Apartment rents reach 7 year low in Tokyo

The average apartment rent across Japan's major cities has fallen even further. In July, the average rent for a condominium in Tokyo's 23-ku fell below 3,000 Yen/sqm a month for the first time in over seven years. The rent in rental-only buildings has also fallen.

According to Tokyo Kantei, the average rent for a condominium apartment in July was 2,995 Yen/sqm a month, down 1.8% from July 2011.Read more

Secondhand apartment prices continue to fall in July

According to Tokyo Kantei, the average secondhand apartment price (based on a 70sqm apartment) in greater Tokyo in July fell 0.7% from the previous month to 28,250,000 Yen.

With the exception of Saitama City which saw prices rise 0.5% from the previous month to 21,180,000 Yen, all other areas in greater Tokyo saw a further decline in prices, with the rate of decline worsening. In Chiba City, the average price fell 1.8% from the previous month to 17,170,000 Yen. This is 6.3% lower than July of 2011.Read more

Tas Corp's rental market data for August

TAS Corp, the company behind the "Tas-Map" real estate valuation site, released their latest data on the rental market for both the greater Tokyo and Kansai area for August 2012.

The data includes a vacancy rate index, average time an apartment is advertised before a tenant is found, average rate of lease renewals, rate of mid-way cancellations and a rent index.

This month's report on the greater Tokyo area focused on the aging population in Saitama and the consequences this will have for landlords in the future.Read more

Survey says Chinese investors keen on resort apartments in Japan

Tokyo-based GlobeLink is a specialist marketing and consulting company that targets wealthy Chinese consumers. They recently conducted a survey of wealthy Chinese investors to find out where they want to invest and why.

A total of 100 consumers from the top wealth bracket in China were surveyed. The participants all reside in major cities in China, and are interested in investing in Japanese real estate.Read more

June house and apartment data from AtHome

AtHome announced the latest price data on new and secondhand homes and apartments across greater Tokyo for the month of June 2012.

-- New houses --

In the greater Tokyo area (Tokyo 23-ku, West Tokyo, Kanagawa, Chiba, Saitama), the average listing price of a brand new house was 31,580,000 Yen, down 3% from June 2011. This is the 5th continuous month of decline, however listing prices were up 0.5% from May.Read more

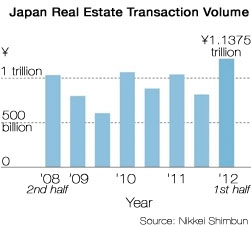

Real estate transaction volume reaches 4 year high

The volume of real estate transactions in Japan has started to pick up, showing signs of an economic recovery.

The volume of real estate transactions in Japan has started to pick up, showing signs of an economic recovery.

In the first half of 2012, transactions of office and residential buildings in major cities (Tokyo, Osaka, Nagoya etc), reached the highest level in four years.

The total volume of transactions by listed companies, including REITs, reached 1.1375 trillion Yen (14.5 billion USD). This is 10% higher than the first half of 2011, and is the highest level since the second half of 2008 which was the time of the Lehman Shock.Read more

Prices falling, but apartment transactions increasing

The downward trend of the price of second-hand apartments in Tokyo's 23-ku is increasing in pace. From the end of 2011, the price of brand new apartments have been in decline, which has put additional downwards pressure on the price of older buildings.

However, the fall in prices and historically low interest rates* are having a positive effect on the number of property transactions. (*Out of all private banks, the Bank of Tokyo-Mitsubishi UFJ and Resona Bank both currently have the lowest 10-year fixed interest rates on home loans of 1.4%.)

Even buildings over 30 years old (1982 and earlier) are becoming more popular as long-term renters move towards making their first purchase.Read more