Japan's luxury hotel market emerges from pandemic pause

The chances of picking up prime hotel or resort asset deals in Japan may be over as the industry swings back into full gear.

Major developer, Mitsui Fudosan, has reported that its revenue from hotel operations has recovered to around 90% of pre-pandemic levels. Demand from tourists from North America and Europe has been particularly strong, making up for the decline in business trips.

35-story tower for Kyobashi

Tokyo Tatemono is planning a 35-story, 180-meter-tall high-rise for Kyobashi. Construction will start in 2025 with completion tentatively scheduled for 2029. A city planning decision was granted on January 13.

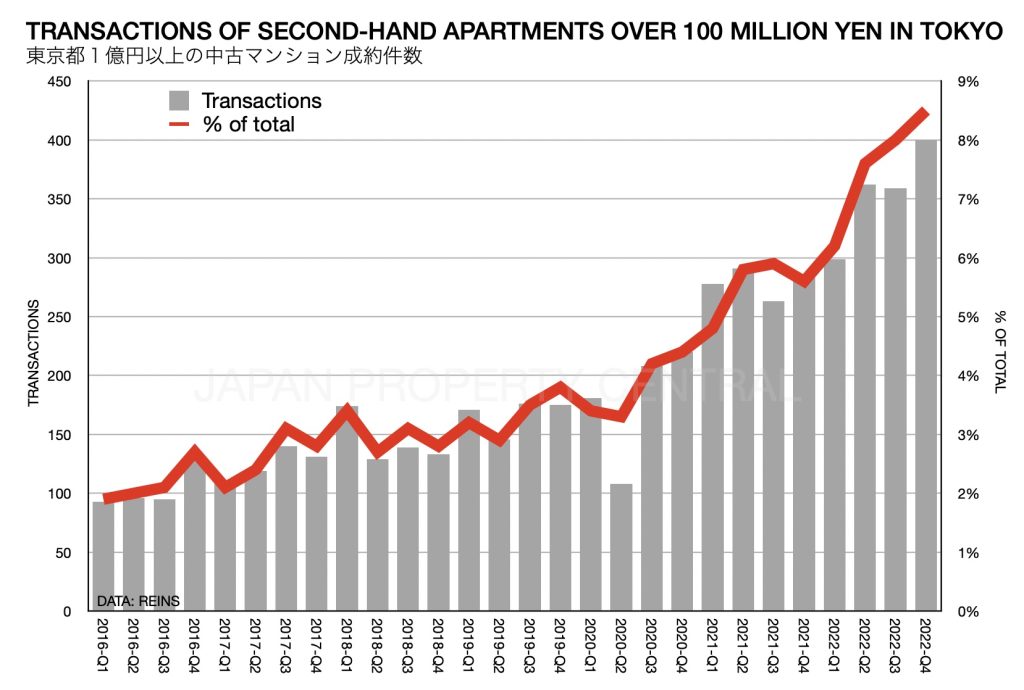

Apartment sales over 100 million Yen hit new high in Tokyo

Tokyo’s 23 wards were the only area within greater Tokyo to see a year-on-year increase in apartment sales in December, with transactions up 6.6%. Saitama Prefecture saw a 4.2% drop, Chiba saw an 11.2% drop, and Kanagawa saw a 7.4% drop.

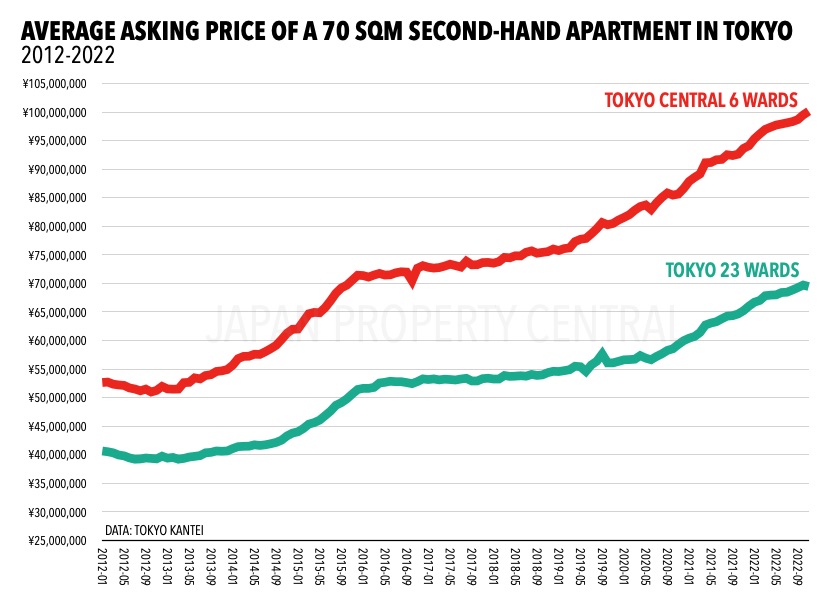

A 70sqm apartment in central Tokyo now costs over 100 million Yen

The average asking price of a 70 sqm (753 sq.ft) second-hand apartment in Tokyo’s central wards of Chiyoda, Minato, and Shibuya, has exceeded the 100 million Yen range in November, 2022.

Our Japan Property Market Report for 2022

2022 was a year of turmoil for markets, with interest rate rises, high inflation, and ongoing supply chain disruptions. Japan did not suffer to the same extent, with interest rates and inflation remaining low. The stable domestic conditions favored the real estate market with prices continuing to rise throughout the year.

Please feel free to view or download the PDF of our annual Japan Property Market Report, linked below.

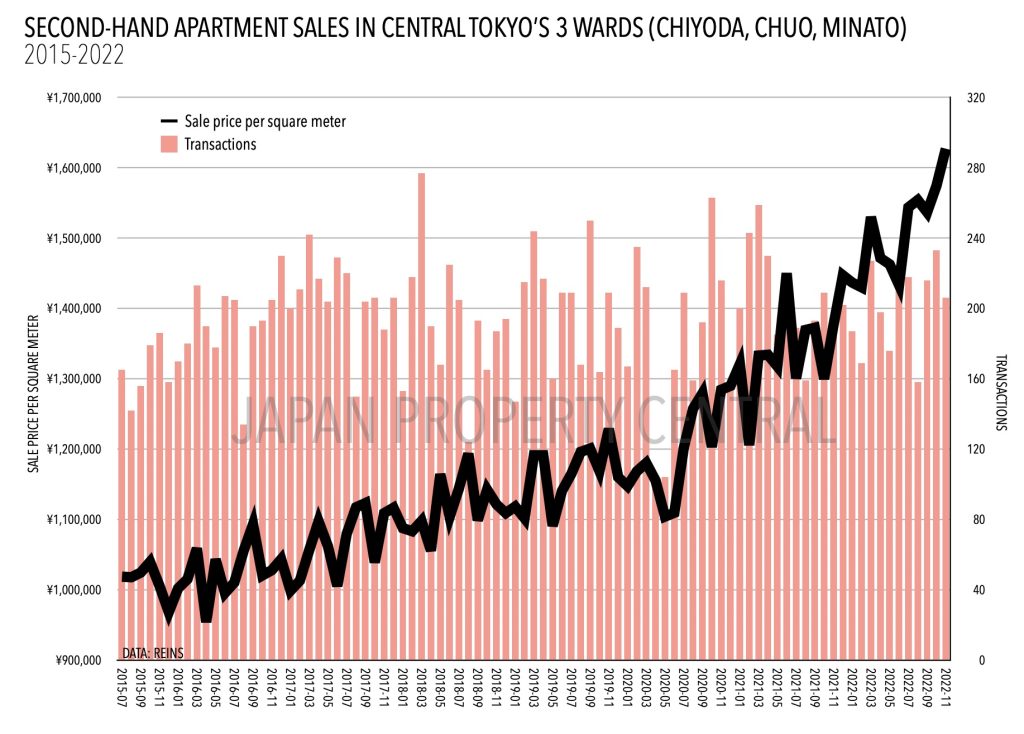

Apartment prices in central Tokyo hit new high in November

Apartment prices in central Tokyo hit a new record high in November, with REINS reporting the average reported sale price of a second-hand apartment in the central three wards at 1,627,200 Yen/sqm. This is a 3.3% increase from the previous month and an 18.2% increase from last year. It’s the highest price-per-square-meter on recent record.

Expected rental yields on Tokyo real estate assets hit 23-year low

Investors are expecting lower rental yields from office and residential assets in Tokyo. According to the Japan Real Estate Institute’s investors survey published on November 2022, the expected rental yield on Class A office space in Tokyo’s Marunouchi and Otemachi district was 3.2% as of October 2022, down from a 3.3% expected yield in April.