Standard land prices in Tokyo increase for 5th year in a row, while nationwide commercial prices increase for first time in 10 years

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT), announced the Standard Land Prices on September 19th. In the Tokyo metropolitan area, land prices across all uses increased by 3.0% from last year, recording the fifth consecutive increase in land prices. Commercial land prices in Tokyo’s 23 wards increased by an average of 5.9%, after recording a 4.9% increase in 2015. Shibuya Ward was in top place with 8.6% growth (6.6% in 2016).

The survey site under the Ginza Owaricho Tower in Ginza 6 Chome saw a 21.8% increase in land prices over the past 12 months.

Nationwide, standard land prices were down 0.6% for residential land, but up 0.5% for commercial land. This is the first time in 10 years to see an increase in commercial land prices.

Kyoto’s tourism boom drives commercial land price growthRead more

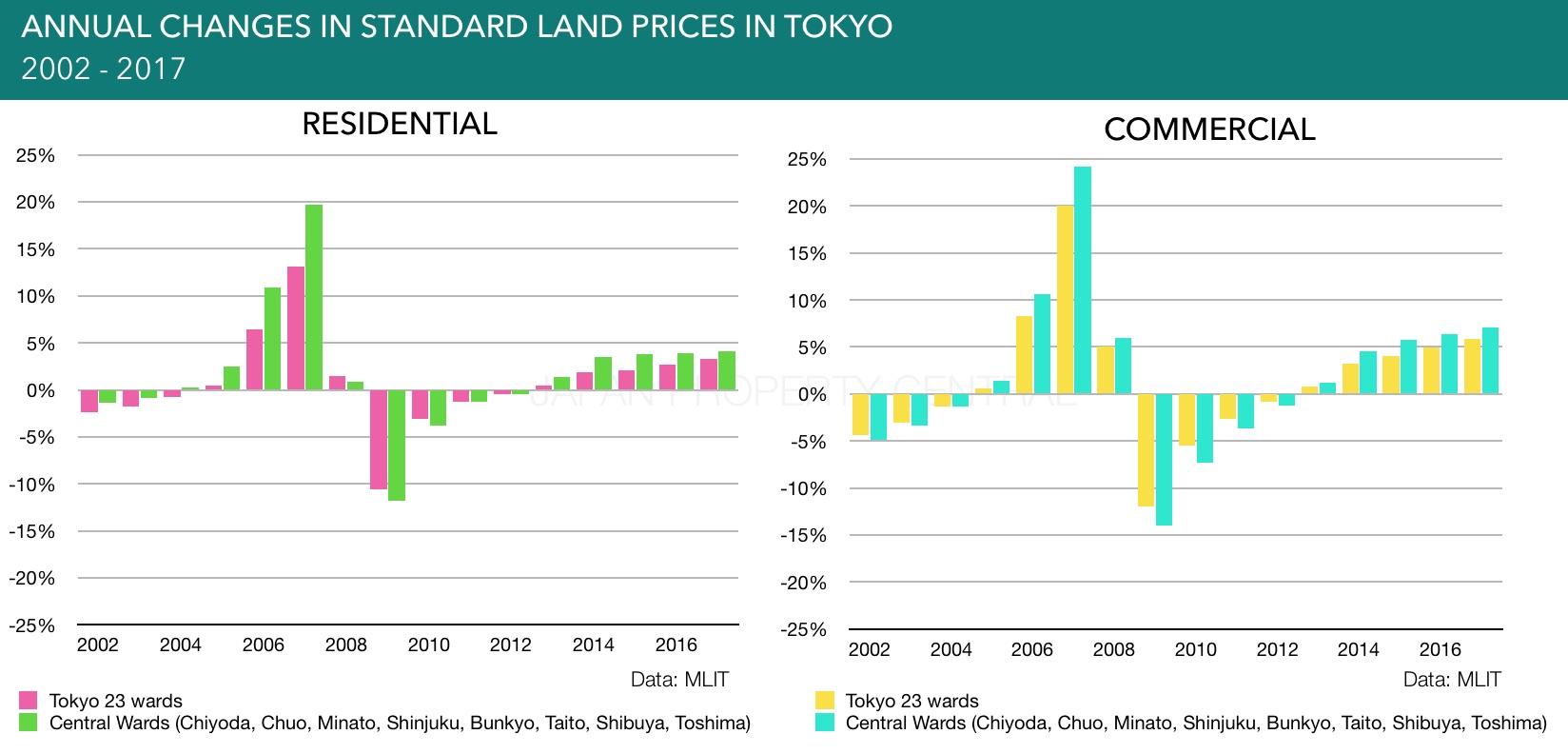

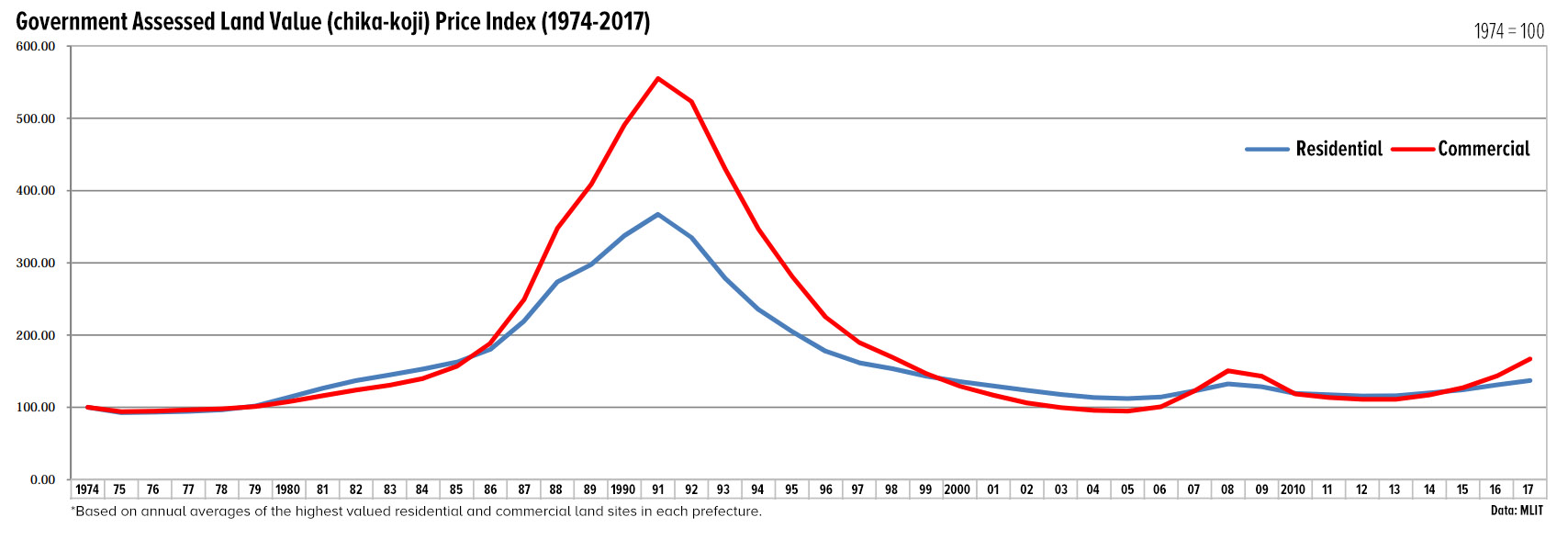

Price growth in Tokyo more subdued than the 2007 mini-bubble

Earlier this year, rosenka tax values at a section of ultra-prime commercial land in Tokyo’s Ginza district increased by 26% from the previous year to a record high of 40,320,000 Yen per square meter, exceeding the previous high of 36,500,000 Yen/sqm in 1992 and causing some to warn of an impending bubble and overheating of the property market in the nation’s capital.

There is valid cause for concern in some sectors of the investment-property market due to potential over-construction and over-lending to landowners to build small blocks of 'apaato' type rental flats in suburban areas with low rental demand.

But are current conditions mimicking previous bubbles?

This time around Japan is getting more foreign tourists than ever before, boosting revenues for both hotels and retails shops, making the increase in commercial real estate values much more pronounced than the residential market which relies more on real domestic demand.

Land prices continue to climb in latest LOOK Report

Land prices continue to climb in Japan’s major cities with 84% of survey sites recording an increase in land prices in the first quarter of 2015. 16% of the locations saw no change in land prices, and none of the locations saw a decrease in prices. Two retail locations saw prices rise by 3 ~ 6%: Ginza in Tokyo and an area near Nagoya Station.

Monetary easing and a bullish condominium market is behind the rise in prices in Tokyo, with 90.7% of locations seeing positive growth.Read more

Land prices continue to rise - MLIT LOOK Report

According to the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) Chika LOOK Report for the fourth quarter of 2014 (October 1 ~ January 1), land prices increased in 83% of the surveyed locations across Japan. For the second quarter in a row, none of the locations saw a decline in land prices.

The Chika LOOK Report is a quarterly survey of land price movements of 150 commercial and residential locations across Japan. In the last quarter, 125 locations saw an increase, up from 124 locations in October 1, 2014. Two of those locations saw land prices rise 3 ~ 6% (the Toranomon area in Tokyo and the Ohori area in Fukuoka), while 25 locations saw no change in land prices.

In the greater Tokyo area, 90.8% of locations saw an increase in land prices, while 79.5% of locations in the greater Osaka area saw an increase.

Land prices up in 83% of locations - MLIT LOOK Report

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced the land price movements across Japan for the third quarter in 2014 (July 1 ~ October 1).

According to the Chika Look Report, 124 locations (83% of the total) saw an increase from the previous quarter, and 26 locations (17% of the total) saw no change. For the first time since this survey began in late 2007, none of the 150 survey sites saw a decrease in prices. Of the 124 locations to see a price rise, 122 locations saw prices rise between 0 ~ 3%, while 2 locations (Ginza and Shinjuku 3 Chome) saw prices rise between 3 ~ 6%.

Strong investor demand caused by monetary easing, as well as demand for apartments in areas with convenient access have helped to sustain the price growth.

In greater Tokyo, 58 locations (89% of the total) saw land prices increase, while the remaining 7 locations (11%) saw no change. In greater Osaka, 30 locations (77%) saw prices increase, wile 9 locations (23%) saw no change. In Nagoya, all 14 locations saw prices increase.Read more

Japan’s standard land prices up in urban areas, but continue to decline in regional areas

According to the MLIT, the standard land price (kijun-chika) across Japan’s three major cities of Tokyo, Osaka and Nagoya increased by 0.8% over the 12 months to July 1, 2014. This is the second year in a row to see an annual increase. In 2013, land prices increased by 0.1%. Residential land prices increased by 0.5% in the three major cities. This was the first time in six years to see an increase.

The nationwide average, however, fell by 1.2%. This is the 23rd year in a row to see a decline in land prices, although the rate of decline has shrunk (land prices dropped by 1.9% in 2013). Regional areas saw a 1.9% decline in land prices in 2014. This is the first time in 16 years that the rate of decline in regional areas has been as low as the 1% range. However, residential and commercial land values in regional areas suffering from declining populations have seen land prices drop further.

Chika-koji land prices in major cities up for first time in 6 years - MLIT

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced the 2014 'chika-koji' assessed land values on March 18. According to the latest data, both commercial and residential land prices rose in Japan's three major cities for the first time in six years.

In Greater Tokyo, Nagoya and Osaka, residential land prices were up 0.5% and commercial land prices were up 1.6% over the 12 months to January 1, 2014.

In central Tokyo, residential land prices were up 5.9% in Minato-ku, 8.7% in Chuo-ku and 6.0% in Chiyoda-ku after negligible changes in 2013. In fact, residential and commercial land prices increased in each of Tokyo's 23 special wards.