Shinjuku office vacancy rate drops to 1% range

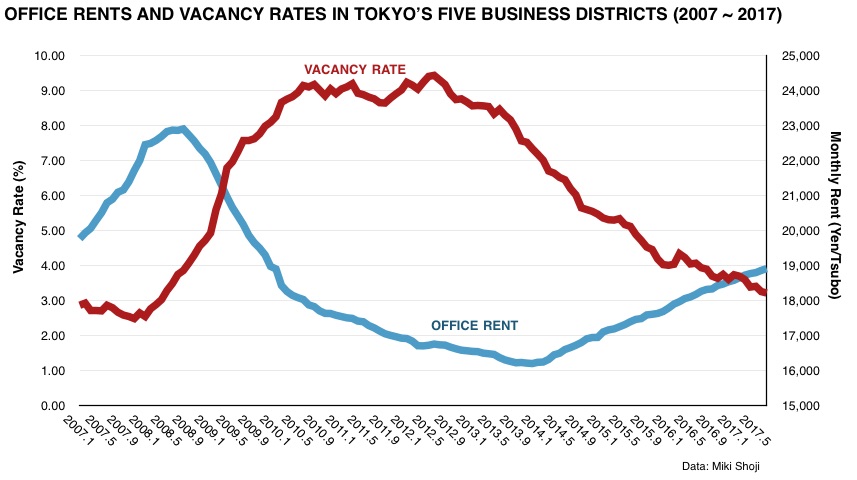

The office vacancy rate across Tokyo’s five central business districts of Chiyoda, Chuo, Minato, Shinjuku and Shibuya dropped to 3.22% in July, down 0.04 points from June and down 0.72 points from July 2016. This is close to the record low of of 3.03% reported in April 2008 and down from a high of 9.43% seen in June 2012.

The vacancy rate in existing buildings (excluding new construction) was 2.87% in July, down 0.74 points from last year.

In Shinjuku ward, the vacancy rate was 1.68%, down 0.06 points from the previous month and down 1.30 points from last year. The vacancy rate dropped to the 1% range in May 2017.

Tokyo's office market continues to strengthen

In August, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 4.72%, down 0.17 points from the previous month and down 1.30 points from last year. This is the lowest vacancy rate seen since December 2008. Shibuya had the lowest vacancy of 2.22%, down 0.05 points from July and down 1.79 points from last year.

With vacancy rates below the 5% level said to indicate a healthy balance between demand and supply, rents continue to increase. The average monthly office rent was 17,490 Yen per Tsubo (5,300 Yen/sqm), up 0.01% from the previous month and up 4.5% from last year. This is the 20th month in a row to see a month-on-month increase.Read more

Tokyo office rents to peak in 2017?

A vacancy rate of 5% is said to be the line between a landlord’s market and a tenant’s market. According to Miki Shoji, the vacancy rate in Tokyo’s central five business districts in July 2015 was 4.89%, down 0.23 points from June and down 1.31 points from last year. Shibuya-ku has the lowest vacancy rate of 2.27%, down 1.82 points from last year. CBRE reported that the all-grade vacancy rate in July 2015 was 3.3% in the 5 wards and 3.6% across the 23 wards. During the mini-bubble in 2007, the vacancy rate across all wards dropped to just 1.2%, while monthly rents reached a peak of 52,350 Yen/Tsubo (15,863 Yen/sqm).

Marunouchi remains the prime office location, and Marunouchi’s landlord - Mitsubishi Estate - is currently enjoying a vacancy rate of just 1.8%.

With renewed confidence in the economy, vacancy rates have again improved, while office rents have increased to a current average of 33,600 Yen/Tsubo (10,181 Yen/sqm), up from 29,050 Yen/Tsubo (8,803 Yen/sqm) seen during the market bottom.

Demand from companies seeking to rent entire floors is thought to be a driving force behind the rising rents. Companies are starting to group divisions and departments into one building or one floor, rather than having various smaller office locations.Read more

Tokyo office vacancy rates reach 6 year low

According to Miki Shoji’s Office Report, the vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.31% in February, down 0.05 points from January and down 1.70 points from last year. This is the lowest level seen since January 2009 and is the 20th month in a row to see an improvement in vacancy rates.

The vacancy rate in brand new office buildings was 29.31%, up 14.46 points from the previous month and up 9.66 points from last year. A large-scale office building was completed in February, which added to the supply for the month. Read more

Tokyo office vacancy rate falls to 6 year low

According to MIki Shoji’s Office Report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.36% in January 2015, down 0.11 points from the previous month and down 1.82 points from last year.

The vacancy rate in brand new office buildings was 14.85%, up 1.45 points from the previous month and up 0.43 points from last year.Read more

Office vacancy rates in Tokyo down for 18th consecutive month

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.47% in December 2014, down 0.08 points from the previous month and down 1.87 points from last year. This is the 18th month in a row to see a month-on-month decrease in vacancy rates.

In Minato-ku, vacancy rates dropped to the 5% range for the first time since January 2009.

The vacancy rate in brand new office buildings was 13.40%, down 0.33 points from the previous month and down 1.10 points from last year. Only one office building was completed in December and was fully leased at the time of completion.Read more

Land prices up in 83% of locations - MLIT LOOK Report

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced the land price movements across Japan for the third quarter in 2014 (July 1 ~ October 1).

According to the Chika Look Report, 124 locations (83% of the total) saw an increase from the previous quarter, and 26 locations (17% of the total) saw no change. For the first time since this survey began in late 2007, none of the 150 survey sites saw a decrease in prices. Of the 124 locations to see a price rise, 122 locations saw prices rise between 0 ~ 3%, while 2 locations (Ginza and Shinjuku 3 Chome) saw prices rise between 3 ~ 6%.

Strong investor demand caused by monetary easing, as well as demand for apartments in areas with convenient access have helped to sustain the price growth.

In greater Tokyo, 58 locations (89% of the total) saw land prices increase, while the remaining 7 locations (11%) saw no change. In greater Osaka, 30 locations (77%) saw prices increase, wile 9 locations (23%) saw no change. In Nagoya, all 14 locations saw prices increase.Read more