REIT acquisitions exceed rosenka values by 2.61 times

The average value of real estate acquisitions made by J-REITs between 2012 and 2017 has exceeded the rosenka tax value by approximately 2.61 times. In 2016 and 2017, office buildings and hotels in central Tokyo, Osaka, Nagoya and around Narita Airport have been purchased by REITS at as much as 5 ~ 15 times their rosenka value.Read more

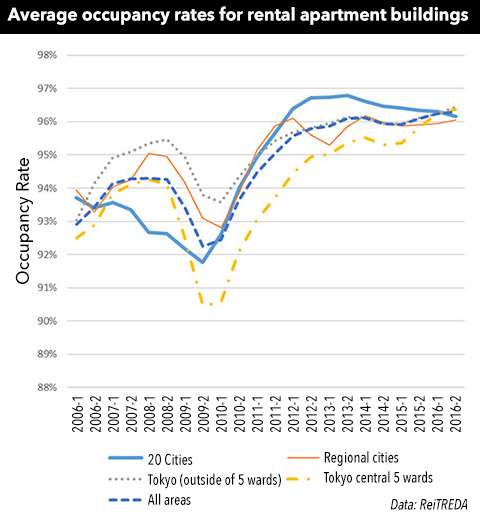

Apartment occupancy rates reach record high in Japan

The average occupancy rate of rental apartment buildings acquired by J-REITs has been steadily improving since 2010 and has exceeded levels last seen during the peak in 2008. In the second half of 2016 the average occupancy rate was 96%, a record high.

This is due both to an improving property market and REITS acquiring relatively new buildings in prime, central locations. While occupancy rates remain high in Tokyo, other cities across the country are seeing a reversal with a declining trend evident since 2013.

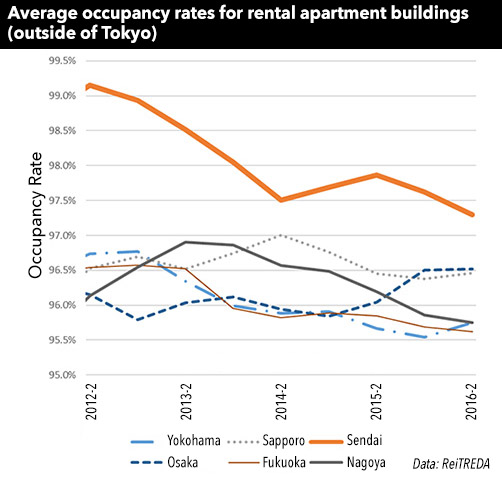

Trends in cities other than Tokyo:

- Sapporo: Although occupancy levels are relatively high, they have been decreasing since late 2014.

- Sendai: Occupancy rates reached record highs due to housing demand following the Tohoku disaster in 2011, but have been slowly falling. Sendai has seen the highest decline of all cities.

- Yokohama: Occupancy has been falling since mid-2013, although there was an improvement in the second half of 2016.

- Nagoya: Occupancy rates have been falling since 2013 and are sitting at a comparatively low level.

- Osaka: Occupancy rates have been improving since late 2015 and are at a relatively high level.

- Fukuoka: Occupancy rates have been steadily falling. The rate of decline has been influenced by a building with an occupancy rate of less than 80%.

*Central Tokyo 5 wards: Chiyoda, Chuo, Minato, Shinjuku, Shibuya.

Source: Mizuho Real Estate Market Report, July 14, 2017.

Tokyo apartment asking prices in July 2017

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq ft) second-hand apartment across greater Tokyo was 35,620,000 Yen in July, showing no change from the previous month but up 1.9% from last year. The average building age was 22.9 years.

In Tokyo’s 23 wards, the average asking price was 53,260,000 Yen, up 0.3% from the previous month and up 0.9% from last year. The average building age was 22.3 years.

In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya) the average asking price was 72,860,000 Yen, down 0.4% from the previous month but up 1.4% from last year. The average building age was 20.6 years.

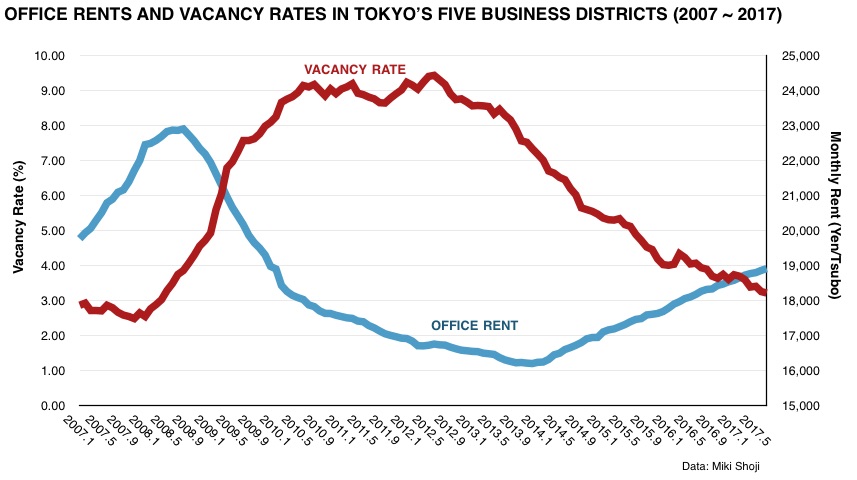

Shinjuku office vacancy rate drops to 1% range

The office vacancy rate across Tokyo’s five central business districts of Chiyoda, Chuo, Minato, Shinjuku and Shibuya dropped to 3.22% in July, down 0.04 points from June and down 0.72 points from July 2016. This is close to the record low of of 3.03% reported in April 2008 and down from a high of 9.43% seen in June 2012.

The vacancy rate in existing buildings (excluding new construction) was 2.87% in July, down 0.74 points from last year.

In Shinjuku ward, the vacancy rate was 1.68%, down 0.06 points from the previous month and down 1.30 points from last year. The vacancy rate dropped to the 1% range in May 2017.

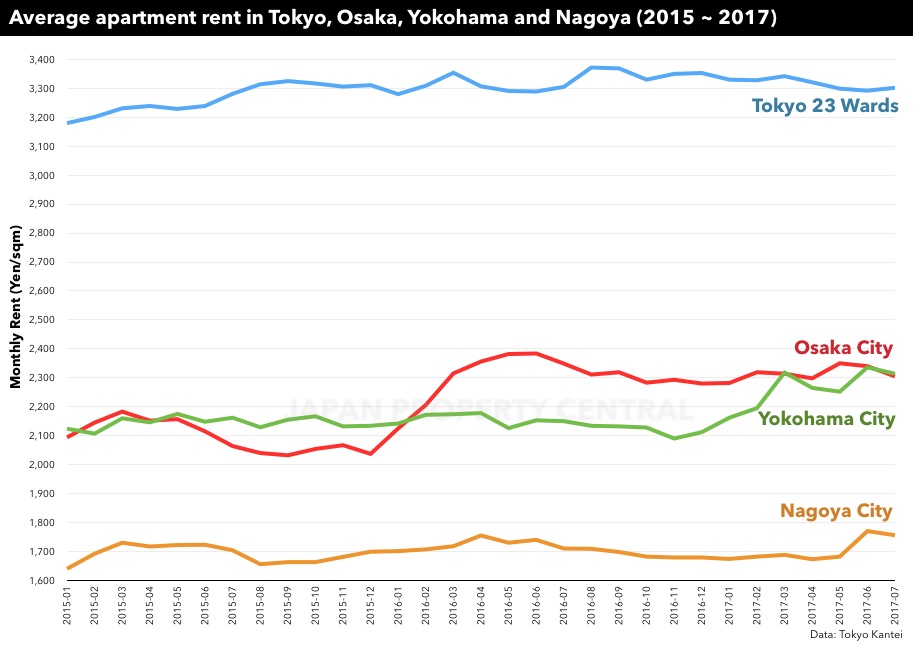

Average apartment rent in July 2017

According to Tokyo Kantei, the average monthly rent of a condominium-type apartment across greater Tokyo in July 2017 was 2,631 Yen/sqm, up 0.5% from the previous month but down 0.8% from last year. The average apartment size was 60.03 sqm and the average building age was 20.8 years.

In the Tokyo metropolitan area the average monthly rent was 3,141 Yen/sqm, up 0.4% from the previous month but down 0.1% from last year. The average apartment size was 57.19 sqm and the average building age was 19.1 years.

In Tokyo’s 23 wards, the average monthly rent was 3,302 Yen/sqm, up 0.3% from the previous month but down 0.1% from last year. The average apartment size was 56.56 sqm and the average building age was 18.3 years.

New apartment prices in greater Tokyo up 16% from last year

According to the Real Estate Economic Institute, a total of 3,426 brand-new apartments were released for sale across greater Tokyo in July, up 50.0% from the previous month and up 3.3% from last year.

2,465 apartments were sold, resulting in a contract ratio of 71.9%, up 8.6 points from last year and above the 70.0% level said to indicate healthy market conditions. Unsold inventory at the end of July was 6,314 apartments, down 184 units from last year.

The average price of a new apartment across greater Tokyo was 65,620,000 Yen, up 16.3% from the previous month and up 16.0% from last year. The average sale price per square meter was 952,000 Yen, up 13.3% from the previous month and up 18.1% from last year.

705 apartments in high-rise buildings (20 storeys and above) were listed for sale, up 220.5% from last year. The contract ratio was 88.2%, up 34.1 points from last year.

The following buildings saw same-day sellouts* in July:

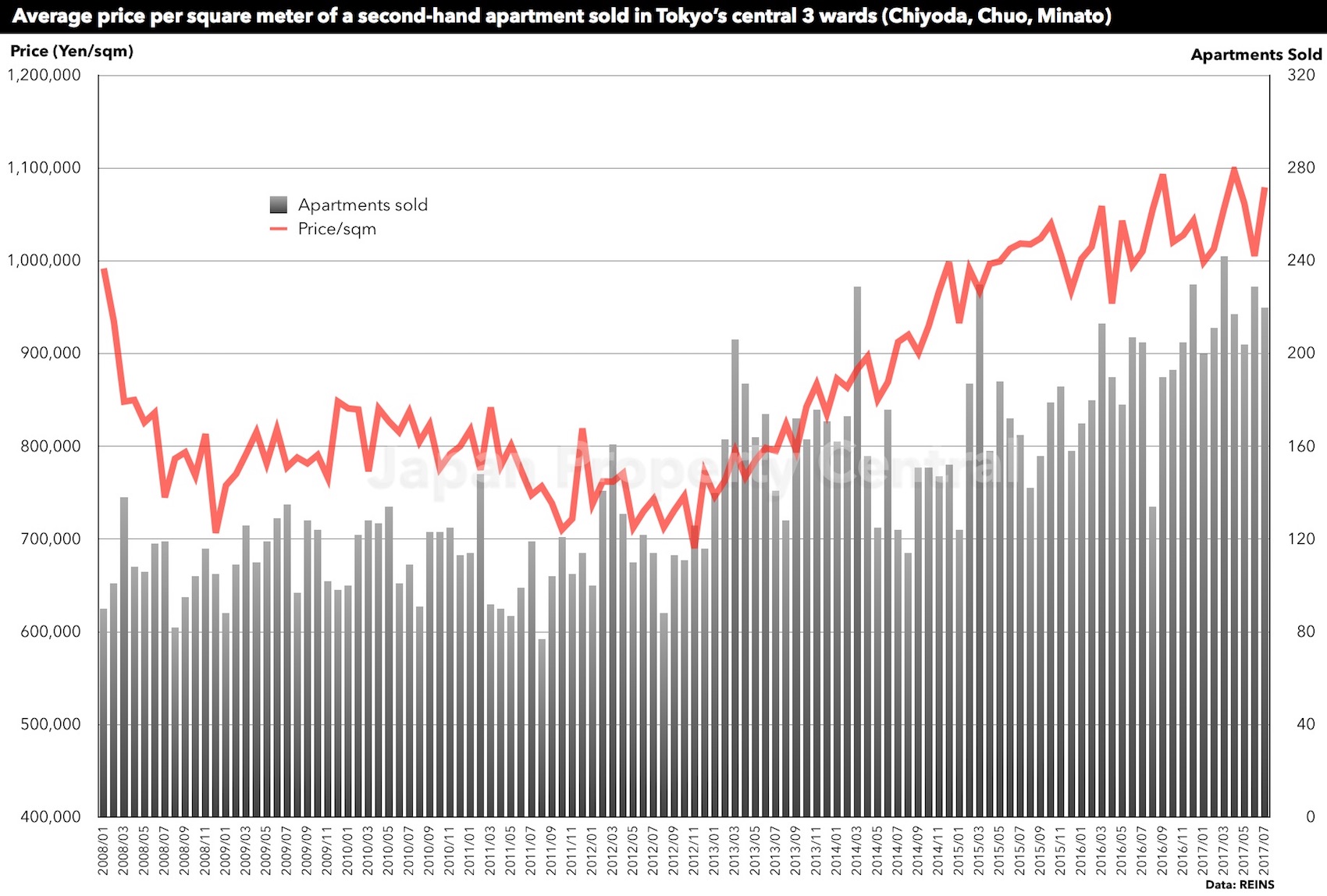

Tokyo apartment sale prices increase for 58th consecutive month

According to REINS, 3,304 second-hand apartments were sold across greater Tokyo in July, down 0.9% from the previous month but up 3.6% from last year. The average sale price was 31,600,000 Yen, down 0.06% from the previous month but up 5.4% from last year. The average price per square meter was 494,800 Yen, down 0.3% from the previous month but up 4.5% from last year. This is the 55th month in a row to record a year-on-year increase in sale prices. The average building age was 20.89 years.

In the Tokyo metropolitan area 1,722 second-hand apartments were sold, down 1.6% from the previous month but up 8.2% from last year. The average sale price was 38,640,000 Yen, showing no change from the previous month but up 3.1% from last year. The average price per square meter was 656,100 Yen, up 0.9% from the previous month and up 3.3% from last year. This is the 58th month in a row to record a year-on-year increase in prices. The average building age was 19.64 years.