Tokyo Midtown Hibiya to open in March 2018

On September 4, Mitsui Fudosan announced that the official name of the large-scale redevelopment opposite Hibiya Park in downtown Tokyo will be Tokyo Midtown Hibiya. The 191m tall building will include office space, the 2,300 seat TOHO Cinemas Hibiya, and 60 stores and restaurants.

The grand opening is scheduled for March 29, 2018.

Onsen and retail complex near new Toyosu Fish Market in jeopardy

The operator of a planned onsen, hotel and retail center to be built next-door to the Toyosu Fish Market in Tokyo has announced that they may withdraw their plans due to concerns about feasibility. The proposed ‘Senkaku-banrai’ center would include a 24hr hot spring bath, hotel and 200 restaurants and stores, with a forecast for 1.9 million annual visitors.

Tokyo Apartment Sales in August 2017

The following is a selection of apartments that were sold in central Tokyo during the month of August 2017:Read more

Home builder introduces 9-storey home to their line-up

In an industry first, PanaHome is now offering a 9-storey home for landowners who want to maximize the use of their land.

The suggested layout for the ‘Vieuno9’ high-rise home includes retail space on the ground floor, office and rental apartments on the lower floors, and the owner's residence on the upper floors. The steel-frame structure allows for ceiling heights of up to 4 meters on the ground floor and 3.14 meters on the top floor, with mid-floors having generous ceiling heights of 2.84 meters.

In 2016, housing starts for multi-storey dwellings (between 3 ~ 9 floors) reached 43,530 units nationwide, an increase of 7.8% from 2015. 82.5% of these homes were located in the Tokyo-Nagoya-Osaka belt where land prices are typically high while lot sizes are small. The Tokyo metropolitan area accounted for 30.6% of these housing starts.Read more

Developer loses 6 billion Yen in fraudulent land sale

Major property developer Sekisui House has reported to have lost as much as 6.3 billion Yen (approx. 58 million USD) to scammers in a fraudulent land sale in central Tokyo.

According to a public announcement made by Sekisui earlier this month, they had agreed to purchase the property from a company that claimed to have already signed a tentative sales agreement with the alleged property owner. On the day of settlement, the property title was to be transferred from the original owner to the middle company and then to Sekisui. After the money had changed hands, the registry office (the government agency responsible for recording official changes in property titles) rejected the deed-change application because the title and identification documents from the alleged seller were falsified. By this point the ‘seller’ and associated parties had fled with the money and could not be contacted.

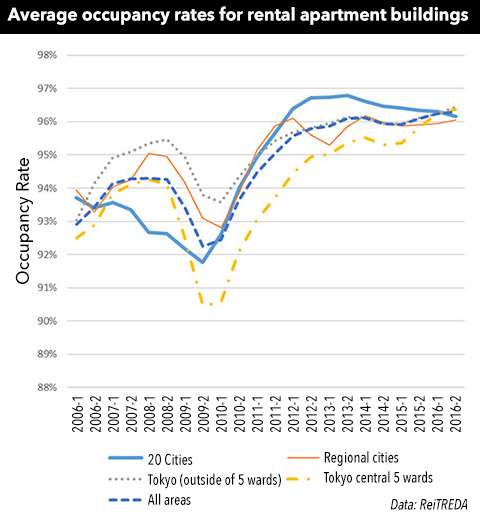

Apartment occupancy rates reach record high in Japan

The average occupancy rate of rental apartment buildings acquired by J-REITs has been steadily improving since 2010 and has exceeded levels last seen during the peak in 2008. In the second half of 2016 the average occupancy rate was 96%, a record high.

This is due both to an improving property market and REITS acquiring relatively new buildings in prime, central locations. While occupancy rates remain high in Tokyo, other cities across the country are seeing a reversal with a declining trend evident since 2013.

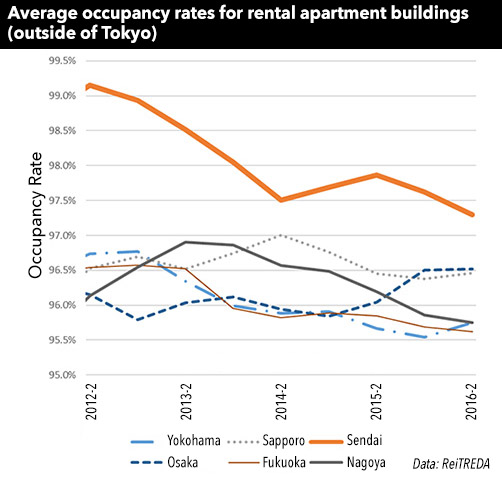

Trends in cities other than Tokyo:

- Sapporo: Although occupancy levels are relatively high, they have been decreasing since late 2014.

- Sendai: Occupancy rates reached record highs due to housing demand following the Tohoku disaster in 2011, but have been slowly falling. Sendai has seen the highest decline of all cities.

- Yokohama: Occupancy has been falling since mid-2013, although there was an improvement in the second half of 2016.

- Nagoya: Occupancy rates have been falling since 2013 and are sitting at a comparatively low level.

- Osaka: Occupancy rates have been improving since late 2015 and are at a relatively high level.

- Fukuoka: Occupancy rates have been steadily falling. The rate of decline has been influenced by a building with an occupancy rate of less than 80%.

*Central Tokyo 5 wards: Chiyoda, Chuo, Minato, Shinjuku, Shibuya.

Source: Mizuho Real Estate Market Report, July 14, 2017.

Tokyo apartment asking prices in July 2017

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq ft) second-hand apartment across greater Tokyo was 35,620,000 Yen in July, showing no change from the previous month but up 1.9% from last year. The average building age was 22.9 years.

In Tokyo’s 23 wards, the average asking price was 53,260,000 Yen, up 0.3% from the previous month and up 0.9% from last year. The average building age was 22.3 years.

In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya) the average asking price was 72,860,000 Yen, down 0.4% from the previous month but up 1.4% from last year. The average building age was 20.6 years.