New apartment prices in Tokyo down 7% in December but annual average reaches record high

According to the Real Estate Economic Institute, 9,389 brand new apartments were released for sale in greater Tokyo in December, up 181.4% from the previous month and up 13.9% from December 2013.

6,567 apartments were sold, making the contract rate 69.9%, down 8.5 points from the previous month and down 6.2 points from the previous year. This is just below the 70% level which is said to be the line between positive and negative market conditions.

The average new apartment price was 50,220,000 Yen, down 3.9% from the previous month and down 5.9% from the previous year. The average price per square meter was 710,000 Yen, down 3.7% from the previous month and down 4.4% from the previous year.

1,940 apartments in high-rise buildings (over 20-storeys) were offered for sale, up 63.9% from the previous year. The contract rate was 63.7%, down 15 points from the previous year and also below the 70% market indicator.Read more

Tokyu plans luxury apartments for Niseko

Niseko Tokyu Resort, part of the Tokyu Group and operator of the Niseku Mt. Resort Grand Hirafu ski resort, will be developing a luxury condominium near the ski field.

Construction is scheduled to begin in July, with completion expected at the end of 2016.

Over the years a number of foreign developers have been steadily building smaller condominiums in the Niseko Hirafu area, but this will be the first project in 20 years that can accommodate over 300 residents.Read more

Omotesando public housing site to be redeveloped

The Tokyo Metropolitan Government announced plans to redevelop the Aoyama Kitamachi Apaato, a city-operated public housing complex located near Omotesando Station and just behind Aoyama Dori Street.

The four hectare site currently contains 25 residential blocks built between 1957 and 1968. This project was said to be the first post-war city housing in Tokyo. Apartments ranged in size from 32 ~ 52 sqm. The 4 and 5 storey buildings have no elevators and some of the buildings did not have bathrooms (bathroom units were added to the balconies later).Read more

December rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condomonium apartment in greater Tokyo was 2,562 Yen/sqm in December, up 0.1% from the previous month and up 1.9% from the previous year. The average apartment size was 59.62 sqm and the average building age was 19.7 years.

In Tokyo’s 23-ku, the average monthly rent was 3,195 Yen/sqm, down 0.1% from the previous month but up 2.3% from the previous year.

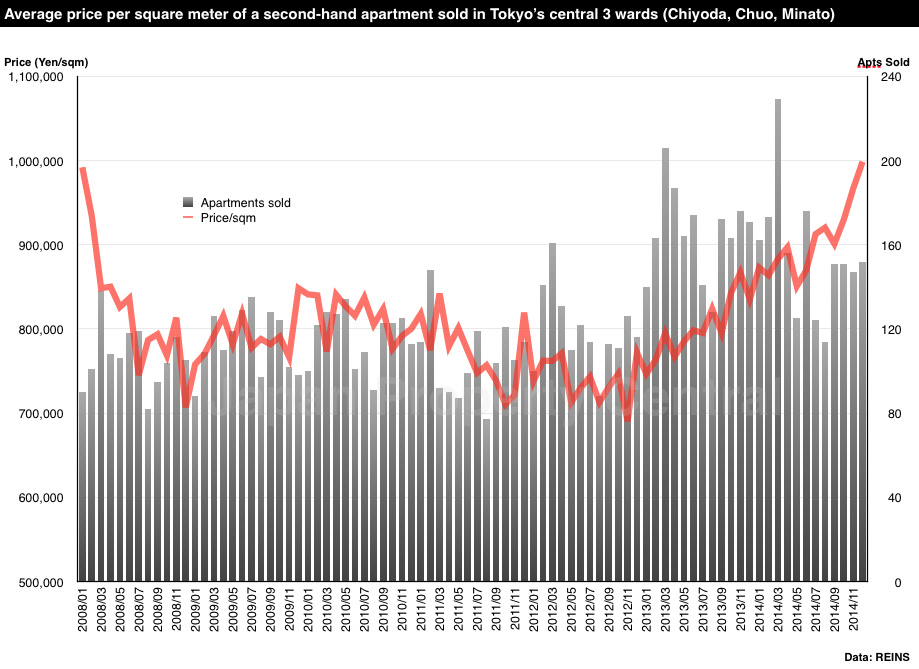

Second-hand apartment prices in central Tokyo up 19% over the year

According to REINS, 2,497 second-hand apartments were sold across greater Tokyo in December 2014, down 11.8% from the previous month and down 13.9% from December 2013. This is the 9th month in a row to see a year-on-year decline.

The average apartment sale price was 28,470,000 Yen, up 1.4% from the previous month and up 11.2% from the previous year. The average price per square meter was 448,700 Yen, up 1.6% from the previous month and up 10.9% from the previous year. The average building age was 19.85 years.

1,250 second-hand apartments were sold in the Tokyo Metropolitan Area, down 12.6% from the previous month and down 12.1% from the previous year. The average sale price was 35,070,000 Yen, up 2.9% from the previous month and up 12.7% from the previous year. The average price per square meter was 593,400 Yen, up 3.1% from the previous month and up 10.7% from the previous year. The average building age was 18.93 years.

Luxury sales are rising in the metropolitan area with 79 apartments priced over 100 million Yen selling in the 4th quarter of 2014, up 31.7% from the same quarter in 2013.

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), the average sale price was 57,310,000 Yen, up 15.4% from the previous month and up 28.5% from the previous year. The average price per square meter was 998,600 Yen/sqm, up 3.3% from the previous month and up 19.6% from the previous year. It has now exceeded the level seen in January 2008 when REINS began keeping records for central Tokyo sale prices.Read more

Revision to voting ratios to make it easier to sell apartment building and land

On December 24, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced a revision to the Facilitation of Reconstruction of Condominiums Act which is intended to make it easier to sell off an older apartment building and land in order to speed up redevelopment.

Under the revision, the voting ratio to sell off the building and land will be reduced to 80% for kyu-taishin apartments that do not meet earthquake-resistant codes (the ratio was originally 100%). It is important to note that this revision does not apply to all apartments built before 1981. It only applies to those that failed an earthquake-resistant inspection.

At the end of 2013, there were 6,010,000 apartments across Japan. Of those, approximately 17% are in buildings built to the older earthquake codes (called kyu-taishin). The figures are higher for condominiums, with a third of condominium apartment buildings across Japan built to the older codes.

By April 2014, there were only 196 cases where kyu-taishin apartment buildings were redeveloped, accounting for just 1.4% of the total number of kyu-taishin apartments.Read more

Akasaka’s latest luxurious penthouse is for sale

| No longer available |

A spacious 3-Bedroom penthouse apartment in the recently completed Park Mansion Akasaka Hikawazaka condominium is up for re-sale.

Park Mansion Akasaka Hikawazaka was developed by Mitsui Fudosan Residential and completed in October 2014. The ‘Park Mansion’ series of apartments is the most prestigious brand on offer by Mitsui and is considered one of the top brands in Japan. There are just 36 apartments in the 13 storey building, and all apartments had sold out by the developer 8 months prior to completion.

The 168.63 sqm (1,814 sqft) apartment is one of just two apartments on the top floor of the building. The south-east and north-east facing corner unit has open views over the greenery of the housing compound of the US Embassy and out towards Ark Hills, the Ana Inter-Continental Hotel and Izumi Garden Tower. It has never been lived in and is in as-new condition.Read more