Land prices up in 83% of locations - MLIT LOOK Report

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced the land price movements across Japan for the third quarter in 2014 (July 1 ~ October 1).

According to the Chika Look Report, 124 locations (83% of the total) saw an increase from the previous quarter, and 26 locations (17% of the total) saw no change. For the first time since this survey began in late 2007, none of the 150 survey sites saw a decrease in prices. Of the 124 locations to see a price rise, 122 locations saw prices rise between 0 ~ 3%, while 2 locations (Ginza and Shinjuku 3 Chome) saw prices rise between 3 ~ 6%.

Strong investor demand caused by monetary easing, as well as demand for apartments in areas with convenient access have helped to sustain the price growth.

In greater Tokyo, 58 locations (89% of the total) saw land prices increase, while the remaining 7 locations (11%) saw no change. In greater Osaka, 30 locations (77%) saw prices increase, wile 9 locations (23%) saw no change. In Nagoya, all 14 locations saw prices increase.Read more

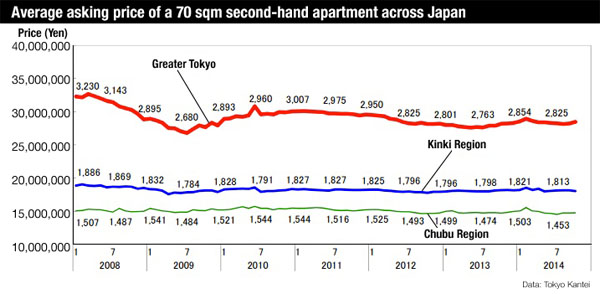

Secondhand apartment prices in October 2014 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 42,560,000 Yen in October, up 0.9% from the previous month and up 4.7% from last year. Asking prices have increased by 8.1% over the past 2 years. The average building age was 22.3 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 60,180,000 Yen, up 1.7% from the previous month and up 10.3% from last year. The average price has increased by 18.0% over the past 2 years. The average building age was 21.7 years.Read more

Office vacancy rates in October 2014 - Miki Shoji

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.60% in October, down 0.05 points from the previous month and down 1.96 points from last year.

The vacancy rate in brand new office buildings was 14.98%, up 1.08 points from the previous month but down 2.06 points from last year.Read more

New apartment prices down 10% in Tokyo

According to the Real Estate Economic Institute, 3,125 brand new apartments were released for sale in greater Tokyo in October, down 6.3% from the previous month and down 10.9% from last year. This is the 9th month in a row to see a year-on-year decline in supply.

The drop in supply is due primarily to an expected drop in demand following the increase in consumption tax in April 2014, as well as rising construction costs which are limiting the viability of many projects for developers. Sales for apartments priced under 40 million Yen have become particularly slow in recent months.

With recent data showing the second consecutive quarter of negative GDP growth in Japan, it seems highly probable that the next planned increase in the consumption tax rate will be delayed. A spokesperson from the Institute believes a delay in the next tax rise will provide a very positive benefit for the market.

1,978 apartments were sold, making the contract rate 63.3%, down 8.3 points from the previous month and down 16.3 points from last year. This is the lowest contract rate seen since February 2009 when it reached 61.7%. This is also the second month in a row where the rate has dropped below the 70% level which is considered to be the line between a positive and negative market conditions.Read more

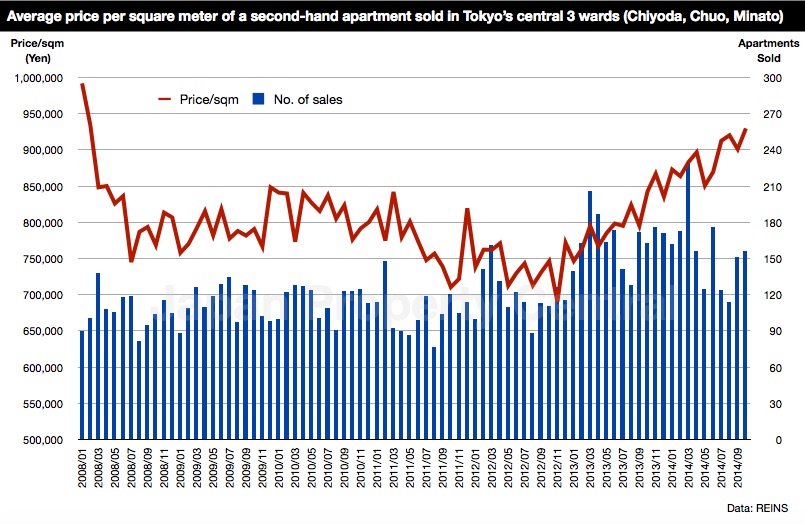

Apartment transactions down for 7th month while prices continue to rise

According to REINS, 2,655 second-hand apartments were sold across greater Tokyo in October, down 9.6% from the previous month and down 13.4% from last year. This is the 7th month in a row to see a year-on-year decline. The average apartment sale price across grater Tokyo was 28,120,000 Yen, up 2.2% from the previous month and up 8.0% from last year. The average price per square meter was 435,300 Yen, up 2.5% from the previous month and up 8.3% from last year. The average building age was 19.47 years.

1,299 second-hand apartments were sold in the Tokyo metropolitan area, down 8.8% from the previous month and down 10.2% from last year. This is also the 7th month in a row to see a year-on-year decline. The average apartment sale price was 34,780,000 Yen, up 3.0% from the previous month and up 7.3% from last year. The average price per square meter was 584,600 Yen, up 2.9% from the previous month and up 8.8% from last year. The average building age was 18.07 years.

In Shinjuku, Shibuya, Suginami and Nakano-ku, the average sale price per square meter increased by 20.8% from 12 months ago to 785,000 Yen/sqm, while the average building age was 19.28 years (down from 21.42 years in October 2013).Read more

Japan's derelict home issue compounded by missing owners

Dealing with the growing number of abandoned and empty homes across Japan is proving to be a difficult task as out-of-date property titles are making it almost impossible to track down the owners, some of whom died decades ago. In many situations the local governments are unable to take any action without the consent of the property owner, and have no choice but to let dangerous and ageing buildings rot while they embark on a lengthy and complex process to find the owners.

Between July and August, the Mainichi Shimbin surveyed 355 local governments across the country that have enacted ordinances to deal with empty homes. Approximately half of them said they had cases where they could not locate the property owner and could not take any action. Of those, a third said that the building was not even registered on the land title, which made matters worse.Read more

Tokyo apartment sales in October 2014

The following is a selection of apartments that were sold in central Tokyo during the month of October 2014:Read more