Tokyo office vacancy rate falls to 6 year low

According to MIki Shoji’s Office Report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.36% in January 2015, down 0.11 points from the previous month and down 1.82 points from last year.

The vacancy rate in brand new office buildings was 14.85%, up 1.45 points from the previous month and up 0.43 points from last year.Read more

January 2015 rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,545 Yen/sqm in January, down 0.7% from the previous month and down 1.1% from last year. The average apartment size was 60.03 sqm and the average building age was 19.7 years.

In Tokyo’s 23-ku, the average monthly rent was 3,180 Yen/sqm, down 0.5% from the previous month but up 1.1% from last year. This is the 3rd month in a row to see a month-on-month decline. The average apartment size was 56.58 sqm and the average building age was 18.0 years.Read more

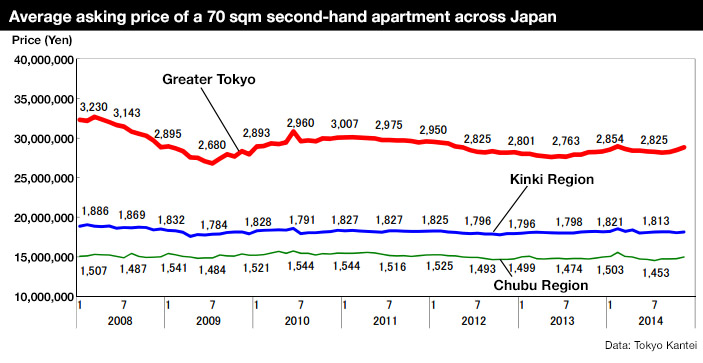

Secondhand apartment prices in December 2014 - Tokyo Kantei

For the first time in three years, the average asking price of a secondhand apartment in greater Tokyo has increased from the previous year. According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in greater Tokyo in 2014 was 28,510,000 Yen, up 2.1% from 2013. In Tokyo’s 23-ku, the average price in 2014 was 42,030,000 Yen, up 5.2% from 2013. It is now 6.3% below the peak seen during the last mini-bubble in 2008.

Prices in December

The average asking price in Tokyo’s 23 wards was 43,790,000 Yen in December, up 1.1% from the previous month and up 7.7% from December 2013. The average building age was 22.2 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 61,970,000 Yen, up 1.1% from the previous month and up 12.8% from the previous year. The average building age was 21.4 years.

The average price across greater Tokyo was 29,870,000 Yen in December, up 0.5% from the previous month and up 2.3% from the previous year.Read more

December rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condomonium apartment in greater Tokyo was 2,562 Yen/sqm in December, up 0.1% from the previous month and up 1.9% from the previous year. The average apartment size was 59.62 sqm and the average building age was 19.7 years.

In Tokyo’s 23-ku, the average monthly rent was 3,195 Yen/sqm, down 0.1% from the previous month but up 2.3% from the previous year.

Office vacancy rates in Tokyo down for 18th consecutive month

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.47% in December 2014, down 0.08 points from the previous month and down 1.87 points from last year. This is the 18th month in a row to see a month-on-month decrease in vacancy rates.

In Minato-ku, vacancy rates dropped to the 5% range for the first time since January 2009.

The vacancy rate in brand new office buildings was 13.40%, down 0.33 points from the previous month and down 1.10 points from last year. Only one office building was completed in December and was fully leased at the time of completion.Read more

Secondhand apartment prices in November 2014 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 43,300,000 Yen in November, up 1.7% from the previous month and up 6.6% from last year. The average building age was 22.3 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 61,280,000 Yen, up 1.8% from the previous month and up 12.0% from last year. The rate of increase has been expanding since August 2014. The average building age was 21.6 years.Read more

1960s Osaka office conversion wins renovation prize

The conversion of a 48-year old small office building into a private residence won best design (open category) in the 2014 Renovation of the Year awards announced on November 2.

The 4-storey office building had a floor plate of 66 sqm and was surrounding by buildings on three sides, limiting natural light. The property was purchased for a relatively low cost due to its age and the difficulty in attracting commercial tenants.Read more