Apartment price to income ratio worsens nationwide, but improves in Tokyo and Osaka

According to Tokyo Kantei, the average price of a brand new apartment in Japan in 2013 was 6.59 times the average annual income (up 0.06 points fro 2012), while a second-hand apartment (10 years old) was 4.58 times times the average income (up 0.02 points from 2012).

The rise in apartment prices has outpaced the increase in average income. The average annual income across Japan increased by 3.85% from the previous year to 4,320,000 Yen in 2013.

Meanwile, the average price of a 70 sqm second-hand apartment in Japan was 19,800,000 Yen in 2013, up 4.38%. The average price of a brand-new apartment nationwide was 28,620,000 Yen, up 5.07% from the year before.

In greater Tokyo (Tokyo, Kanagawa, Saitama and Chiba Prefectures), the price-to-income ratio of brand new apartments was 8.80 times (+0.06 points). The ratio for second-hand apartments actually fell 0.05 points to 6.07 times. Read more

Apartment sales in July 2014

The following is selection of apartments that were sold in central Tokyo during the month of July 2014.Read more

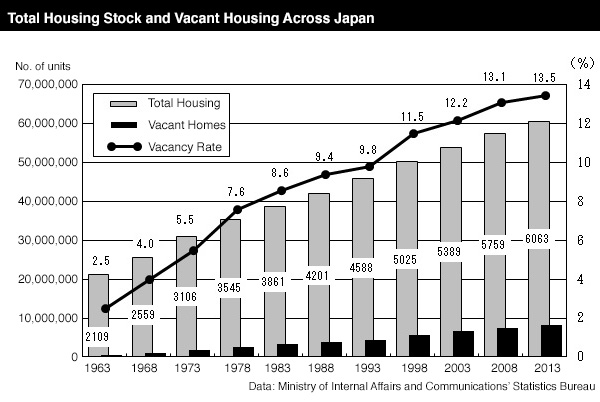

Japan’s nationwide residential vacancy rate hits record high of 13.5%

According to the latest data from the Ministry of Internal Affairs and Communications’ Statistics Bureau, the total housing stock across Japan increased by 3,050,000 units to 60,630,000 units in 2013, up 5.3% from the previous survey in 2008.

Vacancy rates

The number of unoccupied residential properties increased by 630,000 units to 8,200,000 units, up 8.3% from 2008. The nationwide vacancy rate increased by 0.4 points to 13.5% - the highest level seen since record-keeping began in 1963. It is important to realise that these figures include homes that are vacant for a number of reasons. For example, 5.0% of the vacant properties are vacation homes, 3.8% are empty because they are currently for sale, and 38.8% of homes were vacant for other reasons (eg. due to the residents transferring for work, being hospitalised, or because the homes are in the process of being demolished). 52.4% of the vacant homes were rental properties that were sitting empty.

Risk of over-supply

From 2015, inheritance tax deductions will be reduced. As a result, investors have been actively purchasing or building rental apartments as a way to reduce their future inheritance taxes (inheritance tax on real estate is calculated on the tax value of the building and land, which is usually lower than its true market value, while the tax on assets such as cash or stocks is based on its face value. There are also deductions for real estate that is currently rented to a tenant). There is a risk that this trend could lead to an over-supply of rental properties in central areas. Read more

Building age vs. distance from station - which has the biggest impact on rent?

According to data released by Tokyo Kantei, an apartment building’s age has a bigger influence on rent than the distance from the nearest train station.

The difference in rent between an apartment less than 3 years old and a 30-yr old apartment is about 30 ~ 40%. Meanwhile, the difference in rent between an apartment less than a 3 minute walk from the nearest station compared to one 11 ~ 15 minutes away is around 20%.Read more

Rising construction costs causing suburban projects to be cancelled

- Apartment developments cancelled.

- Station-front redevelopment projects on hold.

- Slowdown in retail expansion.

Japan’s construction industry is facing an impending crisis as the construction boom brought about by the 2020 Summer Olympics and Tohoku reconstruction is causing construction costs to rise dramatically.

The rising costs and severe labour shortage is having a direct impact on apartment development in the greater Tokyo area.

In April, the Odakyu Electric Railway Company announced that they were cancelling their plans to develop a high-end residential neighbourhood on the site of the former Mukogaoka Amusement Park in Tama-ku, Kawasaki due to rising construction costs which no longer make the project profitable.

Other apartment developers are also taking a restrained approach. Some that have already acquired development sites are either holding off on construction, leaving the sites empty, or are changing their plans.Read more

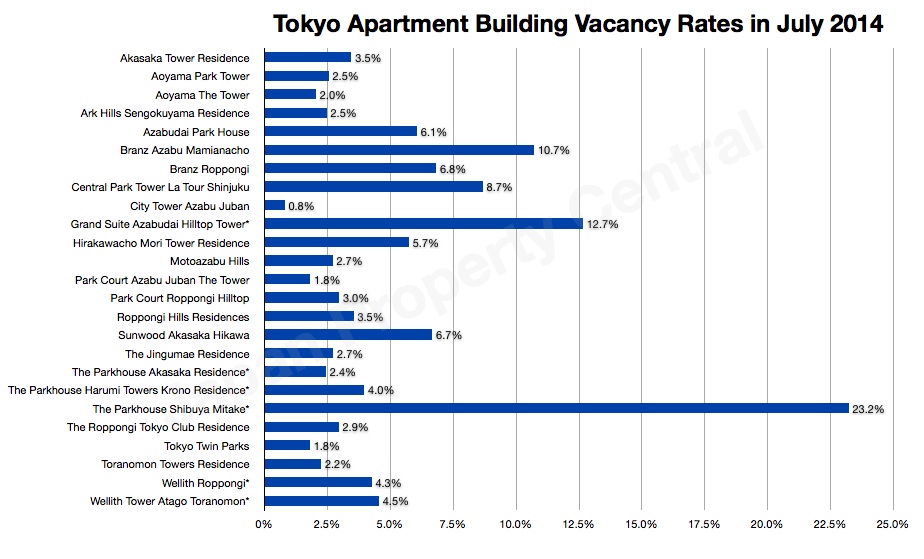

Vacancy rates by apartment building in Tokyo - July

The following is a list of popular apartment buildings in Tokyo and their estimated vacancy rates in July:

About the data:

- Vacancy rate = The number of apartments currently advertised for rent in that building as a percentage of the total number of apartments in the building.

- These figures are estimates only and Japan Property Central does not guarantee that they are 100% accurate. The data may include apartments that have already been leased but are still being advertised, and may not include apartments that are available for rent but not advertised publicly.

- In recently completed buildings you may see a large number of apartments up for rent in the first few months after completion. This indicates that a lot of the apartment buyers were investors, or that a large number of apartments were given to a landowner/s as part of the redevelopment. It may take a few months before these apartments are rented out.

Japan’s renovation boom

Japan’s property renovation market is experiencing a boom as small, medium and even major developers get in on the action. The recent rise in the price of new apartments is driving some buyers to consider older and cheaper apartments on the resale market. Real estate companies have noticed this trend and are busy renovating apartments to re-sell.Read more