Osaka office building sells at 3.5% cap rate

A 13-story office building in Osaka has been acquired by a J-REIT for 17.215 billion Yen (approx. US$121 million). Japan Real Estate Investment Corporation purchased Forecast Sakaisuji Hommachi on August 1 with delivery to take place by the end of the month. The seller was not named.Read more

A 13-story office building in Osaka has been acquired by a J-REIT for 17.215 billion Yen (approx. US$121 million). Japan Real Estate Investment Corporation purchased Forecast Sakaisuji Hommachi on August 1 with delivery to take place by the end of the month. The seller was not named.Read more

Shinagawa data center to sell for 70 billion Yen

Sekisui House Reit has sold the trust beneficiary interest in the Gotenyama SH Building for 70 billion Yen (US$517 million), a 36% premium over what it was acquired for in 2014. The sale price exceeded its appraisal value by 13%.Read more

Sekisui House Reit has sold the trust beneficiary interest in the Gotenyama SH Building for 70 billion Yen (US$517 million), a 36% premium over what it was acquired for in 2014. The sale price exceeded its appraisal value by 13%.Read more

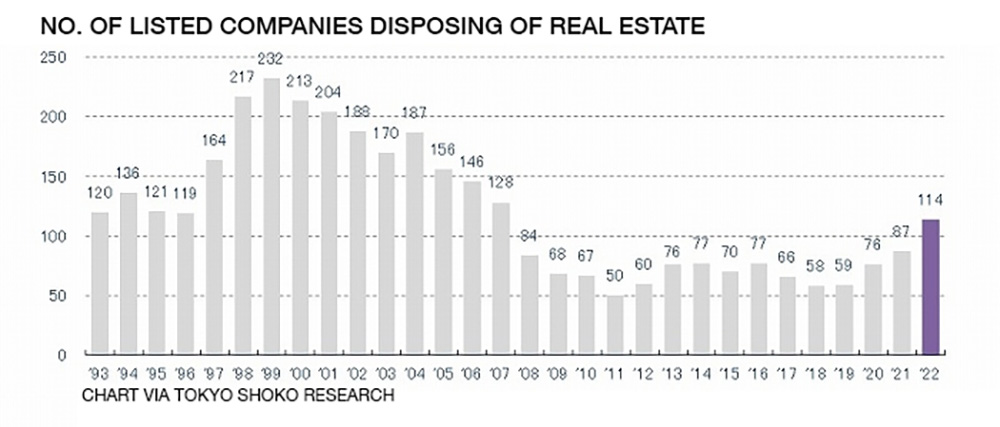

Record high number of listed companies dispose of real estate in 2022

Of the 3,803 TSE listed companies, 114 reported the sale of real estate assets in the 2022 fiscal year, according to Tokyo Shoko Research. This is the highest number seen since 2007. In the late 1990s and early 2000s, the typical annual number ranged from 150 to 230 companies.

Of the 3,803 TSE listed companies, 114 reported the sale of real estate assets in the 2022 fiscal year, according to Tokyo Shoko Research. This is the highest number seen since 2007. In the late 1990s and early 2000s, the typical annual number ranged from 150 to 230 companies.

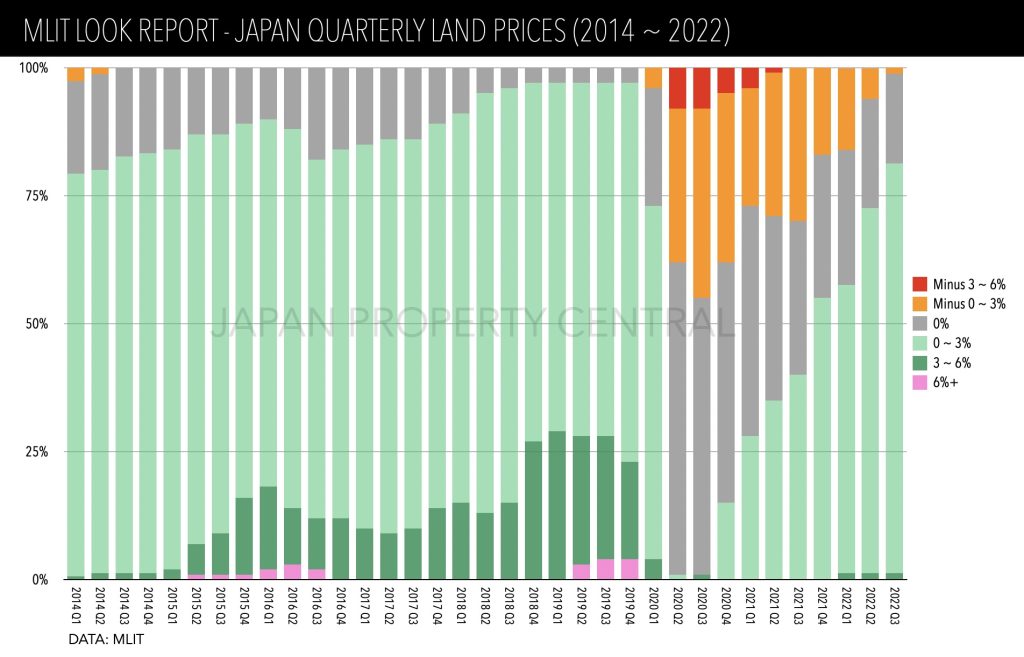

Land prices increase in over 80% of locations

According to the latest quarterly LOOK Report issued by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), land prices at 81.3% of the surveyed locations saw an increase in the third quarter of 2022. This is the highest share seen since the fourth quarter of 2019.

Tokyo Apartment Sales in November 2022

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of November 2022:

Fukuoka’s Island City has sold out

Island City in Fukuoka has sold out, and it only took 28 years. The city-developed manmade island was created in Hakata Bay in 1994. The deficit at the time of completion was 18 billion Yen, but Fukuoka City was expecting land sales to result in a 12.5 billion Yen profit.

Real estate investment appetite returns to pre-pandemic levels

Corporations in Japan are now taking a different approach to their real estate investment activities. Immediately following the initial shock of the pandemic there was a sudden move toward selling off key assets in order to prop up business sheets. Now that the pandemic is subsiding and business is returning to usual, corporations are back to seeking efficient real estate assets that provide stable revenue and allow for diversification out of traditional revenue streams.