The Parkhouse Shinjuku Gyoen has reached completion

Construction of The Parkhouse Shinjuku Gyoen, a 14-storey condominium located directly across the street from the Shinjuku Gyoen National Garden, reached completion last month.

The building contains 52 luxury residences ranging in size from 55 ~ 100 sqm (592 ~ 1,076 sq ft). When sales began back in early 2016, apartments were priced from 64 ~ 269 million Yen, with an average price of around 1,725,000 Yen/sqm.

Tokyo Apartment Sales in October 2017

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of October 2017:Read more

Banks urged to take care when lending on investment properties

According to Japan’s Financial Services Agency’s Financing Report, the average vacancy rate for investment-grade apartment buildings is estimated to be around 7%. For ‘apaato’-type buildings less than 5 years old, the average vacancy rate was just 2.6%, but for a 10-year old building it was 7.1% and 11.6% for 20-year old buildings.

As buildings age, vacancy rates and maintenance costs increase, resulting in some investments becoming cash-flow negative for landlords. The Agency has requested that banks take more care to explain the potential risks and pitfalls of these type of investment loans to borrowers.Read more

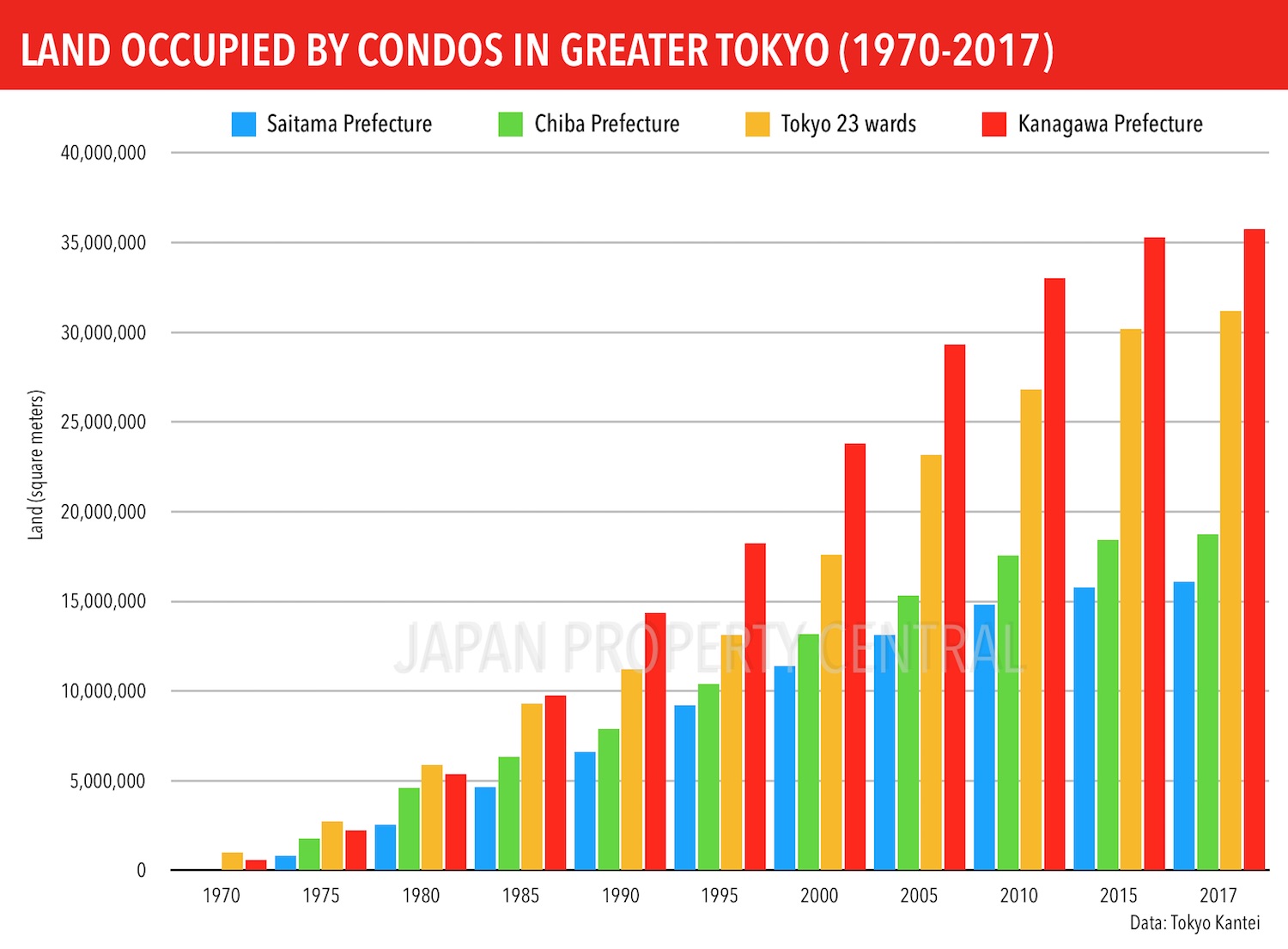

Apartment development focusing on city centers as buyers shun suburbs

In Tokyo’s 23 wards, 4.98% of the land is being used for condominium buildings, an increase of 1.02 points over the past 10 years. The ratio is higher in central Tokyo, with some districts having a ratio of around 9%, signaling a clear shift towards living closer to the office and city center.

The report, released by Tokyo Kantei on October 31st, compiled data on Japan’s three major urban centers. In greater Tokyo, Shibuya ward was in top spot with 8.90%, up 1.46 points from 2007. Chuo ward, which includes the man-made islands of Kachidoki and Harumi in Tokyo Bay, increased by 2.03 points to 6.07%. This district has seen a number of high-rise condos built in recent years, especially in the bayside area, while the Nihonbashi district has seen an increase in small-to-medium sized residential developments.

New apartment prices in Sendai City fall 5% in the first half of 2017.

According to DG Communications, the average price of a new apartment in Sendai City in the first half of 2017 was 42,940,000 Yen, down 4.8% from last year. The average price for the year of 2017 is also expected to decrease from last year, marking the first decline since 2011.

Following the 2011 earthquake, a sudden jump the construction costs and a drop in supply saw the price of new apartments soar to record highs. In 2016, the average price increased by 5.1% from 2015 to 44,427,000 Yen — the highest price seen since record-keeping began in 1988.

The Parkhouse Nishi-Shinjuku Tower 60 reaches completion

Construction of Japan’s tallest apartment building based on total floor count has reached completion this month. The Parkhouse Nishi-Shinjuku Tower 60 is a 60-storey, 209 meter tall condominium located to the west of the Shinjuku business district.

It may not keep its title as the tallest building based on floor count for long - two 65~66-storey, 235m tall apartment buildings with as many as 3,200 apartments are tentatively planned for a site on the eastern side of Shinjuku’s Park Hyatt Hotel and less than 1,000 meters south of The Parkhouse.

Apartment asking prices across greater Tokyo drop slightly in September

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq ft) apartment across greater Tokyo was 35,550,000 Yen in September 2017, down 0.3% from the previous month but up 0.7% from last year. The average building age was 23.1 years.

In Tokyo’s 23 wards the average asking price was 52,920,000 Yen, down 0.9% from the previous month but up 0.5% from last year. The average building age was 22.7 years. Saitama City saw average asking prices increase by 2.0% from the previous month and 10.4% from last year.