Why an Olympic delay could spell disaster for Athletes Village buyers

The discussion of delaying or even canceling the 2020 Tokyo Olympics has become a hot topic in recent weeks and has led to some questions about what will happen to the buyers of the 4,145 apartments in Harumi Flag - the condos that will be refurbished from the Athletes Village.

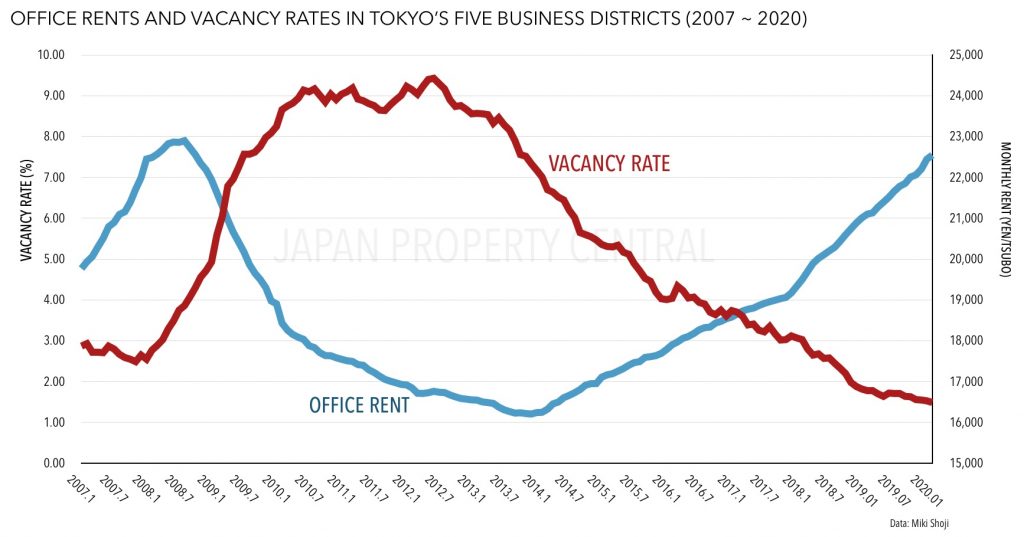

Office vacancy rate reaches new low in February

Tokyo’s prime office vacancy rate hit a new record low in February, dropping 0.04 points from the previous month to 1.49%. This is the lowest vacancy rate seen since December 1990 when it was as low as 0.39%.

Japan’s first wood-frame high-rise condo to be built in Tokyo

Nomura Real Estate Development is in the process of building a wood-frame hybrid condominium in Tokyo’s Ochanomizu district.

Residential leases are on the decline

The number of residential rental contracts signed across greater Tokyo has been on the decline for over a year now, with the effects being felt on real estate brokerages. Teikoku Databank reported 104 real estate brokerages filed for bankruptcy across greater Tokyo in 2019, up 6% from 2018.

Partial interest in Otemachi office tower sells for 99.8 billion Yen

Mitsubishi Estate has sold a partial interest in the Otemachi Park Building for 99.8 billion Yen (approx. US$974 million).

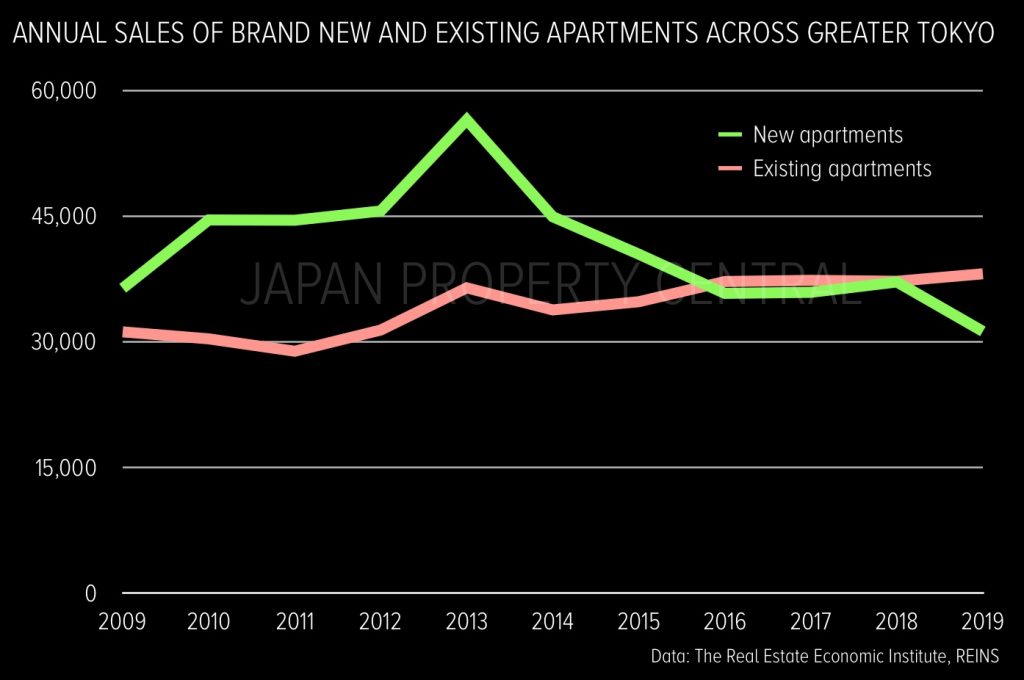

Why existing apartment sales are outperforming new construction

The old trope that Japanese buyers only buy new homes is being turned on its head as existing apartment sales now exceed new construction. In 2019, there were 38,109 reported sales of existing apartments across greater Tokyo (that figure is likely to be much higher due to a lack of public reporting of transactions). Over the same period, there were 31,238 brand new apartments offered for sale.

Coronavirus fears may see home loan interest rates remain low

The potential for future rate cuts to counteract a global slowdown caused by the coronavirus is a silver lining for Japan’s major real estate developers. As interest rates are slashed further, borrowing costs are expected to remain low for developers and home buyers.