Secondhand apartment prices in December 2014 - Tokyo Kantei

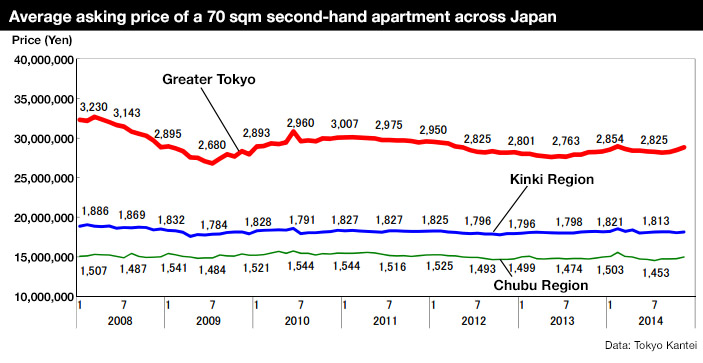

For the first time in three years, the average asking price of a secondhand apartment in greater Tokyo has increased from the previous year. According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in greater Tokyo in 2014 was 28,510,000 Yen, up 2.1% from 2013. In Tokyo’s 23-ku, the average price in 2014 was 42,030,000 Yen, up 5.2% from 2013. It is now 6.3% below the peak seen during the last mini-bubble in 2008.

Prices in December

The average asking price in Tokyo’s 23 wards was 43,790,000 Yen in December, up 1.1% from the previous month and up 7.7% from December 2013. The average building age was 22.2 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 61,970,000 Yen, up 1.1% from the previous month and up 12.8% from the previous year. The average building age was 21.4 years.

The average price across greater Tokyo was 29,870,000 Yen in December, up 0.5% from the previous month and up 2.3% from the previous year.Read more

December rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condomonium apartment in greater Tokyo was 2,562 Yen/sqm in December, up 0.1% from the previous month and up 1.9% from the previous year. The average apartment size was 59.62 sqm and the average building age was 19.7 years.

In Tokyo’s 23-ku, the average monthly rent was 3,195 Yen/sqm, down 0.1% from the previous month but up 2.3% from the previous year.

Office vacancy rates in Tokyo down for 18th consecutive month

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.47% in December 2014, down 0.08 points from the previous month and down 1.87 points from last year. This is the 18th month in a row to see a month-on-month decrease in vacancy rates.

In Minato-ku, vacancy rates dropped to the 5% range for the first time since January 2009.

The vacancy rate in brand new office buildings was 13.40%, down 0.33 points from the previous month and down 1.10 points from last year. Only one office building was completed in December and was fully leased at the time of completion.Read more

Secondhand apartment prices in November 2014 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 43,300,000 Yen in November, up 1.7% from the previous month and up 6.6% from last year. The average building age was 22.3 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 61,280,000 Yen, up 1.8% from the previous month and up 12.0% from last year. The rate of increase has been expanding since August 2014. The average building age was 21.6 years.Read more

November rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,560 Yen/sqm in November, down 1.6% from the previous month but up 0.3% from last year. This is the first time in five months to see a month-on-month decline in rent. The average apartment size was 59.90 sqm and the average building age was 19.5 years.

The average monthly rent in Tokyo’s 23-ku was 3,199 Yen/sqm, down 1.1% from the previous month but up 2.8% from last year. The average apartment size was 56.76 sqm and the average building age was 17.7 years. Although rents across all areas within Tokyo have started to weaken, they are still hovering around the 3,200 Yen/sqm range.Read more

Supply shortage in central Tokyo sees apartment prices up 40% from market bottom

The price of secondhand apartments in Tokyo is rising, with prices in some areas exceeding those seen in the mini-bubble in 2007. In Tokyo’s 23 wards, the average asking price of a 70 sqm in October 2014 was 42,560,000 Yen, up 8.5% from the low of 39,220,000 Yen seen in July 2012.

One of the main drivers behind the rising prices is the shortage in the supply of brand new apartments. Following the Lehman Shock (or global financial crisis), a number of small-to-medium sized developers filed for bankruptcy. This has left the market controlled by a small number of Japan’s top developers. Prior to the Lehman Shock, the annual supply of brand new apartments reach 80,000 units. In 2014, it has almost halved to around 40,000 units. Buyers, who have not been able to find new apartments in their desired area, have turned to the secondhand market which has reduced supply even further. In the central Tokyo area, there are only half as many apartments on the re-sale market than there were in 2011. Read more

Land prices up in 83% of locations - MLIT LOOK Report

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced the land price movements across Japan for the third quarter in 2014 (July 1 ~ October 1).

According to the Chika Look Report, 124 locations (83% of the total) saw an increase from the previous quarter, and 26 locations (17% of the total) saw no change. For the first time since this survey began in late 2007, none of the 150 survey sites saw a decrease in prices. Of the 124 locations to see a price rise, 122 locations saw prices rise between 0 ~ 3%, while 2 locations (Ginza and Shinjuku 3 Chome) saw prices rise between 3 ~ 6%.

Strong investor demand caused by monetary easing, as well as demand for apartments in areas with convenient access have helped to sustain the price growth.

In greater Tokyo, 58 locations (89% of the total) saw land prices increase, while the remaining 7 locations (11%) saw no change. In greater Osaka, 30 locations (77%) saw prices increase, wile 9 locations (23%) saw no change. In Nagoya, all 14 locations saw prices increase.Read more