Waldorf Astoria to open first hotel in Japan in 2026

Waldorf Astoria Hotels & Resorts is opening Japan’s first Waldorf-branded hotel in Tokyo in 2026. The hotel will occupy the 39th ~ 47th floors within the Nihonbashi 1 Chome Central District Redevelopment.

Quick real estate news summary for the week

Apartment asking prices in central Tokyo hit record high, vintage building in Chiyoda to be redeveloped, and Gifu to see largest apartment building in 2022. Below is a quick weekly summary of some of the recent goings-on in the Japanese real estate market.

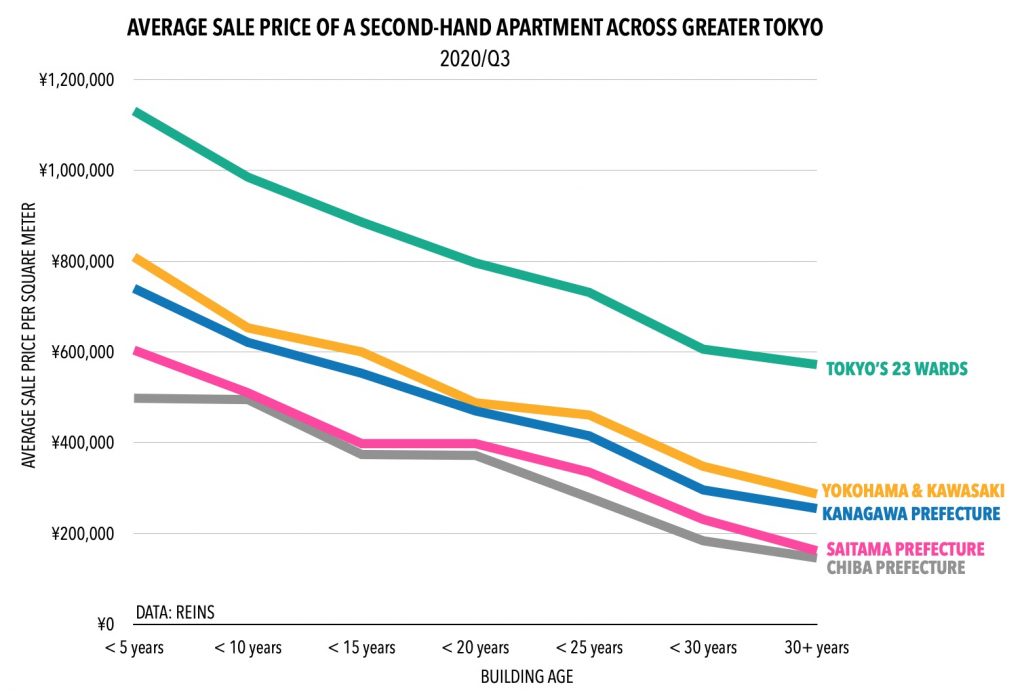

Why a newer apartment may cost up to 4x the price of an older one

In Tokyo’s 23 wards, an apartment less than 5 years old sold for 49% more per square meter than one over 30 years old. In other words, an old apartment is about half the price of a new one on a price-per-square-meter basis. The difference was highest in Saitama Prefecture where an apartment under 5 years old sold for 3.7 times that of one over 30 years old.

Luxury apartments in Yotsuya sell out

All apartments in a luxury project near Yotsuya Station sold out in the first round of sales held last month.

New apartment supply in first half of 2020 hits 47-year low

According to the Real Estate Economic Institute, the supply of new apartments across greater Tokyo in the first half of 2020 (counted from April to September) dropped below 10,000 units for the first time since record-keeping began in 1973. A total of 8,851 new apartments were released for sale, down 26.2% from the first half of 2019.

Secondhand apartment transactions in 3rd quarter reach 30-year high

According to REINS, the number of secondhand apartments reported to have sold across Greater Tokyo in the third quarter of 2020 reached the highest level seen since record-keeping began in 1990. A total of 9,537 apartments had sold between July and September, up 1.4% from the same period in 2019.

Canadian firm to invest US$9.5 billion in Japanese real estate

On October 12, the Nikkei newspaper reported that Canadian investment firm BentallGreenOak (BGO) plans to invest up to 1 trillion Yen (approx. US$9.5 billion) in Japanese real estate over the next two to three years. The company is anticipating that corporations will start selling off their office and hotel real estate holdings as the global pandemic continues, creating buying opportunities.