Tokyo Apartment Sales in September 2021

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of September 2021:

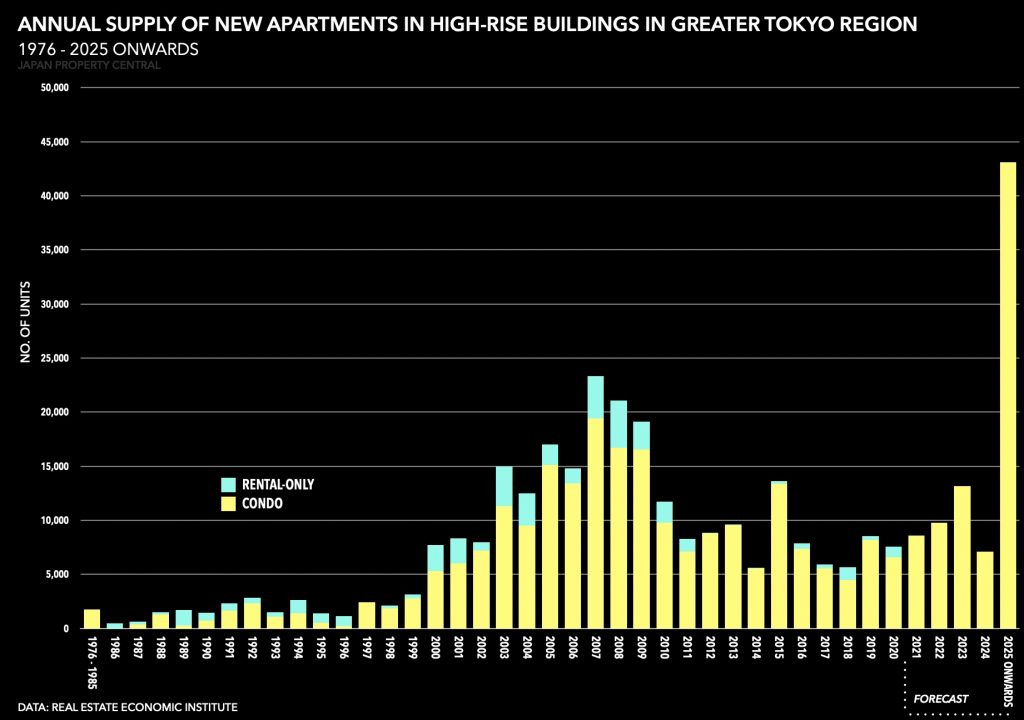

Japan’s high-rise apartment market from 2021 to 2025 onwards

If you were anticipating a post-Olympic slow down in the construction industry you may be in for a surprise. The latest report from the Real Estate Economic Institute shows a total of 280 high-rise apartment buildings either under construction or planned across Japan from 2021 onwards. This is an increase of 77 buildings from the previous report in March 2020.

Real estate assets under management hit highest level in history

Institutional investors both domestic and foreign are piling into Japan’s real estate market. As of the end of June 2021, REITs and private placement funds held a total of over 44 trillion Yen (approx. US$400 billion) in real estate - the highest level in history.

Why Japan and why Japanese real estate?

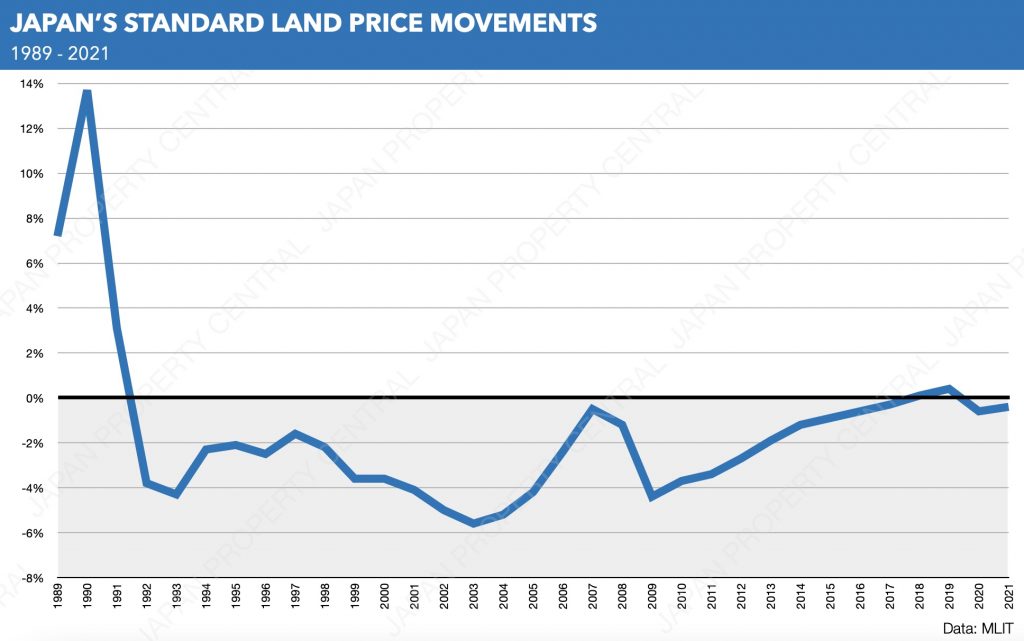

Land values drop nationwide for second year, but increase in Tokyo

Japan’s Standard Land Prices were announced yesterday by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT). The national average dropped by 0.4% from last year. This is the second year in a row to see a decline, but it is a slight improvement from last year’s 0.6% drop. The nationwide average has been in the negative for 27 of the past 30 years.

Japan's largest travel company to sell HQ building

JTB Corporation, the largest travel agency in Japan, is selling off two of its buildings in Tokyo and Osaka in a deal that could fetch tens of billions of Yen. The company has struggled since the start of the pandemic, with travel transaction volume dropping 96% in 2020.

Foreign buyers battle for Seibu’s hotels

In the few months since news broke of Seibu Holdings’ plan to offload some of its hotels, Blackstone Group and an investment fund affiliated with Morgan Stanley have emerged as possible buyers. Negotiations are expected to conclude by the end of the year.

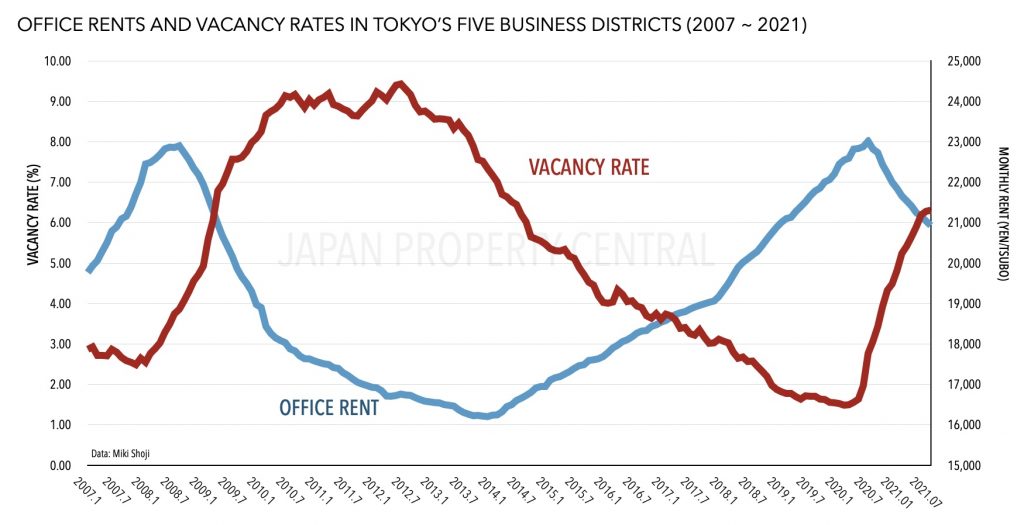

Office vacancy rate increases for 18th month

The average office vacancy rate across Tokyo’s five business districts of Chiyoda, Chuo, Minato, Shinjuku, and Shibuya reached 6.31% in August, according to office brokerage Miki Shoji. This is a 0.03 point increase from the previous month and the 18th month in a row to see vacancy rates climb.