How the coronavirus is affecting different sectors of Japan's real estate market

The coronavirus pandemic is affecting the various sectors of Japan’s real estate market in different ways. Some segments are booming while others are seeing the worst conditions in recent history.

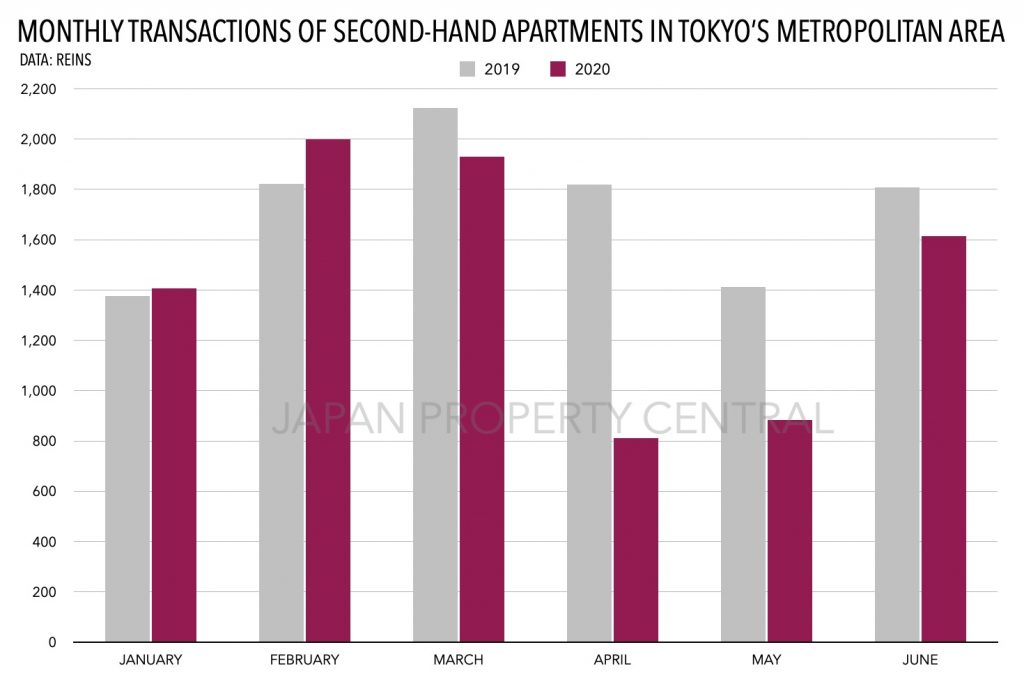

Apartment transactions and sale prices recover in June

Buying activity in the greater Tokyo area is starting to resume, with monthly transactions starting to recover from levels seen during the shut down in April and May. In June, a total of 3,107 second-hand apartments were reported to have sold across greater Tokyo, up 83.6% from May. This number is still 11% below the transactions seen in June 2019, but an improvement from the 52.6% year-on-year drop seen in April and the 38.5% drop seen in May.

Son sells Tiffany Building in Ginza

As part of their expansion in investment in the Ginza district, real estate company HULIC has acquired the Tiffany Ginza Building from SoftBank CEO Masayoshi Son this month. This was a joint purchase with Fuyo General Lease, a Mizuho Financial Group company.

The ARGYLE aoyama opens

On June 19, the 20-story mixed-use redevelopment of Aoyama Bell Commons reached completion. The 90-meter tall building, named the ARGYLE aoyama, includes office, hotel and retail.

Tokyo Apartment Sales in June 2020

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of June 2020:

Quick real estate news summary for the week

High-rise residents feeling the stress of the pandemic, central Tokyo apartment prices rise against the odds, while housing starts drop. Below is a quick weekly summary of some of the recent goings-on in the Japanese real estate market.

Rosenka land values increase nationwide for 5th year in a row

On July 1, the National Tax Agency announced the rosenka land values for 2020. Land values nationwide saw a 1.6% year-on-year increase, an improvement from the 1.3% increase seen in 2019 and the fifth year in a row to see growth.