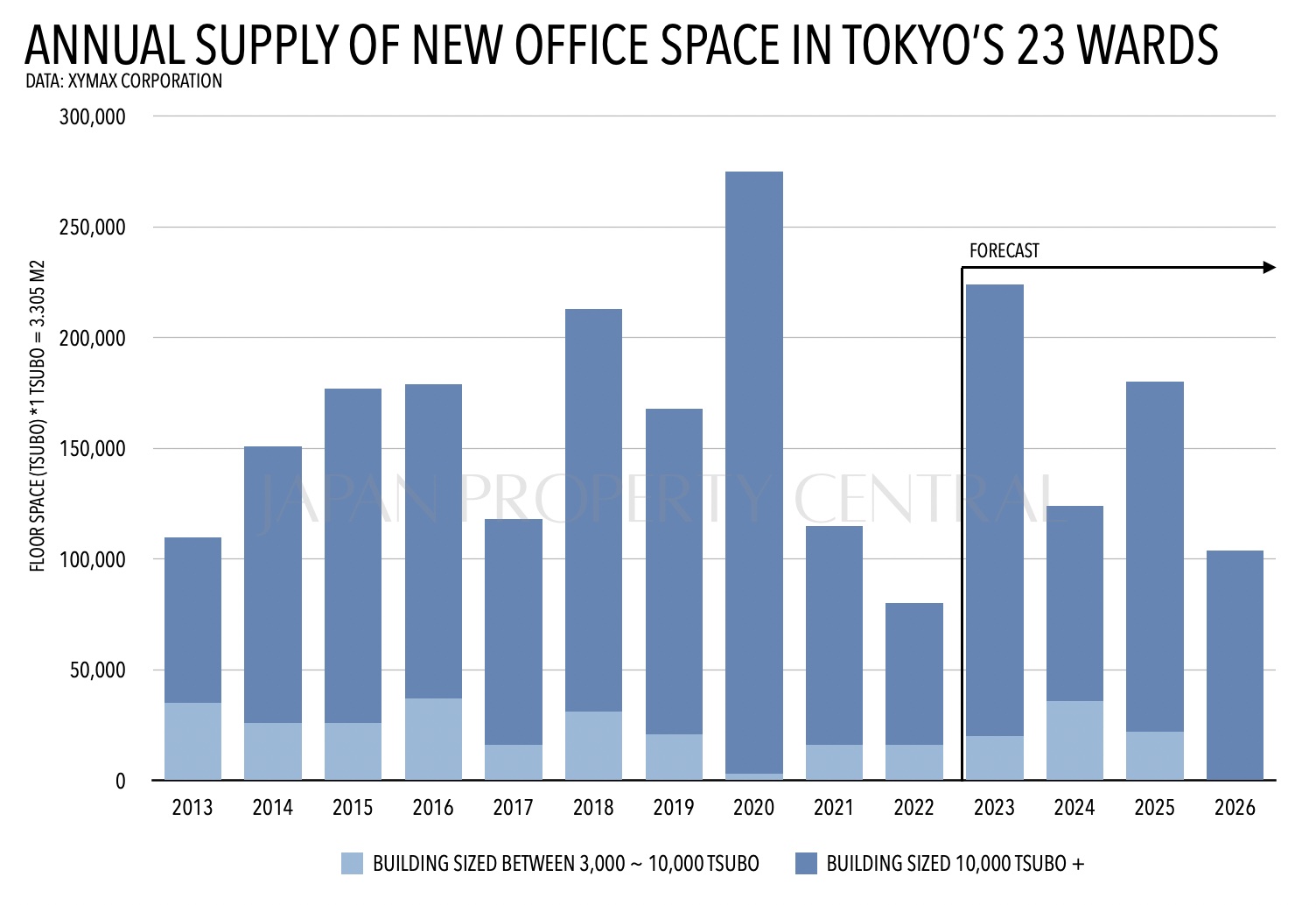

Tokyo's annual office supply forecast for 2023 - 2026

With the completion of several large-scale office buildings later this year, the total supply of new office space to hit the market in 2023 is going to be more than double what it was in 2022.Read more

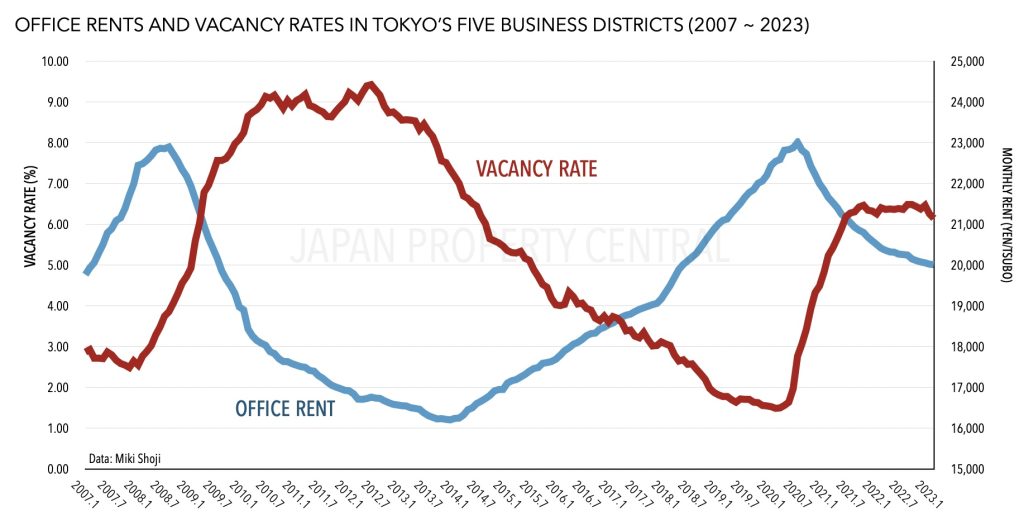

Tokyo's office vacancy rate hits 12-month low

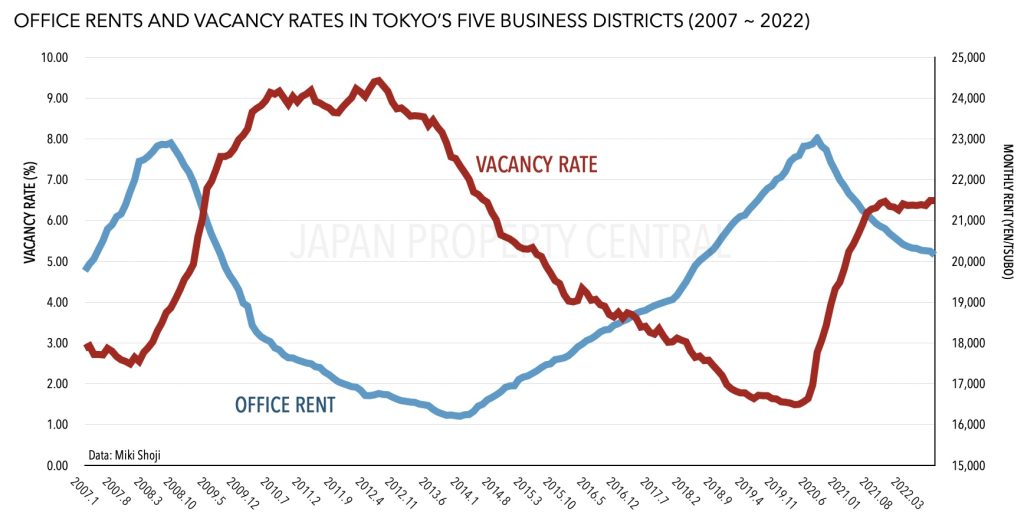

Tokyo’s office vacancy rate saw a slight improvement in February, dropping by 0.11 percentage points to 6.15%, according to office brokerage Miki Shoji.

Why Japan's developers and investors have their sights set on mid-size office buildings

In a recent interview in the Mainichi Shimbun’s Weekly Economist, the president of Ichigo Investment Advisors said that they found mid-sized office buildings to be advantageous during the slowdown in the office market.

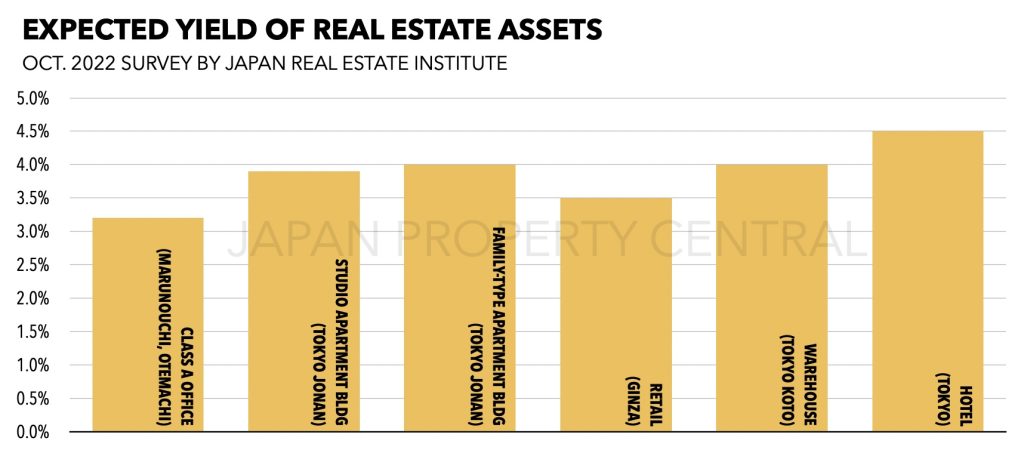

Expected rental yields on Tokyo real estate assets hit 23-year low

Investors are expecting lower rental yields from office and residential assets in Tokyo. According to the Japan Real Estate Institute’s investors survey published on November 2022, the expected rental yield on Class A office space in Tokyo’s Marunouchi and Otemachi district was 3.2% as of October 2022, down from a 3.3% expected yield in April.

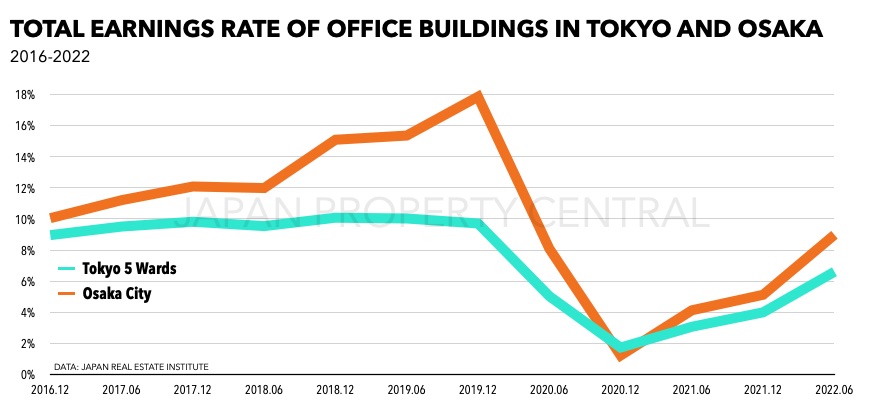

Office buildings see improved earnings rate in 2022

On November 29, the Japan Real Estate Institute released its six-monthly report on the total earnings rate (rental income and capital gains) of office buildings in central Tokyo.

Mita office building to sell for 13 billion Yen

Machinery component manufacturer, MinebeaMitsumi, announced the planned sale of its Tokyo Honbu Building in Minato ward’s Mita address.

Office vacancy rate stays flat in Tokyo

The office vacancy rate in central Tokyo remained unchanged at 6.49% in September, according to office brokerage Miki Shoji. Office rents, however, continued to decline with the average rent dropping 94 Yen from August to 20,156 Yen per tsubo (approx. 6,098 Yen/sqm).