Share house investment scam sees bank share price dive 20% in one day

The scandal surrounding a failed share house developer continues to grow this month as more information about dodgy spruiking tactics and falsified documents comes to light. As many as 700 investors from a single share house developer are facing potential bankruptcy, but the number of victims could easily rise as other investment-spruiking companies are put under the spotlight.

The scandal surrounding a failed share house developer continues to grow this month as more information about dodgy spruiking tactics and falsified documents comes to light. As many as 700 investors from a single share house developer are facing potential bankruptcy, but the number of victims could easily rise as other investment-spruiking companies are put under the spotlight.

A lawyer representing a class action by investors against the Tokyo-based share house company alleges that the inflated price of the share houses sold to investors was determined by the maximum amount that the bank was willing to lend a buyer, rather than the true market price. A gross return was 8 ~ 9% was then applied to the sale price, even if it was higher than the market rent. The buyer would buy under the assumption that they could rely on stable, guaranteed rents that would provide them with a cash surplus each month. The high yield was only possible because the share house operator was providing a rental guarantee that far exceeded the rent they were receiving - causing the operator to lose money each month.Read more

Bidding restarted for Sengaku-ji Station high-rise apartment tower

A 160m tall apartment tower is planned for a site located above Sengaku-ji Station in Minato-ku, Tokyo. The project covers a 13,000 sqm site located on the eastern side of the Daiichi-Keihin Road, with the Yamanote train tracks running along the western side. This is reclaimed land that was once part of Tokyo Bay.

In February it was announced that a joint venture between Kajima Corporation, Tokyu Land and Keikyu Corporation had successfully bid on the development. On April 4, the Tokyo Metropolitan Government announced that their bid was disqualified after charges were filed against an executive from Kajima Corporation for allegedly colluding on a bid for the new high-speed maglev train. Read more

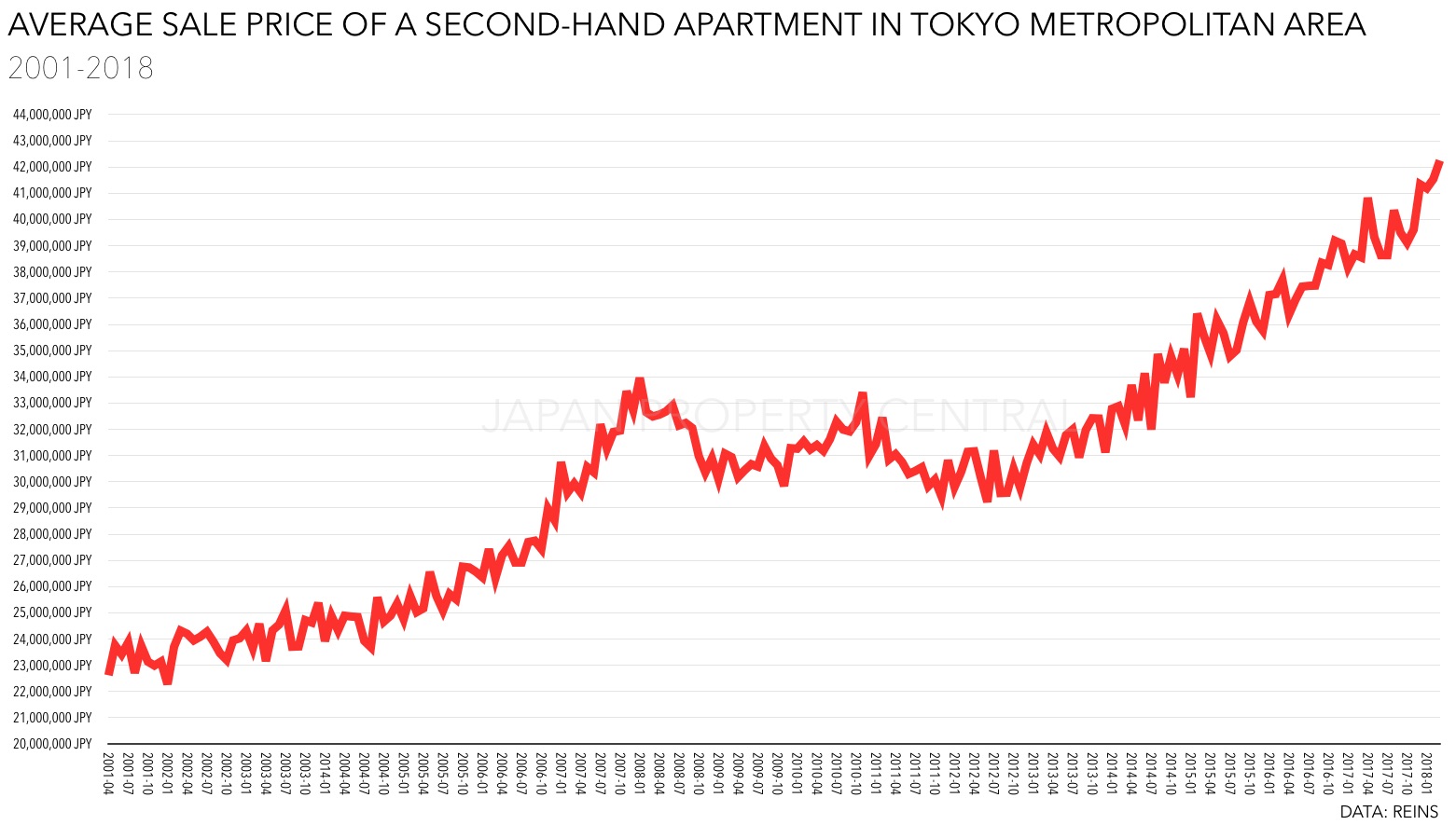

Tokyo apartment sale prices increase for 66th month

According to REINS, 3,819 second-hand apartments were reported to have sold across greater Tokyo in March, up 11.5% from the previous month and up 2.7% from last year. The average sale price was 33,690,000 Yen, up 0.5% from the previous month and up 7.1% from last year. The average price per square meter was 521,100 Yen, up 1.8% from the previous month and up 5.7% from last year. This is the 63rd month in a row to see a year-on-year increase in sale prices.Read more

Apartment prices take a dip in Tokyo Bayside island district

According to data compiled by Tokyo Kantei, the average asking prices of second-hand apartments in several districts on the manmade islands in Tokyo Bay have declined over the past two years. This is despite the hype from the upcoming 2020 Tokyo Olympics, which will see several facilities and the Athletes Village constructed on these islands. The report covered family-type apartments listed for sale between June and August 2017, comparing them to average asking prices in 2015 and 2016.

Kokusai-tenjijo Station Area:

Serviced by the Rinkai Line, this station is about 450 meters from the Tokyo Big Sight exhibition hall and opposite the Ariake Tennis Courts and Ariake Colosseum. A 1500-unit large-scale apartment complex is currently under construction not far from this station with completion scheduled in early 2020. Apartments in this new project have an average price of around 1,000,000 Yen/sqm. Meanwhile, the average asking price of a second-hand apartment in this district was 679,000 Yen/sqm, down 5.9% from 2016 and down 8.9% from 2015.Read more

Tokyo Apartment Sales in March 2018

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of March 2018:Read more

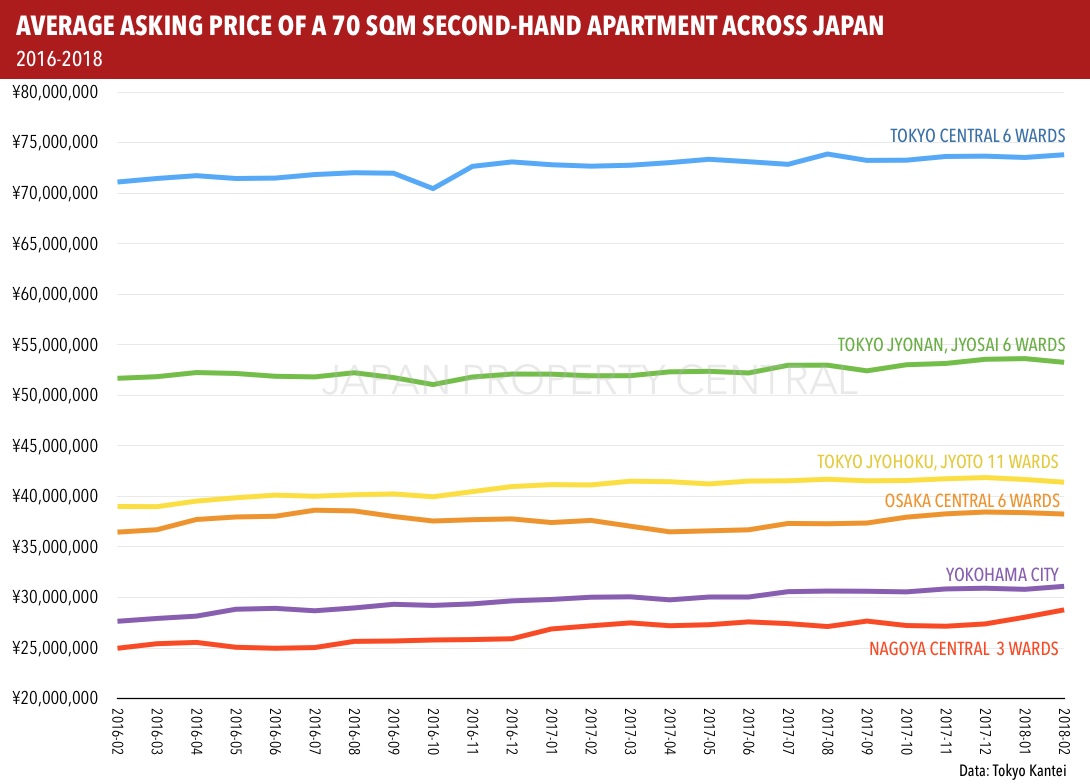

Apartment asking prices in Tokyo in February 2018

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq.ft) apartment across greater Tokyo was 35,980,000 Yen in February 2018, showing no change from the previous month but up 0.4% from last year. The average building age was 23.4 years.Read more

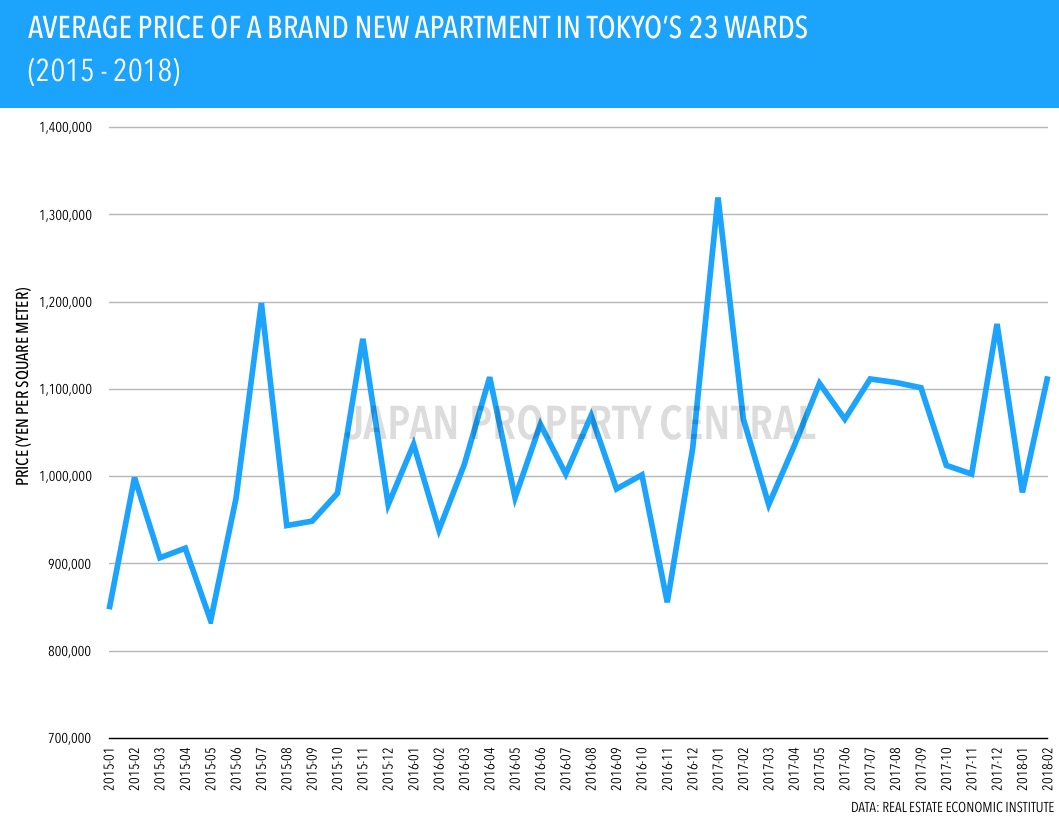

New apartment prices in Greater Tokyo up 7.8% in February

According to the Real Estate Economic Institute, 2,490 brand new apartments were released for sale across greater Tokyo in February, up 28.7% from the previous month and up 7.8% from last year. The average sale price was 61,280,000 Yen, up 5.8% from last year. The average price per square meter was 889,000 Yen, up 4.3% from last year.

The contract ratio was 65.0%, down 3.4 points from last year and down 0.2 points from the previous month.Read more