. The owner, Izumo-taisha (aka the Izumo Grand Shrine), is considering tearing down the building due to its deteriorating state.

Architects and local groups are petitioning the shrine to consider the cultural importance of the building and preserve it for future generations. The shrine office was designed by architect Kiyonori Kikutake (1928-2011) and completed in 1963. Kikutake, along with Kisho Kurokawa, was one of the founders of the metabolist movement and designed numerous buildings across Japan.Read more

Japan's first JW Marriott Hotel to open in Nara

March 14, 2016Nara Prefecture,NaraReal Estate News,All,Hotel News

Mori Trust announced that the Marriott International hotel group will open their first JW Marriott luxury branded hotel in Nara City in 2020. The JW Marriott Hotel Nara will be built on vacant land across the street from the Nara City Hall and near the former Heijo Palace - a UNESCO World Heritage Site.

Mori Trust announced that the Marriott International hotel group will open their first JW Marriott luxury branded hotel in Nara City in 2020. The JW Marriott Hotel Nara will be built on vacant land across the street from the Nara City Hall and near the former Heijo Palace - a UNESCO World Heritage Site.

Mori Trust acquired the 4,000 sqm block from the prefecture and will start construction of the 15,000 sqm (161,400 sq.ft) hotel next year. The 6 ~ 7 storey hotel will have 150 guest rooms, restaurant, bar and pool facilities.Read more

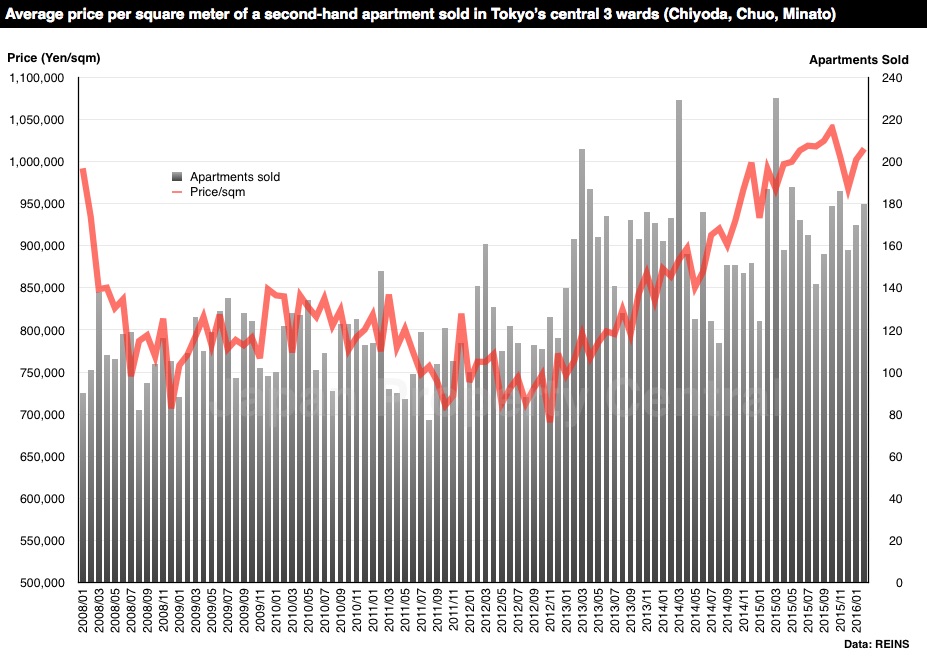

Tokyo apartment transactions increase for 5th consecutive month

March 11, 2016Real Estate News,Market Information,All,Tokyo

According to REINS, 3,539 second-hand apartments were sold across greater Tokyo in February, up 33.3% from the previous month and up 7.5% from last year. This is the 5th month in a row to see a year-on-year increase in transactions.

The average sale price was 30,450,000 Yen, up 2.0% from the previous month and up 4.1% from last year. The average price per square meter was 471,200 Yen, up 0.6% from the previous month and up 4.7% from last year. This is the 38th month in a row to see a year-on-year increase in sale prices. The average building age was 19.71 years.

In the Tokyo metropolitan area, 1,759 second-hand apartments were sold, up 36.1% from the previous month and up 11.9% from last year. The average sale price was 37,160,000 Yen, up 0.1% from the previous month and up 2.1% from last year. The average price per square meter was 618,900 Yen, down 2.3% from the previous month but up 2.1% from last year. The average building age was 18.64 years.Read more