Desperate sellers in ski resort town forced to pay buyers to offload apartments

Some owners, in an attempt to offload their apartments in aging ski resort towns, are paying companies to take the properties off their hands. For companies offering this relatively new service, charging fees to the seller is how they balance the risk of holding a property that comes with high running costs and limited resale potential.

How it works

According to the website of a company that specializes in buying up resort apartments, they ask the seller to pay them enough to cover the following:

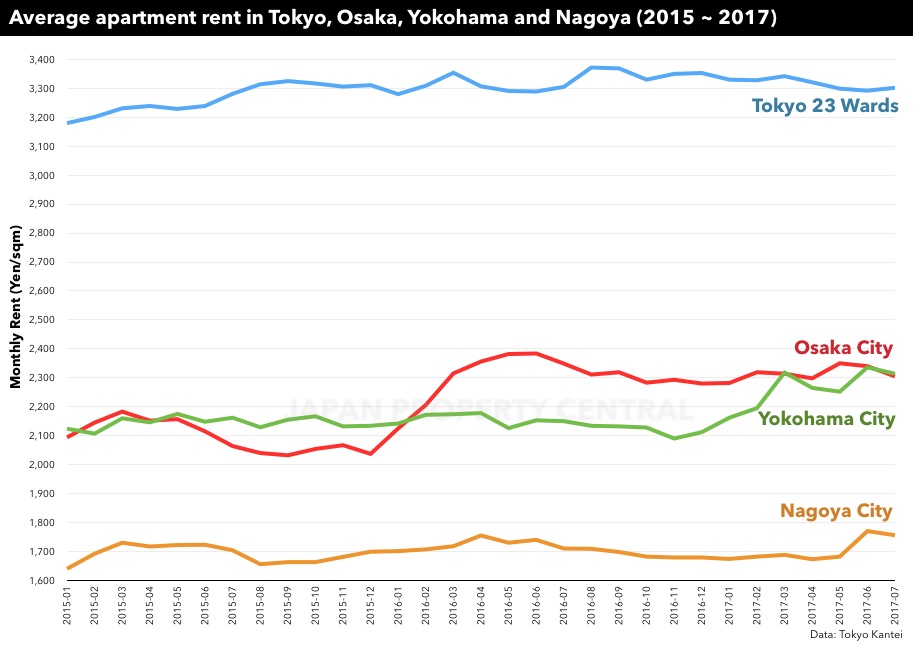

Average apartment rent in July 2017

According to Tokyo Kantei, the average monthly rent of a condominium-type apartment across greater Tokyo in July 2017 was 2,631 Yen/sqm, up 0.5% from the previous month but down 0.8% from last year. The average apartment size was 60.03 sqm and the average building age was 20.8 years.

In the Tokyo metropolitan area the average monthly rent was 3,141 Yen/sqm, up 0.4% from the previous month but down 0.1% from last year. The average apartment size was 57.19 sqm and the average building age was 19.1 years.

In Tokyo’s 23 wards, the average monthly rent was 3,302 Yen/sqm, up 0.3% from the previous month but down 0.1% from last year. The average apartment size was 56.56 sqm and the average building age was 18.3 years.

New apartment prices in greater Tokyo up 16% from last year

According to the Real Estate Economic Institute, a total of 3,426 brand-new apartments were released for sale across greater Tokyo in July, up 50.0% from the previous month and up 3.3% from last year.

2,465 apartments were sold, resulting in a contract ratio of 71.9%, up 8.6 points from last year and above the 70.0% level said to indicate healthy market conditions. Unsold inventory at the end of July was 6,314 apartments, down 184 units from last year.

The average price of a new apartment across greater Tokyo was 65,620,000 Yen, up 16.3% from the previous month and up 16.0% from last year. The average sale price per square meter was 952,000 Yen, up 13.3% from the previous month and up 18.1% from last year.

705 apartments in high-rise buildings (20 storeys and above) were listed for sale, up 220.5% from last year. The contract ratio was 88.2%, up 34.1 points from last year.

The following buildings saw same-day sellouts* in July:

Restauranteur planning hotels for Karuizawa and Nasu

Restaurant and wedding function company, Hiramatsu, has announced plans to open an additional two auberge-style resorts in Karuizawa and Nasu.

Both resorts will have around 30 guest suites and are scheduled to open in 2020. The Karuizawa property is located on a 53,000 sqm site of leased land in Miyota Town, just west of Karuizawa. Annual revenues are forecast to be 1.1 billion Yen (approx. 10 million USD), and the total investment will be around 3 billion Yen (approx. 27 million USD).

Renovated machiya guesthouse in Kyoto makes 1 million Yen in first month

A renovated guesthouse located just 7 minutes from Kyoto Station has made a gross turnover of 1 million Yen (approx. 9,150 USD) in the first month of operations.

Yadoru Kyoto Washi-no-Yado is a 102-year old traditional Kyoto machiya-style townhouse that was given a full renovation and converted into a holiday rental. The occupancy rate for the month of July was over 97%. Over 80% of the guests have been foreign travelers, with visitors from China and Taiwan making up 60% of bookings.

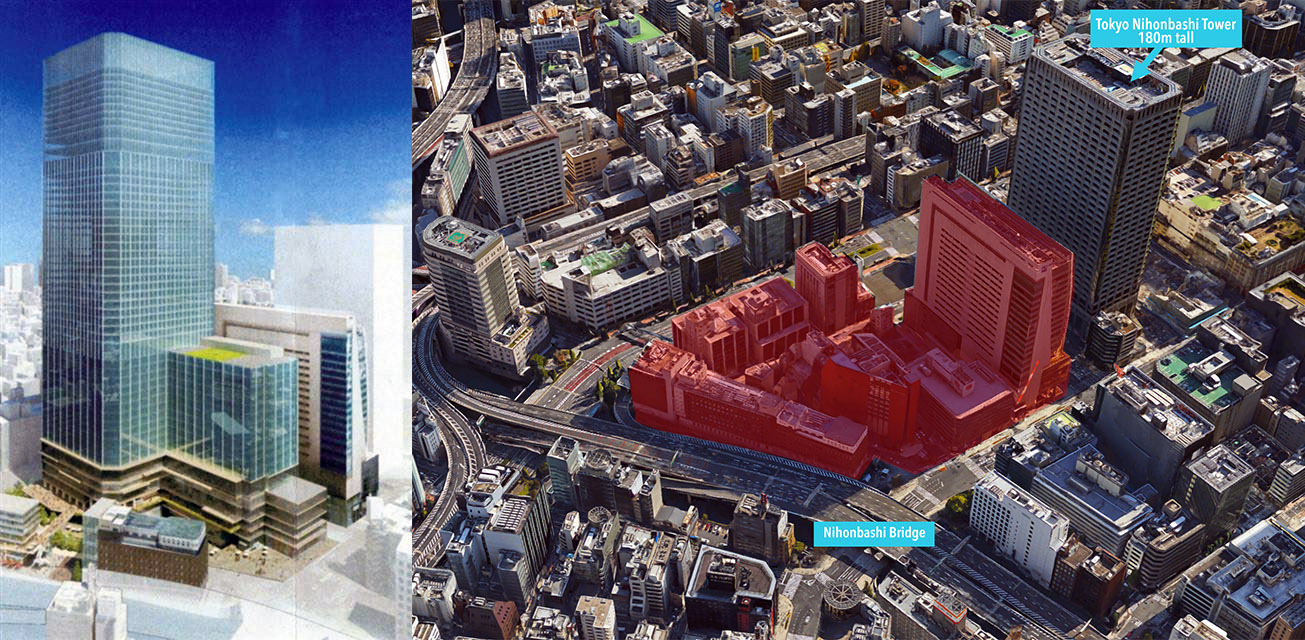

287m tall high-rise planned for Nihonbashi

Details on the Nihonbashi 1 Chome Central District Redevelopment have been announced. The project will include a 287m tall high-rise with office, hotel and serviced apartments, as well as several low-rise retail, office and residential buildings.

Details on the Nihonbashi 1 Chome Central District Redevelopment have been announced. The project will include a 287m tall high-rise with office, hotel and serviced apartments, as well as several low-rise retail, office and residential buildings.

The high-rise tower will be taller than Tokyo Midtown (248m), Toranomon Hills (247m) and the Tokyo Metropolitan Government Building (242m), but shorter than the 390m tall tower planned for the Tokiwabashi Redevelopment Project located 300 meters to the west of the Nihonbashi site.

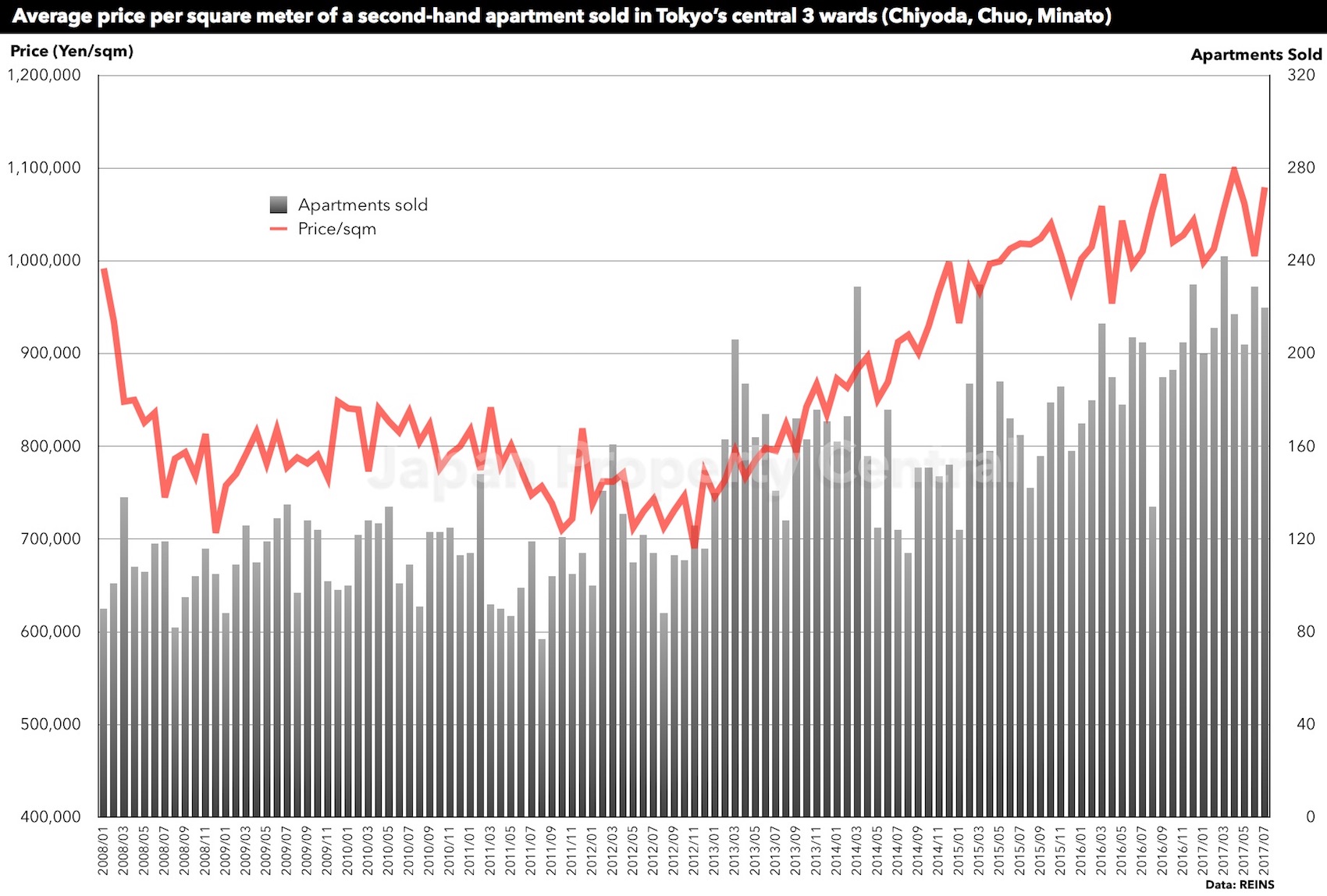

Tokyo apartment sale prices increase for 58th consecutive month

According to REINS, 3,304 second-hand apartments were sold across greater Tokyo in July, down 0.9% from the previous month but up 3.6% from last year. The average sale price was 31,600,000 Yen, down 0.06% from the previous month but up 5.4% from last year. The average price per square meter was 494,800 Yen, down 0.3% from the previous month but up 4.5% from last year. This is the 55th month in a row to record a year-on-year increase in sale prices. The average building age was 20.89 years.

In the Tokyo metropolitan area 1,722 second-hand apartments were sold, down 1.6% from the previous month but up 8.2% from last year. The average sale price was 38,640,000 Yen, showing no change from the previous month but up 3.1% from last year. The average price per square meter was 656,100 Yen, up 0.9% from the previous month and up 3.3% from last year. This is the 58th month in a row to record a year-on-year increase in prices. The average building age was 19.64 years.