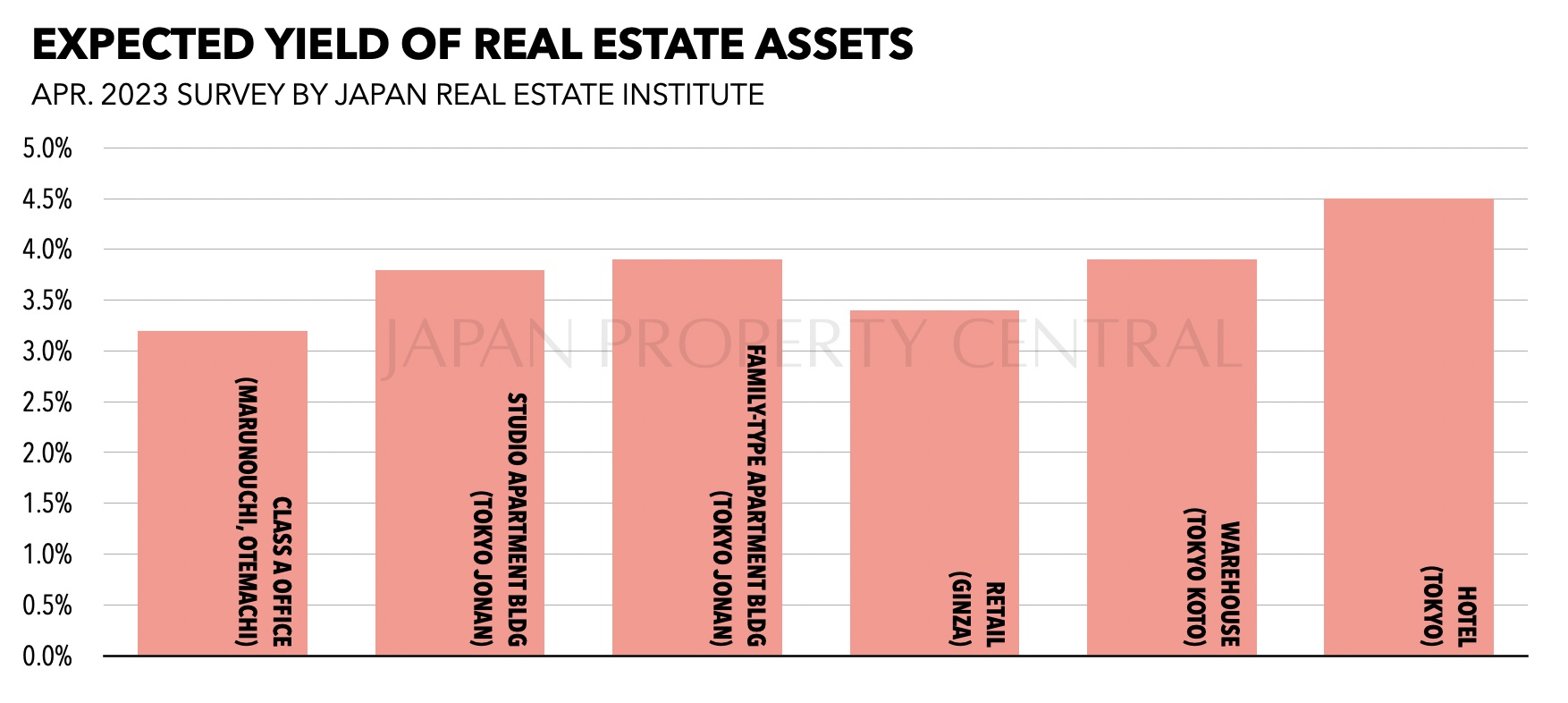

Expected yields on Japanese real estate remain at historic lows

Despite the turmoil happening in some overseas commercial real estate sectors, investors in Japanese real estate continue to anticipate record-low yields. That may be due in part to low interest rates which make it one of the few places with a positive yield spread over government bonds. The latest investor survey by the Japan Real Estate Institute in April shows expected yields have either remained the same or dropped, depending on the asset class and location.Read more

Despite the turmoil happening in some overseas commercial real estate sectors, investors in Japanese real estate continue to anticipate record-low yields. That may be due in part to low interest rates which make it one of the few places with a positive yield spread over government bonds. The latest investor survey by the Japan Real Estate Institute in April shows expected yields have either remained the same or dropped, depending on the asset class and location.Read more

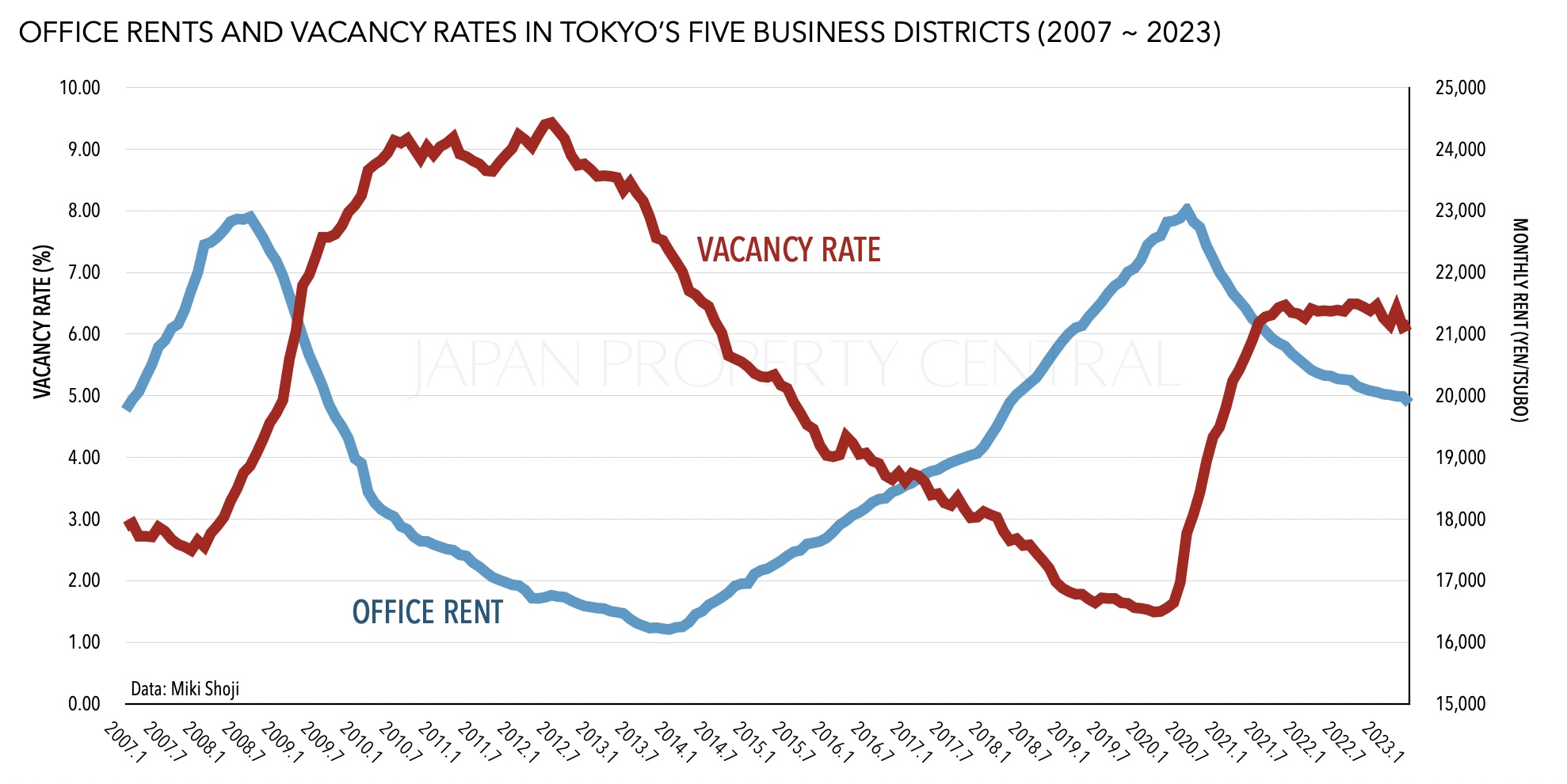

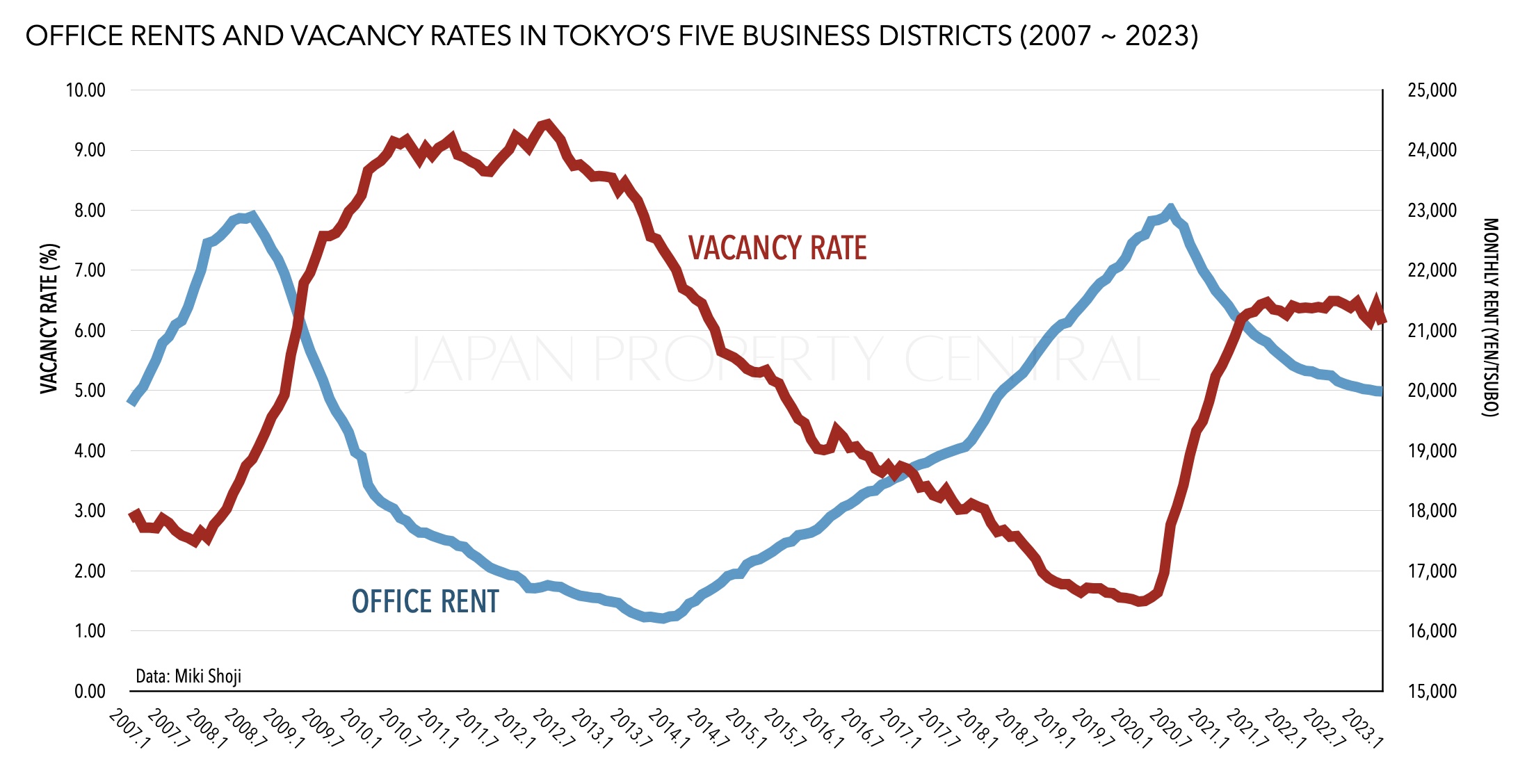

Tokyo office vacancy rates expected to stabilize at the 6% range

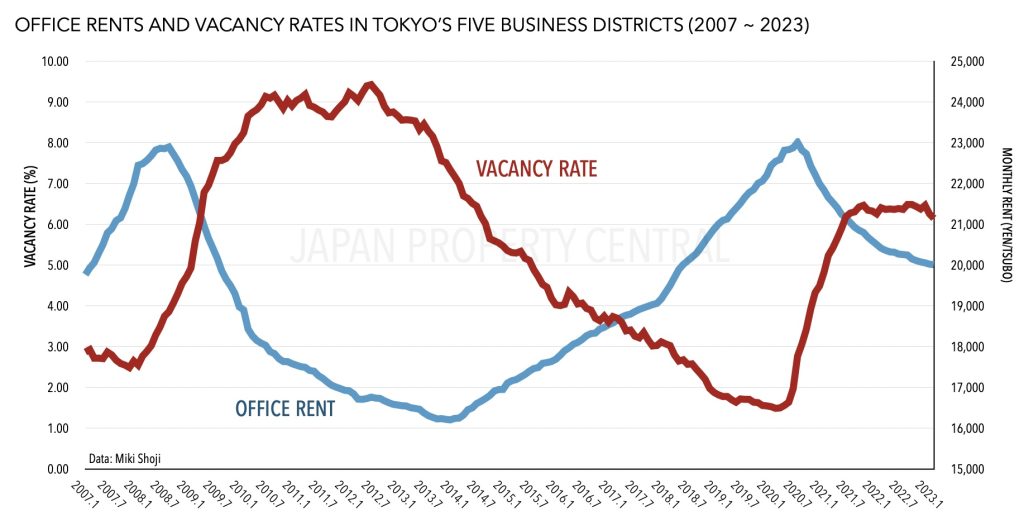

According to a report by Mitsubishi UFJ Trust and Banking Corporation, the office vacancy rate in Tokyo is expected to remain around the 6% range for the next five years. Rents are expected to bottom out in 2024, followed by a mild increase.Read more

According to a report by Mitsubishi UFJ Trust and Banking Corporation, the office vacancy rate in Tokyo is expected to remain around the 6% range for the next five years. Rents are expected to bottom out in 2024, followed by a mild increase.Read more

Omotesando office/retail buildings sold to domestic buyer

Two buildings alongside Omotesando’s Kotto-dori Street have been sold to a Kobe-based realtor.Read more

Two buildings alongside Omotesando’s Kotto-dori Street have been sold to a Kobe-based realtor.Read more

Tokyo's office vacancy rate improves 0.3 points in April

Tokyo’s office vacancy rate in April was 6.11%, a 0.3 point improvement from the previous month and a 0.27 point improvement from last year. The office leasing market is showing signs of recovery, and some companies are seeking to expand their office space.Read more

Tokyo’s office vacancy rate in April was 6.11%, a 0.3 point improvement from the previous month and a 0.27 point improvement from last year. The office leasing market is showing signs of recovery, and some companies are seeking to expand their office space.Read more

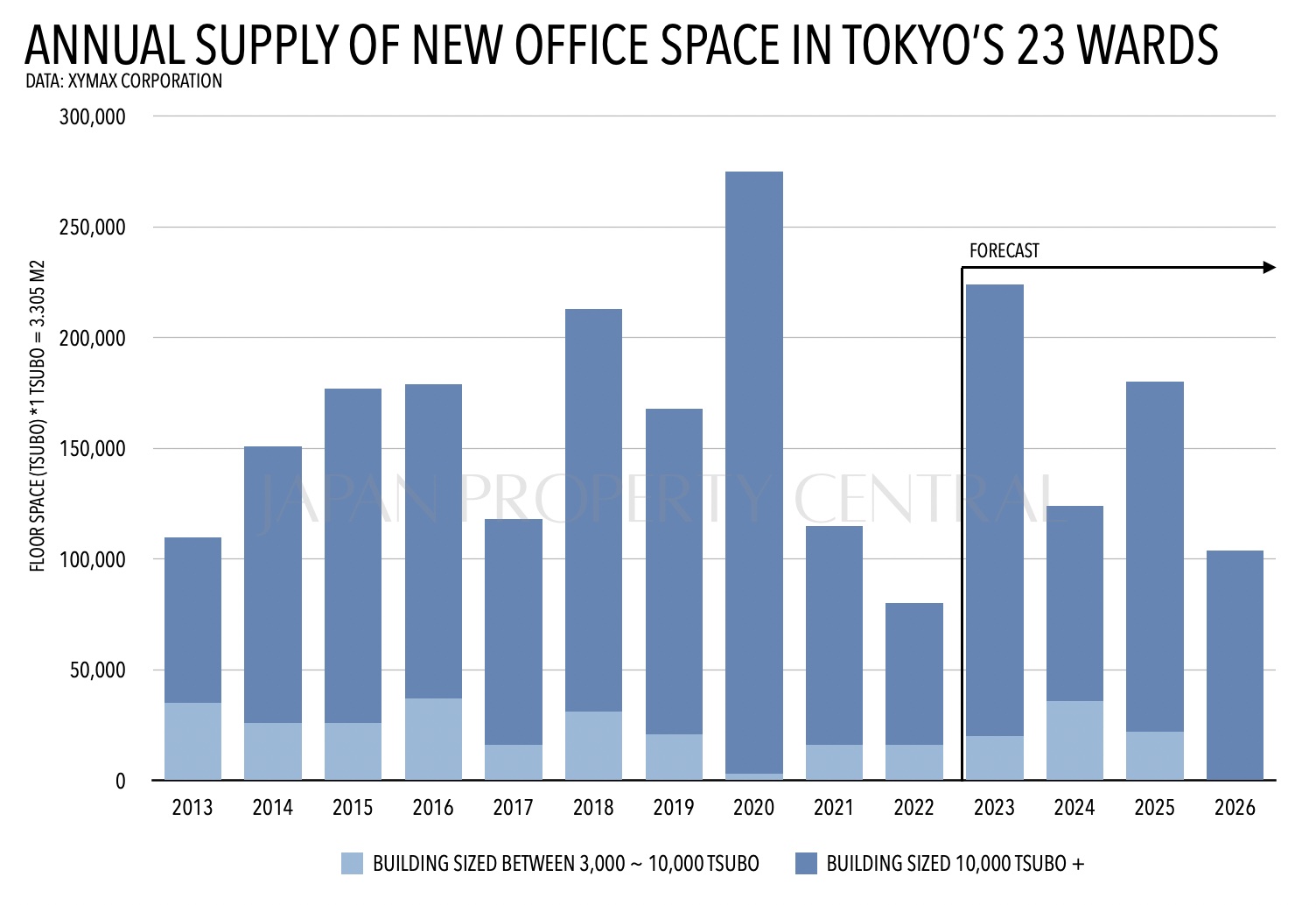

Tokyo's annual office supply forecast for 2023 - 2026

With the completion of several large-scale office buildings later this year, the total supply of new office space to hit the market in 2023 is going to be more than double what it was in 2022.Read more

Tokyo's office vacancy rate hits 12-month low

Tokyo’s office vacancy rate saw a slight improvement in February, dropping by 0.11 percentage points to 6.15%, according to office brokerage Miki Shoji.

Why Japan's developers and investors have their sights set on mid-size office buildings

In a recent interview in the Mainichi Shimbun’s Weekly Economist, the president of Ichigo Investment Advisors said that they found mid-sized office buildings to be advantageous during the slowdown in the office market.