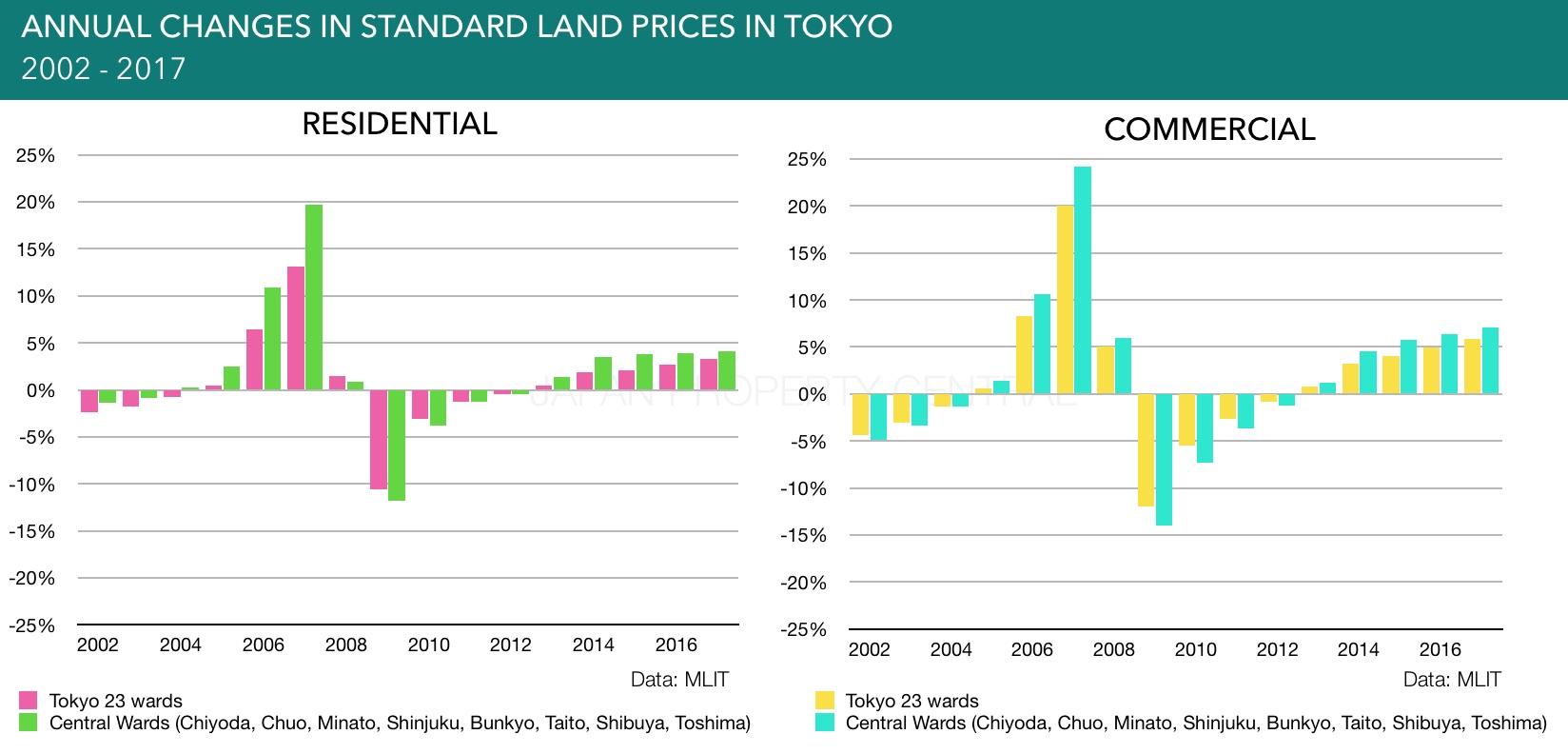

Standard land prices in Tokyo increase for 5th year in a row, while nationwide commercial prices increase for first time in 10 years

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT), announced the Standard Land Prices on September 19th. In the Tokyo metropolitan area, land prices across all uses increased by 3.0% from last year, recording the fifth consecutive increase in land prices. Commercial land prices in Tokyo’s 23 wards increased by an average of 5.9%, after recording a 4.9% increase in 2015. Shibuya Ward was in top place with 8.6% growth (6.6% in 2016).

The survey site under the Ginza Owaricho Tower in Ginza 6 Chome saw a 21.8% increase in land prices over the past 12 months.

Nationwide, standard land prices were down 0.6% for residential land, but up 0.5% for commercial land. This is the first time in 10 years to see an increase in commercial land prices.

Kyoto’s tourism boom drives commercial land price growthRead more

Maison Mita to be redeveloped into high-rise

Maison Mita, a 67-unit, 49-year old condominium in central Tokyo’s Mita neighbourhood will be redeveloped into a 77m tall, 23-storey high rise by both Mitsubishi Jisho Residence and Asahi Kasei Realty & Residence. Demolition of the current building is expected to start in December 2017 and the new building is due for completion by December 2020.

Apartment owners had been discussing redevelopment for the past 10 years.

Apartments in the older building ranged in size from 34 ~ 108 sqm, with a mixture of studio and family-oriented layouts. The building was developed by Kyoei Life Insurance and completed in 1968. Kyoei developed several Maison-named condominiums in central Tokyo in the 1960s, 70’s and ‘80s. The insurance company filed for bankruptcy with liabilities of 4.6 trillion Yen in 2000 in what was said to have been the country’s biggest bankruptcy since WWII.

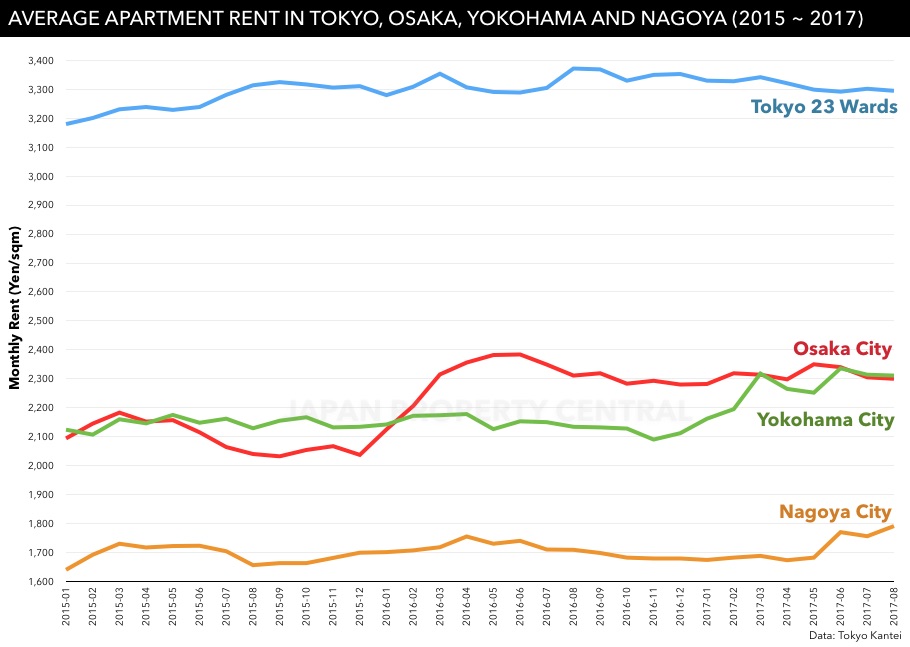

Average apartment rent down in greater Tokyo

According to Tokyo Kantei, the average monthly rent of a condominium-type apartment across greater Tokyo in August was 2,628 Yen/sqm, down 0.1% from the previous month and down 1.2% from last year. The average apartment size was 59.74 sqm and the average building age was 21.1 years.

New apartment prices in greater Tokyo increase for 5th month in a row

According to the Real Estate Economic Institute, there were 2,101 brand new apartments offered for sale across greater Tokyo in August, down 38.7% from the previous month but up 6.9% from last year. The average sale price was 57,940,000 Yen, down 11.7% from the previous month but up 2.3% from last year. The average price per square meter was 871,000 Yen, up 9.1% from last year and the fifth month in a row to record a year-on-year increase.

The contract ratio in greater Tokyo was 68.2%, up 1.6 points from last year. In the Tokyo metropolitan area it was 72.4%, above the 70% line said to indicate healthy market conditions.

The following buildings saw same-day sellouts in August:

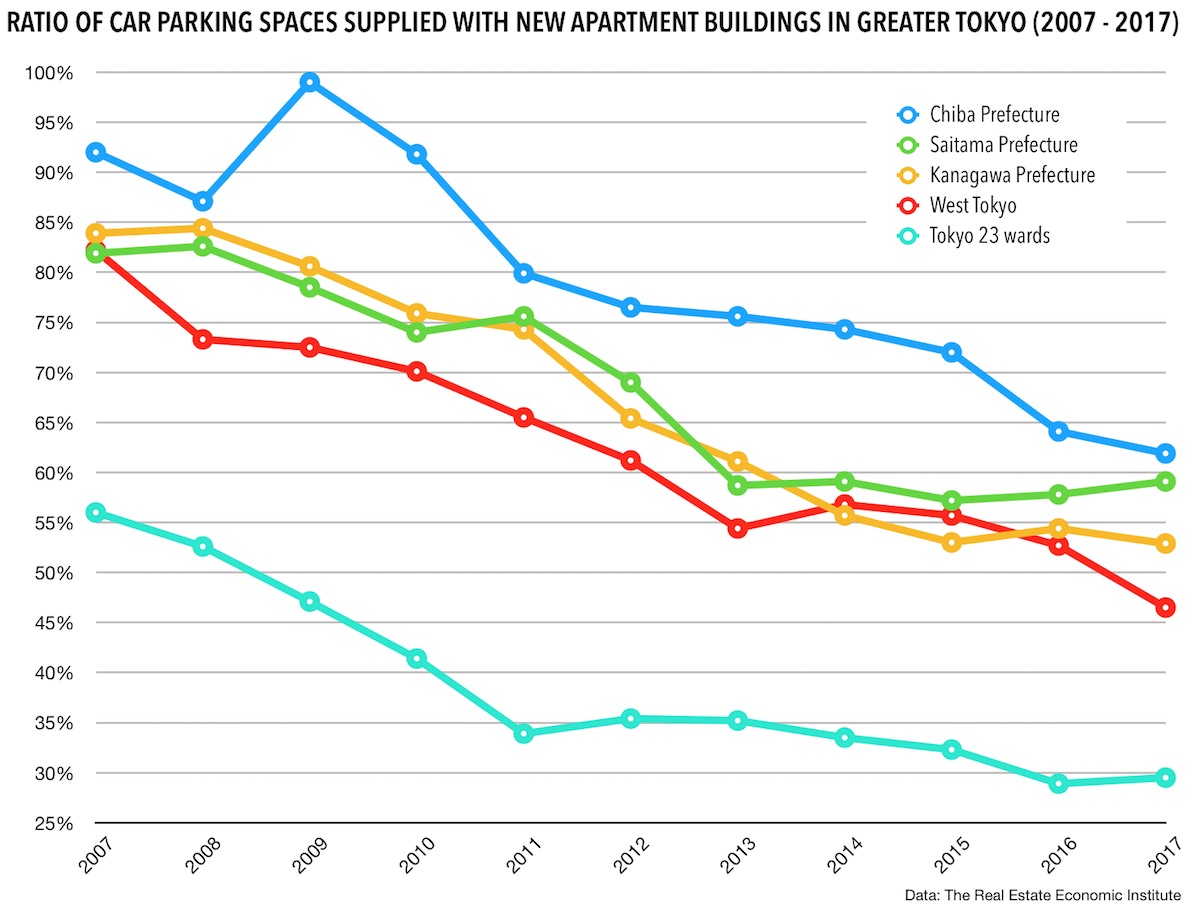

Car parking spaces becoming scarce in Tokyo

Anyone with a car who is looking to buy an apartment in the Tokyo area may already understand the challenge in finding a building that has parking spaces available.

Car parking spaces in the Tokyo area are becoming fewer and fewer in number and the trend is expected to continue in the coming years. The ratio of car parking spaces provided in new condominiums in greater Tokyo has fallen from a ratio of 77.3% in 2007 to just 42.2% for the first half of 2017.

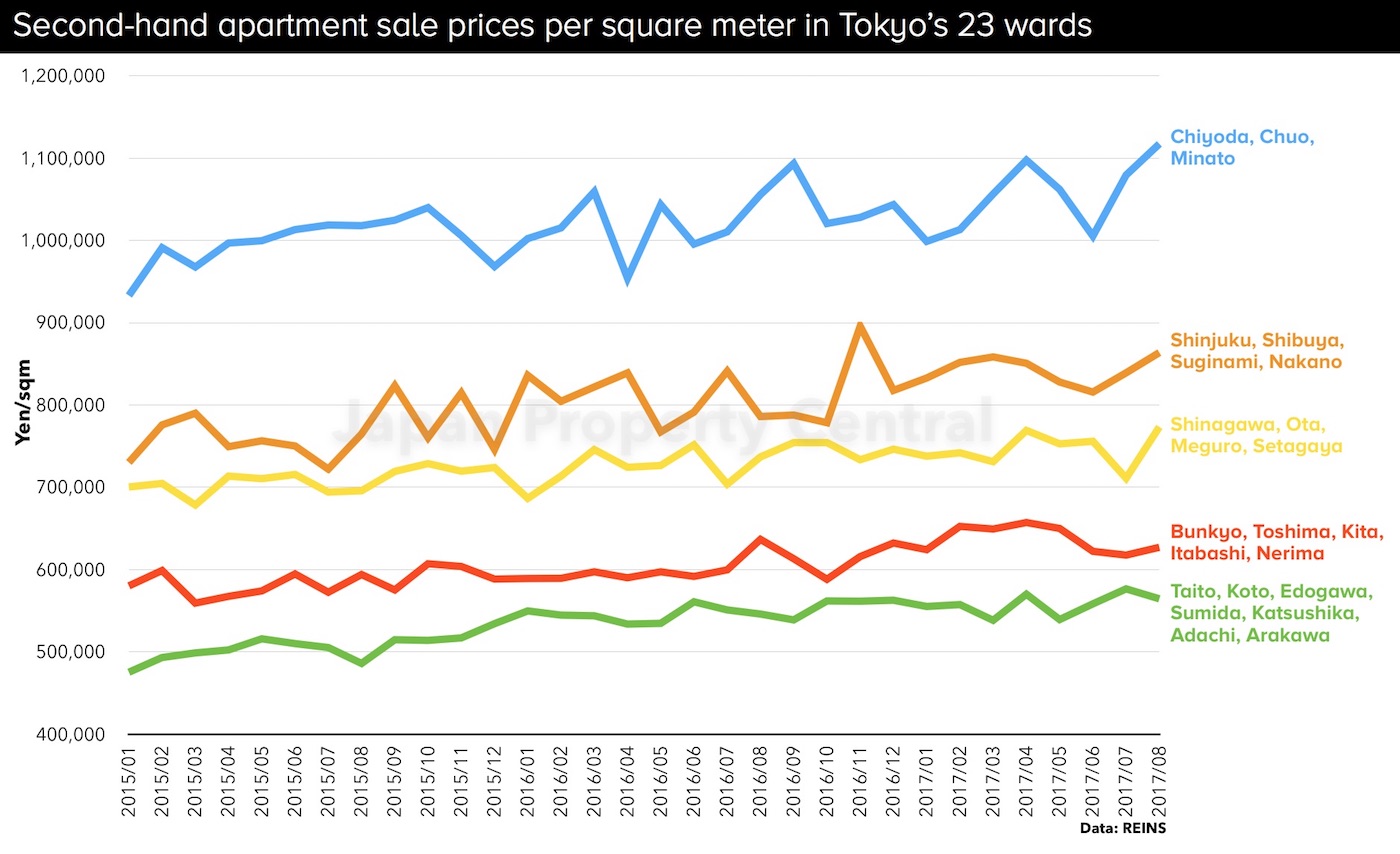

Tokyo apartment sale prices increase for 59th consecutive month

According to REINS, 2,265 second-hand apartments were sold across greater Tokyo in August, down 31.4% from July and down 5.0% from last year. August is one of the hottest months in the year and often a time when Japanese take a vacation, so sales are typically slower than in July or September.

The average sale price was 32,380,000 Yen, up 2.5% from the previous month and up 7.6% from last year. The average price per square meter was 505,000 Yen, up 2.1% from the previous month and up 5.9% from last year. This is the 56th month in a row to record a year-on-year increase in sale prices. The average building age was 20.69 years.

In the Tokyo metropolitan area 1,141 second-hand apartments were sold, down 33.7% from the previous month and down 4.8% from last year. The average sale price was 40,350,000 Yen, up 4.4% from the previous month and up 7.4% from last year. The average price per square meter was 684,200 Yen, up 4.3% from the previous month and up 7.4% from last year. This is the 59th month in a row to record a year-on-year increase in sale prices. The average building age was 19.39 years.

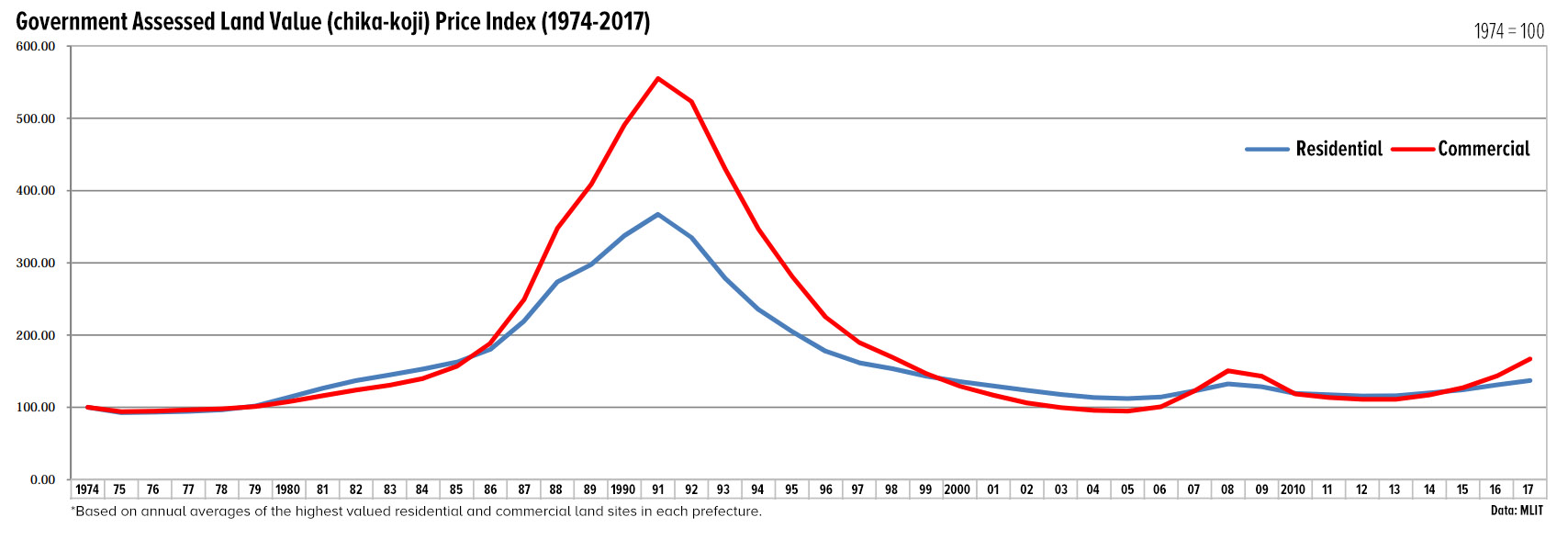

Price growth in Tokyo more subdued than the 2007 mini-bubble

Earlier this year, rosenka tax values at a section of ultra-prime commercial land in Tokyo’s Ginza district increased by 26% from the previous year to a record high of 40,320,000 Yen per square meter, exceeding the previous high of 36,500,000 Yen/sqm in 1992 and causing some to warn of an impending bubble and overheating of the property market in the nation’s capital.

There is valid cause for concern in some sectors of the investment-property market due to potential over-construction and over-lending to landowners to build small blocks of 'apaato' type rental flats in suburban areas with low rental demand.

But are current conditions mimicking previous bubbles?

This time around Japan is getting more foreign tourists than ever before, boosting revenues for both hotels and retails shops, making the increase in commercial real estate values much more pronounced than the residential market which relies more on real domestic demand.