Rent in Tokyo jumps 4.2% thanks to supply of new construction

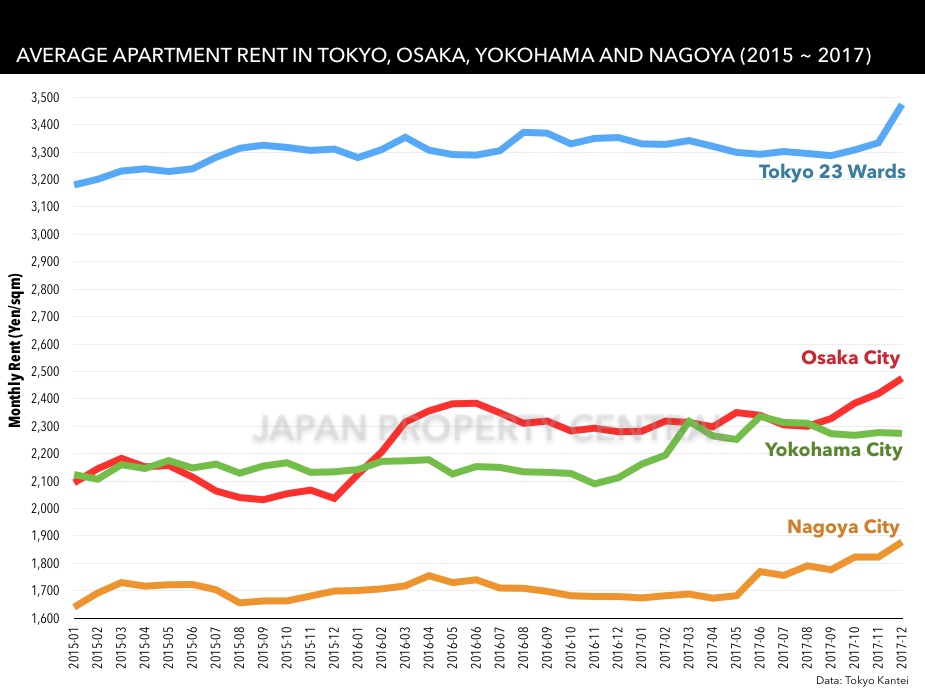

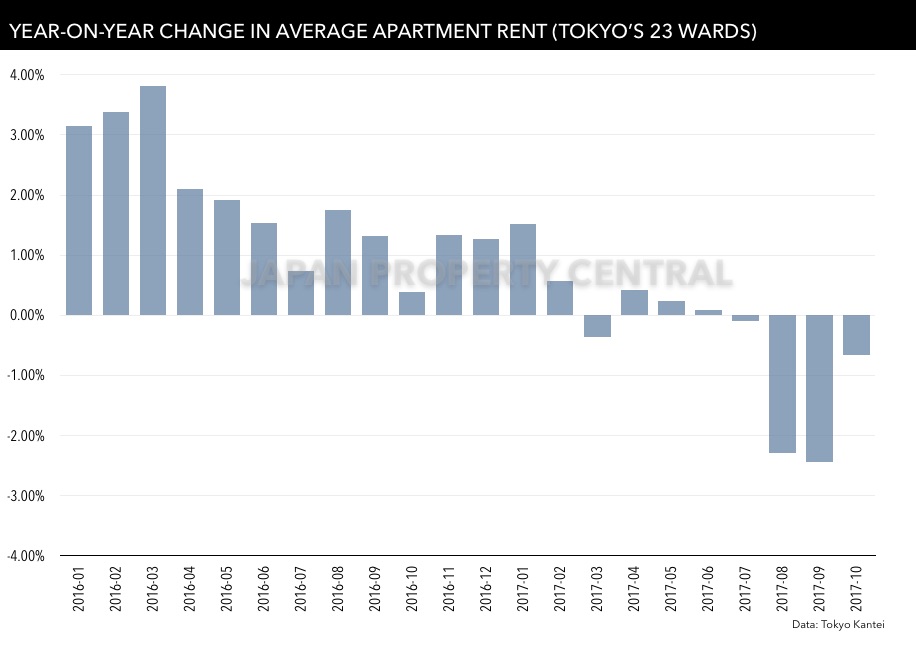

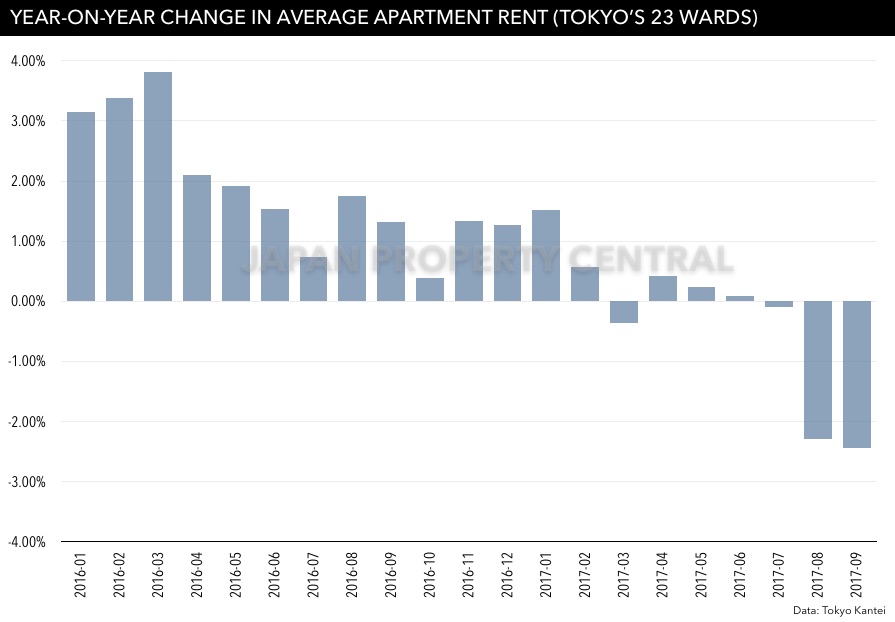

According to Tokyo Kantei, the average monthly rent of a condominium in Tokyo’s 23 wards was 3,474 Yen/sqm in December 2017, up 4.2% from the previous month and up 3.6% from 2016. The increase was caused by a larger share of relatively new buildings which typically command higher rents, along with the release of a large number of brand new high-rise apartment towers in Shinjuku and Shinagawa.Read more

Average rent in Tokyo drops for 5th month in a row

According to Tokyo Kantei, the average monthly rent of a condominium in Tokyo’s 23 wards was 3,334 Yen/sqm in November 2017, up 0.8% from the previous month but down 0.5% from last year. Average rents have been down year-on-year since July, although they have been showing an increasing trend for apartments in buildings less than 10 years old.Read more

Tokyo’s Ota Ward first in Japan to ban overnight accommodation in exclusive residential zones

Tokyo’s Ota Ward is the first district in Japan to ban all minpaku-style overnight or short-term accommodation in exclusively residential zones. On December 8, local councillors voted in favor of the ban with the rules to go into effect from June 15, 2018.

Ota was one of the first areas in Japan to actively promote and encourage short-term rentals. In January 2016 Ota ward allowed registered hosts of properties in approved 'special zones' to rent out accommodation for minimum stays of 6 nights without needing a hotel license. Normally a stay of less than 30 days would require a hotel license. Councillors have also voted in favor of reducing this stay to a minimum of 2 nights and 3 days.Read more

Average rent in Tokyo drops for 4th month in a row

According to Tokyo Kantei, the average monthly rent of a condominium in Tokyo’s 23 wards was 3,308 Yen/sqm in October, up 0.6% from the previous month but down 0.7% from last year. This is the 4th month in a row to record a year-on-year decline in rents.Read more

16-fold rent increase for shopkeepers at Asakusa’s Sensoji temple

Shopkeepers alongside the Nakamise shopping street, a 250 meters long souvenir shop-lined pedestrian mall leading to Sensoji temple in Tokyo, are reeling after being hit with a potential 16-fold increase in store rents. In September, Sensoji temple informed the tenants of plans to increase the rent from the current level of 15,000 Yen per month for a 10 square meter shop to a new rent of 250,000 Yen per month, making it in line with market rents for the neighborhood and ending years of subsidized rents that had been offered by the previous landlord - the Tokyo metropolitan government.

Banks urged to take care when lending on investment properties

According to Japan’s Financial Services Agency’s Financing Report, the average vacancy rate for investment-grade apartment buildings is estimated to be around 7%. For ‘apaato’-type buildings less than 5 years old, the average vacancy rate was just 2.6%, but for a 10-year old building it was 7.1% and 11.6% for 20-year old buildings.

As buildings age, vacancy rates and maintenance costs increase, resulting in some investments becoming cash-flow negative for landlords. The Agency has requested that banks take more care to explain the potential risks and pitfalls of these type of investment loans to borrowers.Read more

Average rent drops for 3rd consecutive month in Tokyo

In September, the average monthly rent of a condominium in Tokyo’s 23 wards was 3,287 Yen/sqm, down 0.2% from the previous month and down 2.4% from last year. This is the 3rd month in a row to record a year-on-year drop in rents and the lowest level seen in the past 12 months.Read more