Secondhand apartment sale prices reach new record in central Tokyo

According to REINS, 3,114 second-hand apartments were sold across greater Tokyo in June, up 3.5% from the previous month and up 10.7% from last year. This is the 3rd month in a row to see a year-on-year increase in transactions.

The average apartment sale price was 29,140,000 Yen, up 0.9% from the previous month and up 6.2% from last year. The average price per square meter was 453,300 Yen, up 0.1% from the previous month and up 6.6% from last year. The average building age was 20.26 years.

1,579 apartments were sold in the Tokyo metropolitan area, up 8.6% from the previous month and up 14.3% from last year. The average sale price was 35,670,000 Yen, down 1.4% from the previous month but up 4.5% from last year. The average price per square meter was 596,500 Yen, down 2.7% from the previous month but up 5.9% from last year. The average building age was 19.44 years.

Sale prices in central Tokyo reach new record high

Miyagi Prefecture’s vacancy rate set to rise

Local governments in Miyagi Prefecture are paying close attention to vacancy rate trends as demand for temporary housing following the Tohoku disaster is expected to be short-lived.

Local governments in Miyagi Prefecture are paying close attention to vacancy rate trends as demand for temporary housing following the Tohoku disaster is expected to be short-lived.

The prefecture has a vacancy rate of 9.4%, making it the lowest in Japan and the only prefecture with a single digit vacancy rate. The low number of vacant houses, however, can be largely attributed to a steep rise demand for temporary housing from residents displaced by the 2011 Tohoku disaster.

There are concerns that the vacancy rate will start to climb again as the public housing projects built for these residents are gradually completed.Read more

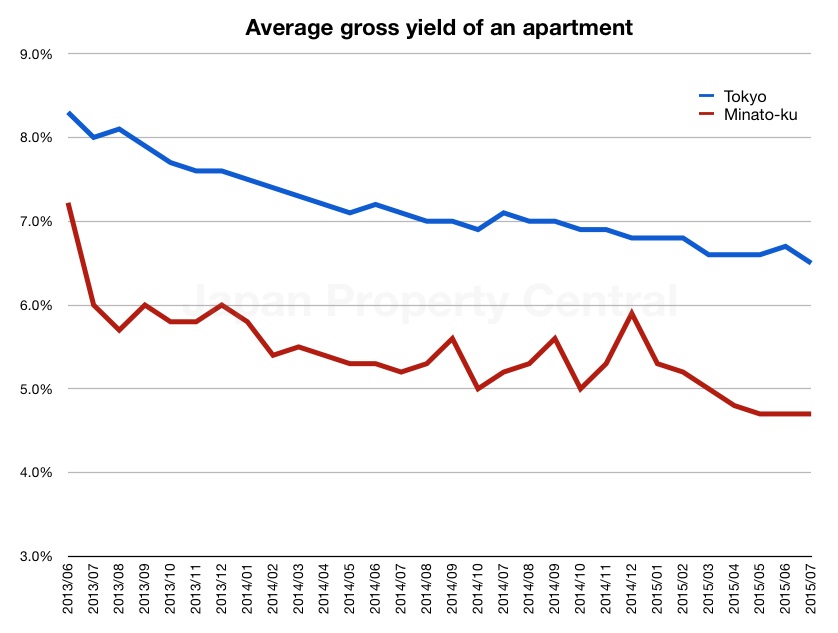

Residential yields in Minato-ku - July 2015

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in July was 4.7%, showing no change from the previous month and down 0.5 points from last year. The average gross yield across Tokyo was 6.5%, down 0.2 points from the previous month and down 0.6 points from last year.

The average asking price of a second-hand apartment in Minato-ku was 857,785 Yen/sqm as of July 1, 2015, up 85 Yen from the previous month and up 9.1% from last year. The average asking price for land was 1,226,363 Yen/sqm, up 1.1% from the previous month but down 1.9% from last year.Read more

Tokyo Apartment Sales in June 2015

The following is a selection of apartments that were sold in central Tokyo during the month of June 2015:Read more

Rosenka land values up in urban areas, but down nationwide

According to the National Tax Agency, rosenka land values across Japan in 2015 fell for the 7th year in a row, although the decline appears to be bottoming out. This year nationwide land values dropped by 0.4%, which is an improvement from 2014 which saw values drop by 0.7%. In Tokyo, rosenka values increased by 2.1%, after seeing a 1.8% rise in 2014. In Osaka, values increased by 0.5%.

A rapid increase in foreign tourists and a boost in investment in central Tokyo from foreign funds has helped to pull up property values and retail rents.

Midosuji Boulevard in front of Osaka’s Hankyu Department Store saw rosenka land values rise by 10.1% from last year to 8,320,000 Yen/sqm, while Meieki Dori Avenue in front of Nagoya Station saw values increase by 11.5% to 7,360,000 Yen/sqm.Read more

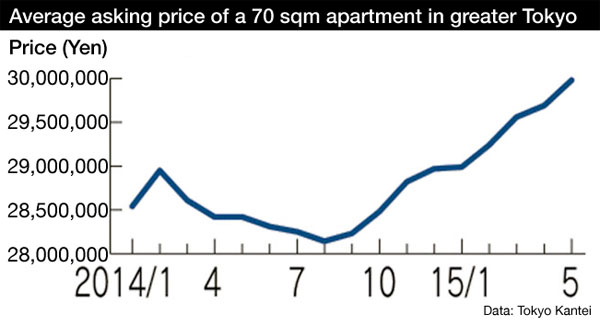

Secondhand apartment prices in May 2015 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq ft) apartment in greater Tokyo in May was 29,980,000 Yen, up 1.0% from the previous month and up 5.5% from last year. This is the 9th month in a row to see an increase from the previous month. The average building age was 22.0 years.

The increasing cost of buying a brand new apartment is causing buyers to shift their attention to the resale market. With the average price of a new apartment over 10 times the average annual income, and far exceeding the normal multiple of 6, more and more buyers are becoming priced out of the new apartment market.Read more

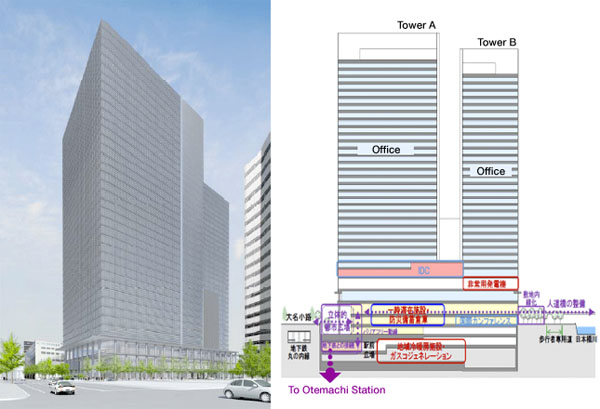

Otemachi 2 Chome Project expected to sell for 200 billion Yen

The Japanese government is redeveloping a state-owned site in the Otemachi district near Tokyo Station.

The Urban Renaissance Agency, a semipublic housing company, will build a two office towers which will then be sold to a real estate company or fund once it has been filled with tenants. The sale price is expected to be over 200 billion Yen (1.62 billion USD), which, if achieved, would make it the highest price ever seen for government property.

To date, the most expensive recorded sale of state-owned land was for the former Japan Defense Agency land in Roppongi (now Tokyo Midtown). The land sold to a consortium of real estate developers in 2000 for 180 billion Yen.Read more