Japan's rosenka land values increase after 2 years

This year’s rosenka land tax values were released by the National Tax Agency on July 1, and it’s been a mixed bag with some areas seeing gains and others losses.

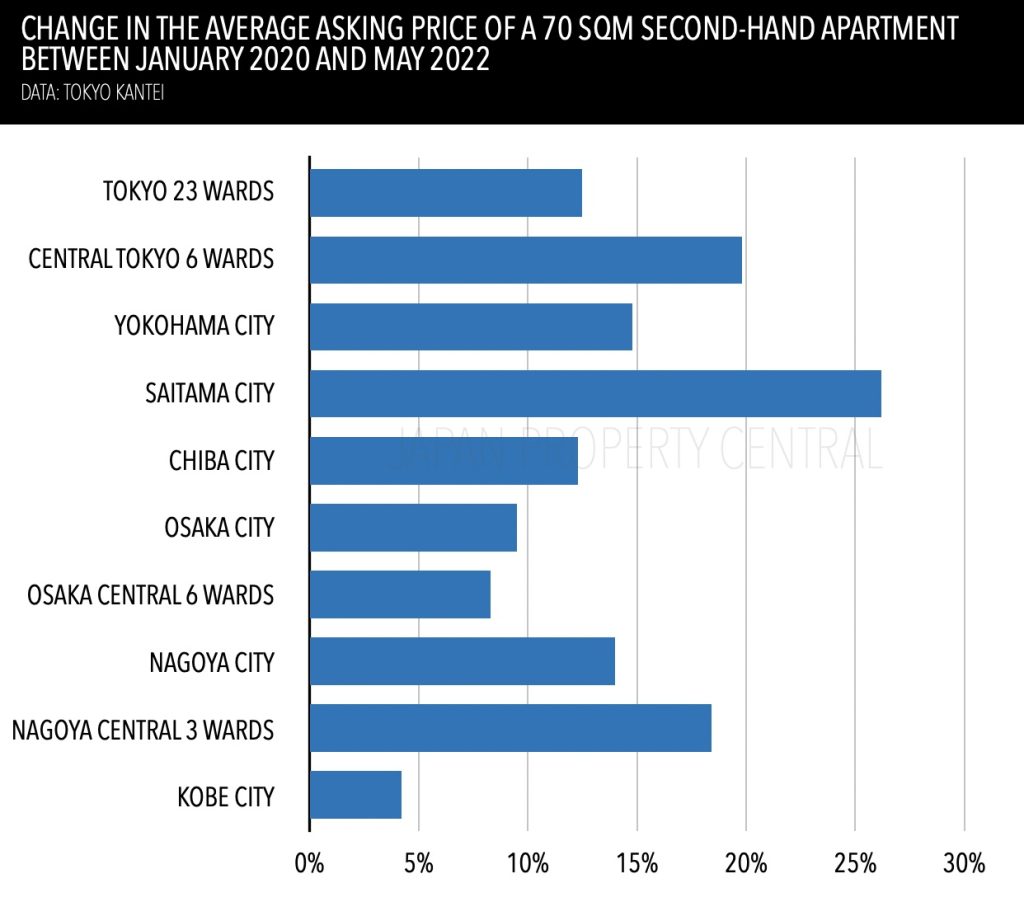

Tokyo apartment asking prices increase for 23rd month

According to Tokyo Kantei, the average asking price of a 70 sqm second-hand apartment in Tokyo’s 23 wards was 67,990,000 Yen (approx. US$502,000) in May 2022, up 0.1% from the previous month and up 7.8% from last year. This is the 23rd month in a row to see an increase.

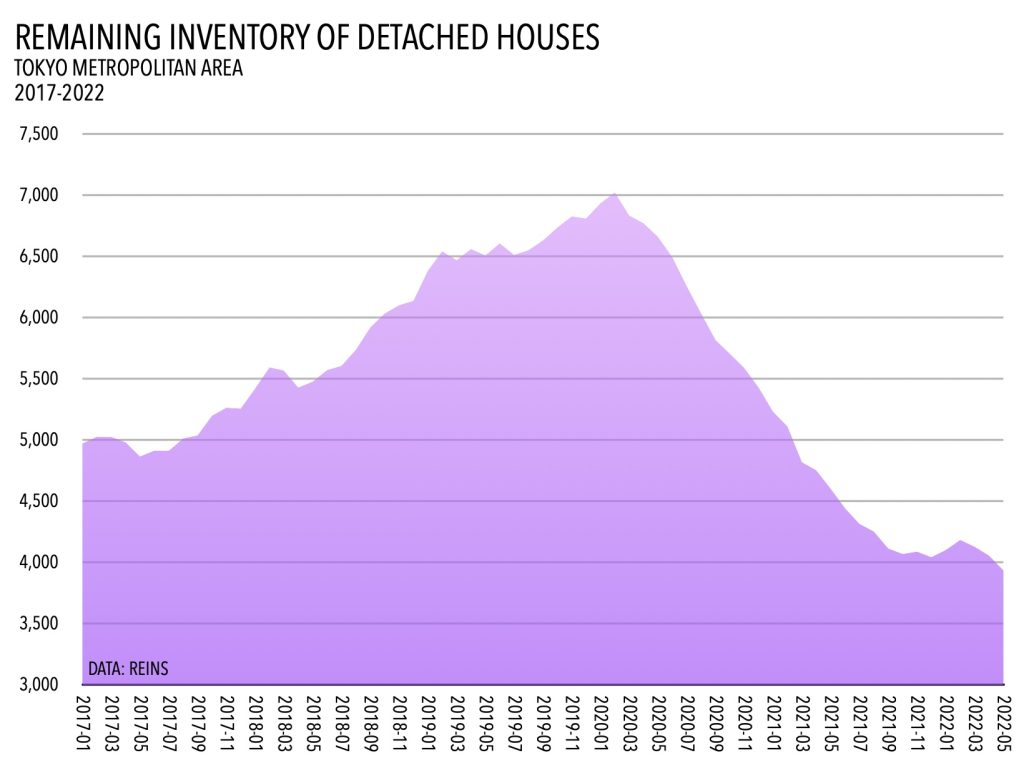

Housing inventory down 44% in Tokyo since start of pandemic

We have about twice as many people looking for houses than apartments, yet detached homes represent less than 15% of total housing inventory (houses and apartments) available for purchase across Tokyo. As a licensed brokerage, we have access to the entire market but cannot stress enough just how hard it is to source homes for clients.

Tokyo apartment prices increase for 25th month

The average sale price of a second-hand apartment in Tokyo’s 23 wards recorded the 25th consecutive year-on-year increase in May, with prices increasing by 10.8% to 876,200 Yen/sqm.

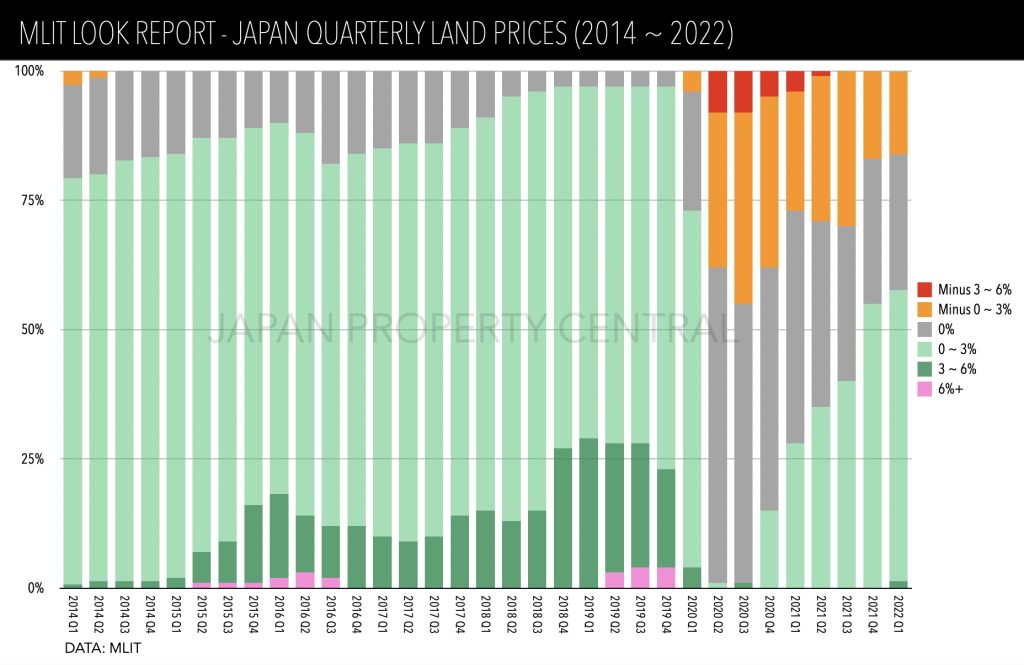

Land prices continue to rise in first quarter of 2022

According to the latest quarterly LOOK Report issued by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), land prices at 57% of the surveyed locations saw an increase in the first quarter of 2022. This is a vast improvement from a 28% share seen in the same quarter in 2021 and a 1% share seen in the second quarter of 2020 when the effects of the pandemic began to be known.

Tokyo Apartment Sales in May 2022

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of May 2022:

Real estate investment appetite returns to pre-pandemic levels

Corporations in Japan are now taking a different approach to their real estate investment activities. Immediately following the initial shock of the pandemic there was a sudden move toward selling off key assets in order to prop up business sheets. Now that the pandemic is subsiding and business is returning to usual, corporations are back to seeking efficient real estate assets that provide stable revenue and allow for diversification out of traditional revenue streams.