Minato-ku relaxes floor area ratios to encourage apartment redevelopment

From June 1, 2015, the Minato City Government in Tokyo introduced allowances to building volume ratios to encourage the re-development of old, non-earthquake resistant apartment buildings.

Apartment buildings that meet certain requirements and receive government approval may be re-built to a larger size than would normally be allowed on that block of land. An allowance of up to 200% may be given if conditions are met. This may bring the maximum possible building volume ratio (yosekiritsu) up to 1,000%, depending on zoning.Read more

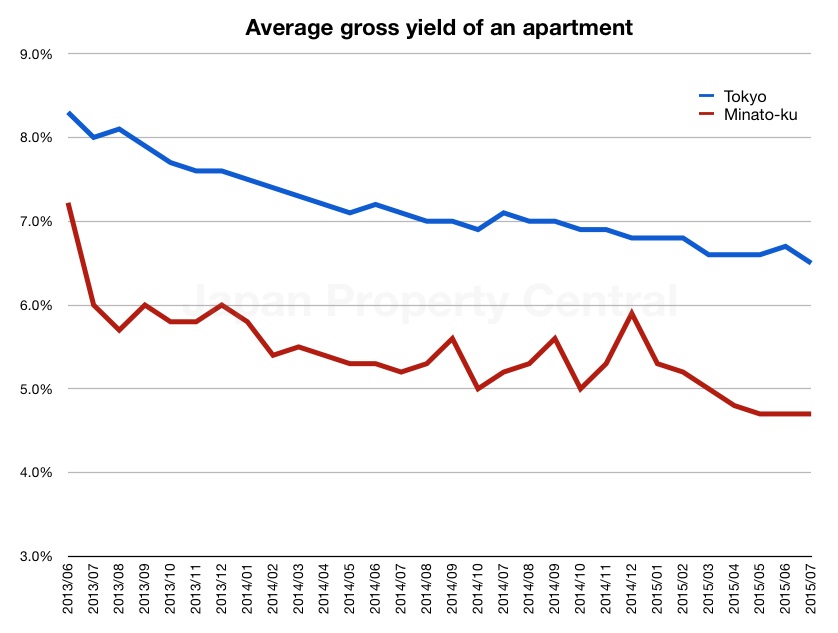

Residential yields in Minato-ku - July 2015

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in July was 4.7%, showing no change from the previous month and down 0.5 points from last year. The average gross yield across Tokyo was 6.5%, down 0.2 points from the previous month and down 0.6 points from last year.

The average asking price of a second-hand apartment in Minato-ku was 857,785 Yen/sqm as of July 1, 2015, up 85 Yen from the previous month and up 9.1% from last year. The average asking price for land was 1,226,363 Yen/sqm, up 1.1% from the previous month but down 1.9% from last year.Read more

High-rise condo in Ariake bans AirBnb hosts

The growing number of apartment owners or tenants leasing out their properties on AirBnb in Tokyo is becoming a cause for concern for owners’ associations.

The board of directors of Brillia Mare Ariake, a 33-storey condominium in Tokyo Bay, have taken steps to curb the conspicuous number of private short-term rentals in the building. According to a post on Brillia Mare Ariake’s management blog, the rise in holiday letting or short-term rental listings, including share-houses, in the building had the board of directors worried. Of particular concern was the use of the building’s facilities, such as the pool and spa, by a large number of short-term guests and visitors that are unaware of building rules. The increase in the number of strangers using the building's facilities was also considered to pose a risk to property values.Read more

Tokyo Apartment Sales in June 2015

The following is a selection of apartments that were sold in central Tokyo during the month of June 2015:Read more

Rosenka land values up in urban areas, but down nationwide

According to the National Tax Agency, rosenka land values across Japan in 2015 fell for the 7th year in a row, although the decline appears to be bottoming out. This year nationwide land values dropped by 0.4%, which is an improvement from 2014 which saw values drop by 0.7%. In Tokyo, rosenka values increased by 2.1%, after seeing a 1.8% rise in 2014. In Osaka, values increased by 0.5%.

A rapid increase in foreign tourists and a boost in investment in central Tokyo from foreign funds has helped to pull up property values and retail rents.

Midosuji Boulevard in front of Osaka’s Hankyu Department Store saw rosenka land values rise by 10.1% from last year to 8,320,000 Yen/sqm, while Meieki Dori Avenue in front of Nagoya Station saw values increase by 11.5% to 7,360,000 Yen/sqm.Read more

Chiyoda ofice building converted to serviced apartments and office suites

NTT Urban Development have converted a 22-year old office building in Chiyoda-ku into a mixed-use serviced apartment, share office and serviced office space.

‘Hive Tokyo’ (formerly Pacific Square Kudan Minami) is targeted towards both Japanese and foreign clients. The 10-storey building is located across the street from the Yasukuni Shrine and a 6 minute walk from Ichigaya Station. The building is scheduled to open in August 2015.Read more

Banks to increase home loan rates this month

Several of Japan’s mega-banks plan to increase home loan interest rates this month. The Bank of Tokyo-Mitsubishi UFJ will increase the prime interest rate on their 10-year fixed-rate home loan by 0.10 points to 1.35% for loans approved in July, while Mizuho plan to increase their rate by 0.05 points to 1.30%. Sumitomo Mitsui Trust Bank also plan to increase their prime rate by 0.05 points to 0.95%.

This is the second month to see an increase in interest rates The three banks have no plans to change their variable rates.

Sources:

The Nikkei Shimbun, June 26, 2015.

Jiji Press, June 26, 2015.