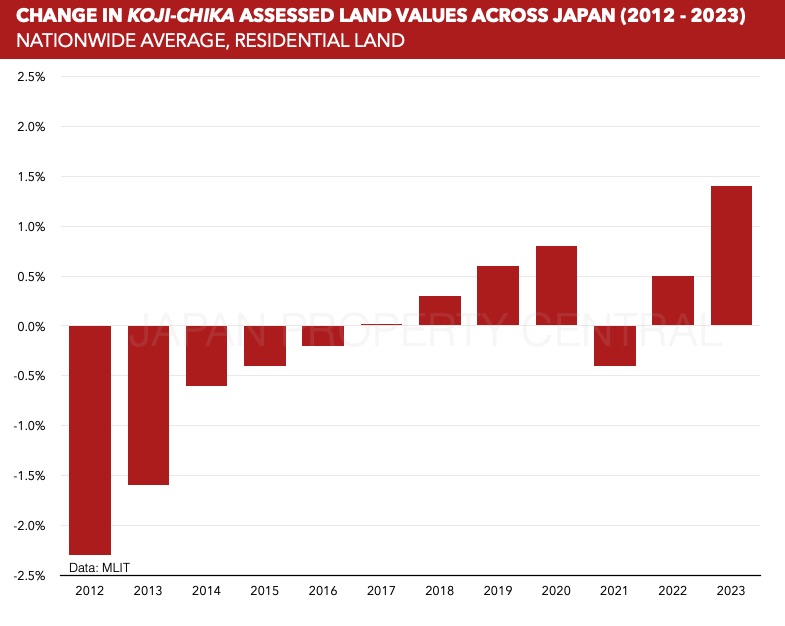

Nationwide land values increase for 2nd year in a row

The nationwide Assessed Land Values (koji-chika), as issued by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) saw a year-on-year increase in 2023. This is the second year in a row to see an increase. The growth is apparent not only in urban centers, but is also spreading to regional areas as the country emerges from the pandemic.Read more

The nationwide Assessed Land Values (koji-chika), as issued by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) saw a year-on-year increase in 2023. This is the second year in a row to see an increase. The growth is apparent not only in urban centers, but is also spreading to regional areas as the country emerges from the pandemic.Read more

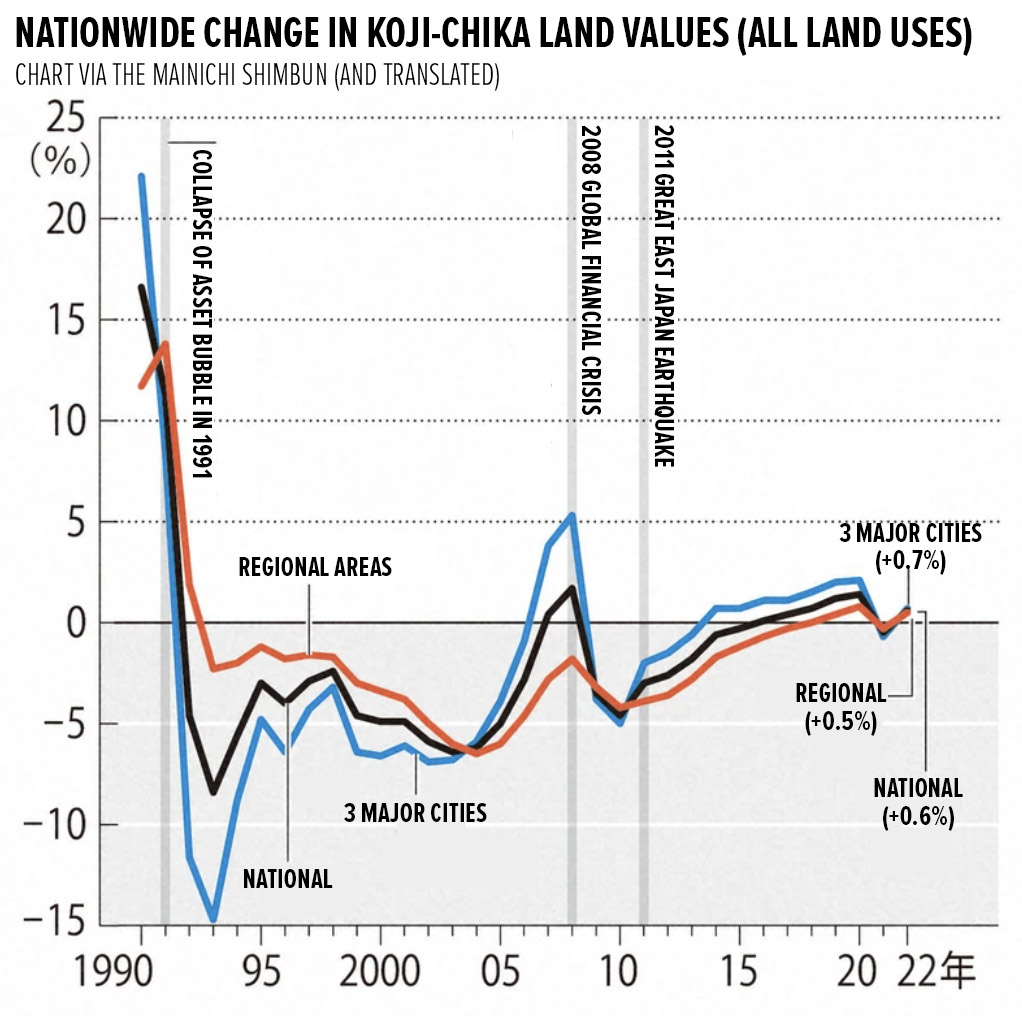

Nationwide land values increase for first time in 2 years

On March 22, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced the official assessed land values (koji-chika) for 2022. Nationwide, the average land value across all land uses increased by 0.6%, recording the first increase in two years.

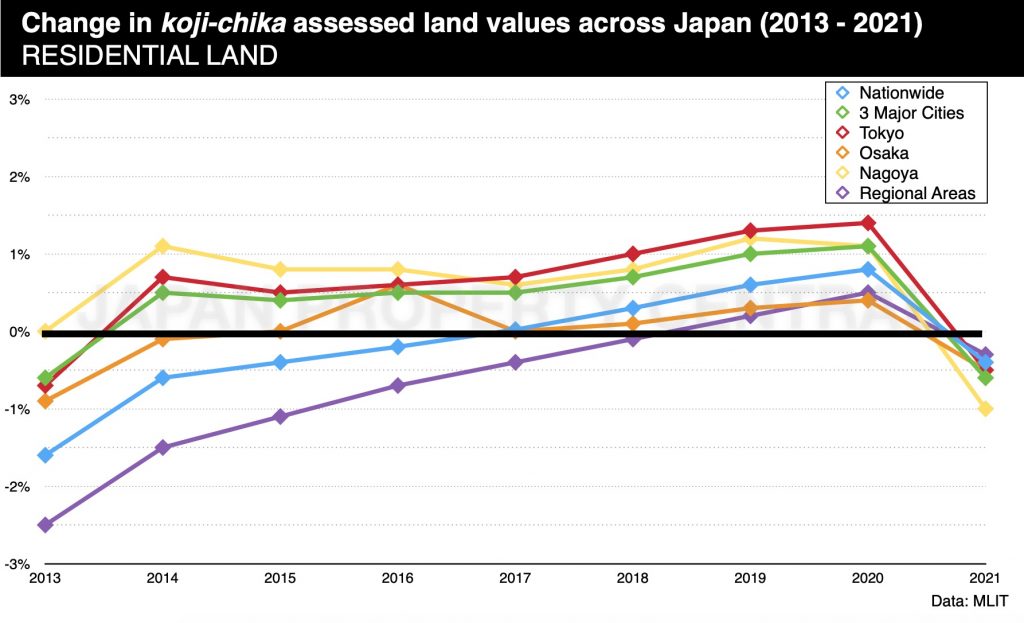

Land values drop for first time in 6 years

The nationwide ‘koji-chika’ (or chika-koji) land valuations for January 1, 2021 have just been announced. Read on if you want to see how the coronavirus pandemic has affected Japan’s real estate market.

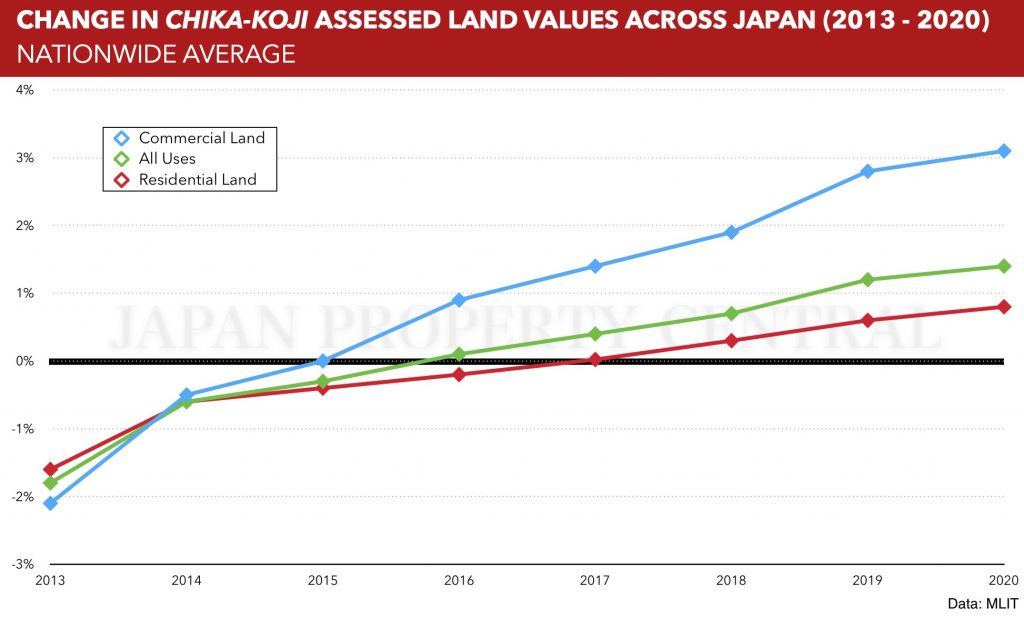

Japan’s regional land prices increase for first time in 28-years

Nationwide land prices rose for the fifth year in a row this year, but hard-hitting effects of the novel coronavirus could put a swift end to Japan’s real estate recovery.

According to the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), the nationwide ‘chika-koji’ assessed land price saw a 1.4% increase in 2020. This was a 0.2 point improvement from 2019’s 1.2% increase.

Regional residential land prices increase for first time since 1992

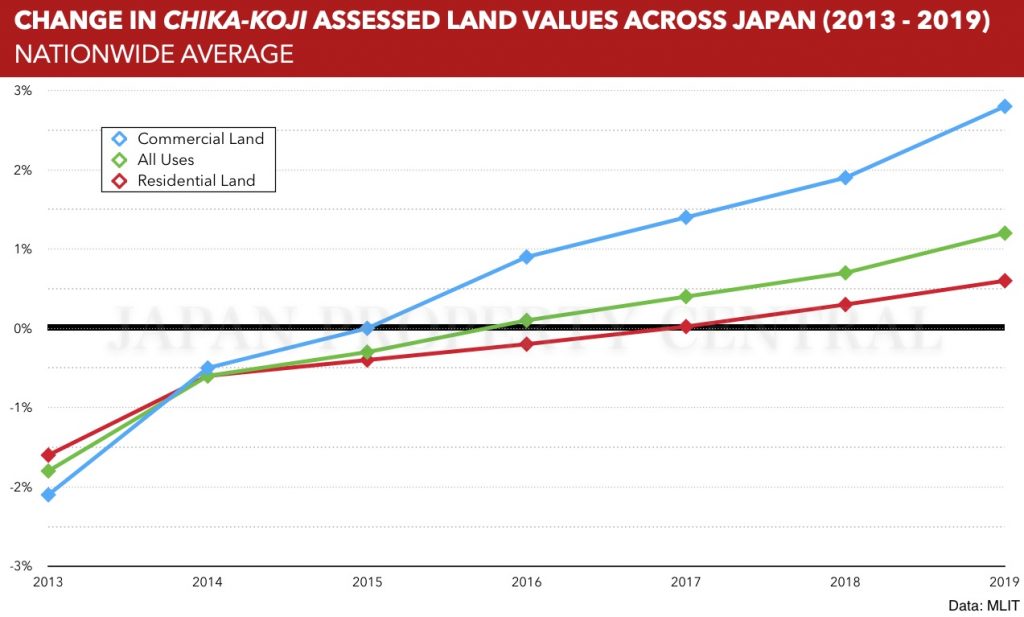

Something that is on every local investor and real estate agent’s calendar is the announcement of the koji-chika assessed land prices by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT). This year’s results came as no surprise to those in the industry, with average land prices increasing for the fourth year in a row. A 1.2% increase nationwide was reported in 2019, a 0.5 point increase from 2018.

Price growth in Tokyo more subdued than the 2007 mini-bubble

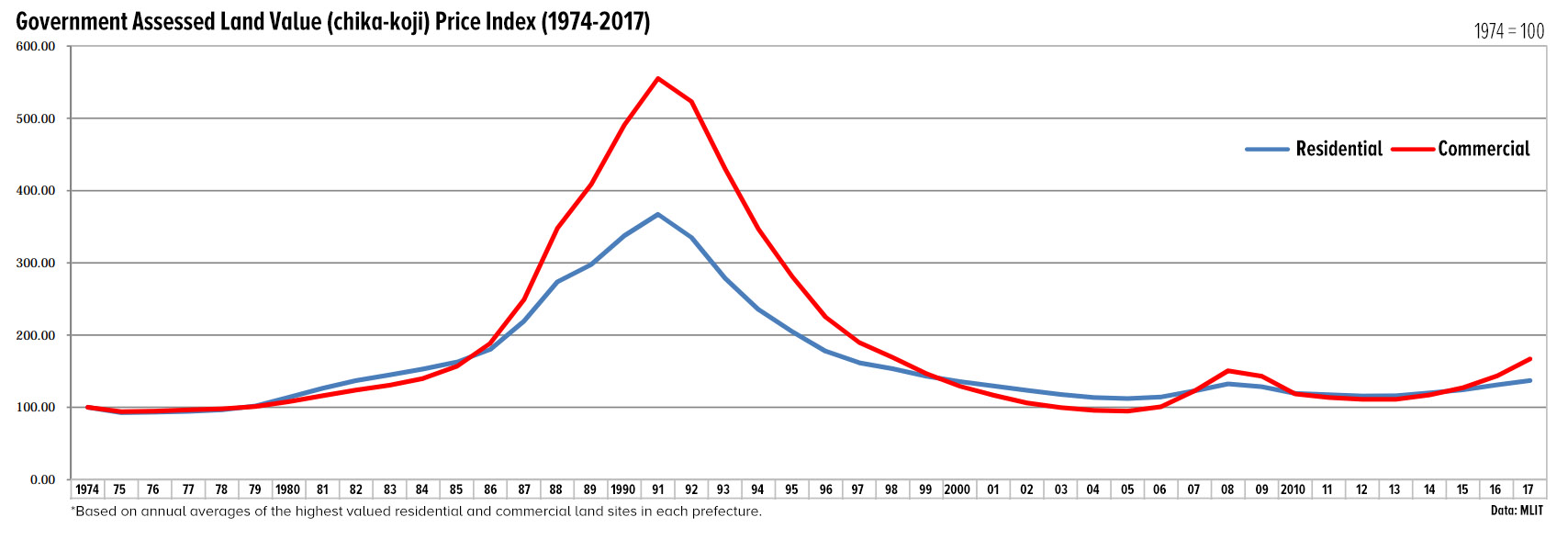

Earlier this year, rosenka tax values at a section of ultra-prime commercial land in Tokyo’s Ginza district increased by 26% from the previous year to a record high of 40,320,000 Yen per square meter, exceeding the previous high of 36,500,000 Yen/sqm in 1992 and causing some to warn of an impending bubble and overheating of the property market in the nation’s capital.

There is valid cause for concern in some sectors of the investment-property market due to potential over-construction and over-lending to landowners to build small blocks of 'apaato' type rental flats in suburban areas with low rental demand.

But are current conditions mimicking previous bubbles?

This time around Japan is getting more foreign tourists than ever before, boosting revenues for both hotels and retails shops, making the increase in commercial real estate values much more pronounced than the residential market which relies more on real domestic demand.

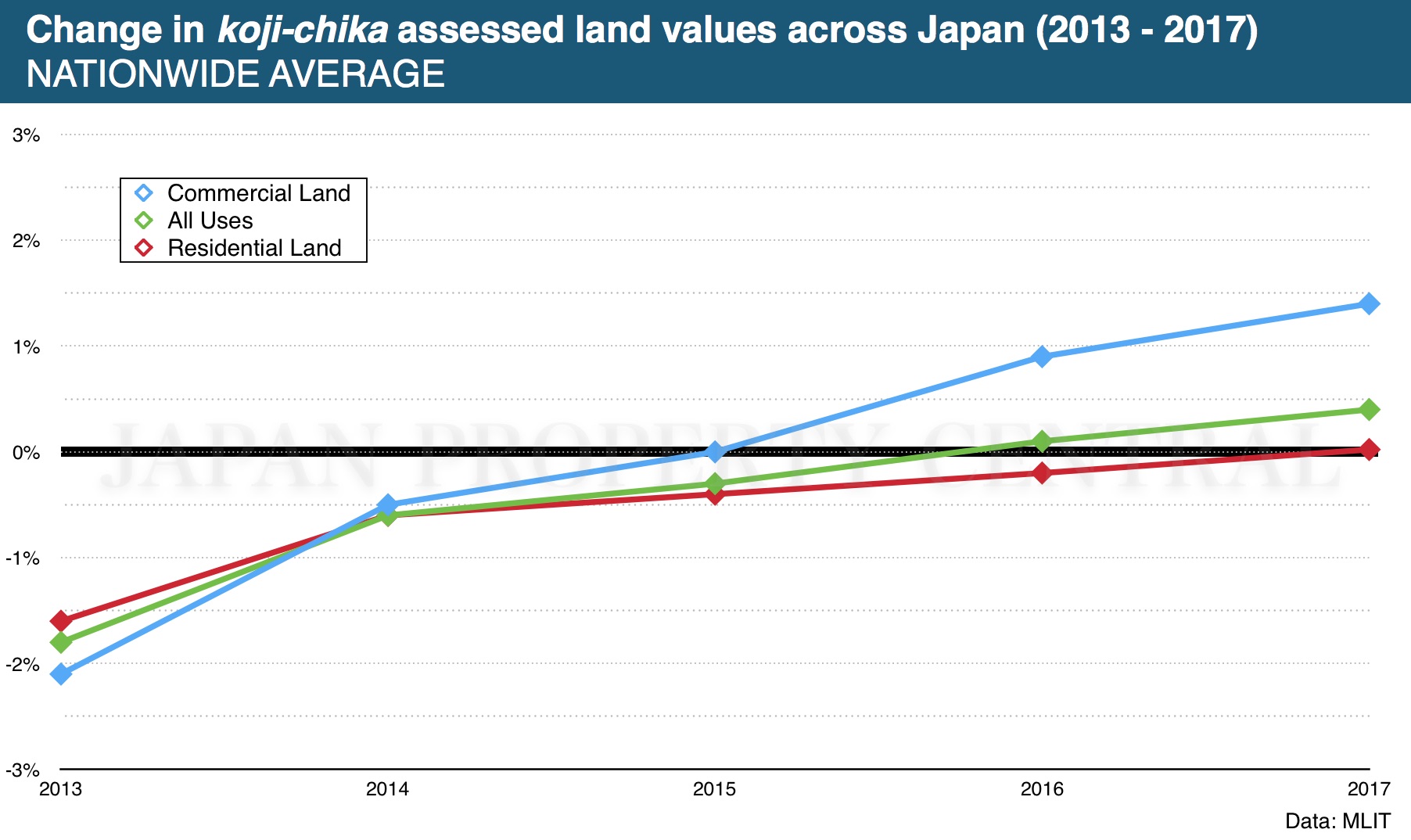

Japan’s residential land prices increase for first time in 9 years

For the first time in 9 years the nationwide koji-chika assessed land value for residential land across Japan increased from the previous year. In 2017, the residential land value increased by 0.022% from 2016. This is in contrast to a 0.2% decrease reported in 2016.

Of the 17,909 residential survey sites nationwide, 34% reported an annual increase in land values while 43% reported a decrease. The difference was particularly noticeable for land that was within walking distance to transport and shops compared to land that was further from the station and generally considered to be inconvenient. Residential land prices in regional areas decreased by 0.4%. This was the 25th year in a row to record a decrease, although the rate of decline has been shrinking for the past 7 years.Read more