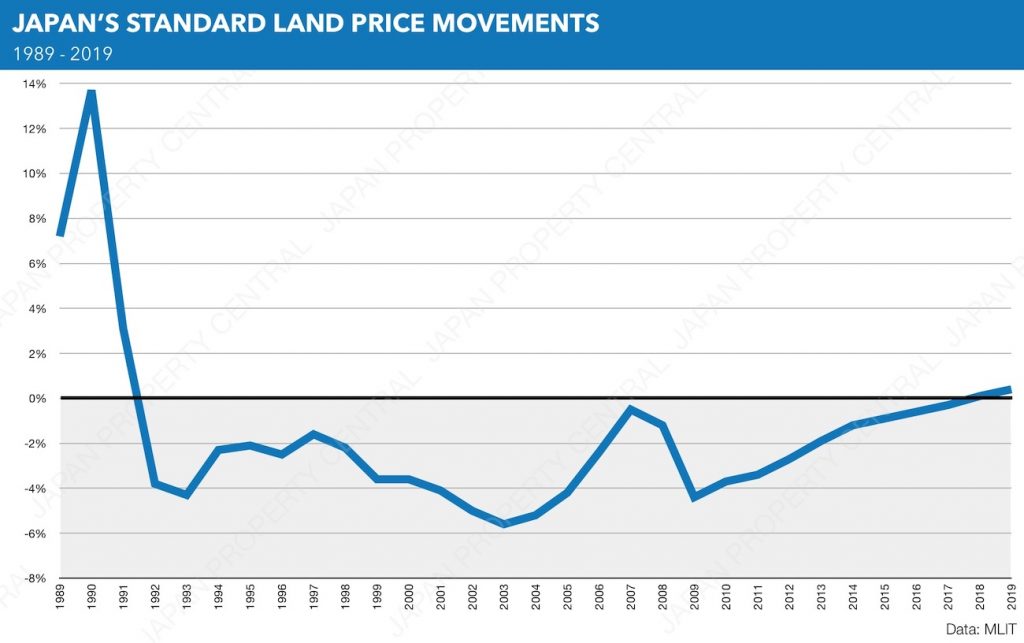

Regional commercial standard land prices increase for first time in 28 years

In 2019, Standard Land Prices for commercial land in Japan’s regional areas recorded a 0.3% increase - the first time positive growth has been seen since 1991.

Rosenka land values increase for 4th year in a row

The rosenka land values for 2019 were announced by the National Tax Agency on July 1. Nationwide, land values increased by 1.3%. This is the fourth year in a row to record a year-on-year increase. The rate of growth has also expanded, following 0.7% in 2018, 0.4% in 2017 and 0.2% in 2016. This is the first time to see four years of consecutive growth since 1992.

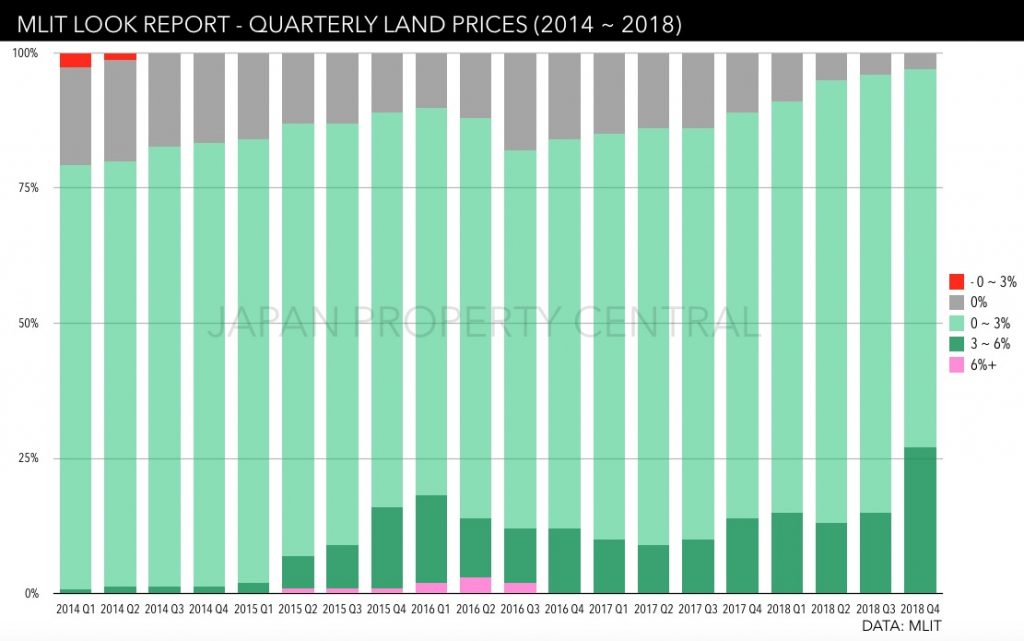

Japan land prices increase in 97% of locations, setting new record

On February 15, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) published their quarterly LOOK Report for land prices in Japan’s major cities in the fourth quarter of 2018.

According to the report, land prices increased in 97 of the 100 surveyed locations. This is the highest share in the history of reporting, beating previous records set in recent quarters. It is also the fourth consecutive quarter to see increases in over 90% of locations.

Rosenka land values increase nationwide for 3rd year in a row

This year, Japan’s nationwide rosenka land values increased for the third year in a row with an annual rate of growth of 0.7%. The rate of growth has increased from 2017 which saw 0.4% and 2016 with 0.2%.

The Tokyo metropolitan area saw a 4.0% increase, up from a 3.2% increase seen in 2017. Kyoto Prefecture saw a 2.2% increase and Osaka saw a 1.4% increase. A total of 18 prefectures saw an overall increase in land values in 2018, up from 13 prefectures in 2017. Total real estate transactions by listed companies in 2017 reached 5 trillion Yen (approx. 45 billion USD), up 20% from 2016 and the third highest annual volume in history.Read more

Price growth in Tokyo more subdued than the 2007 mini-bubble

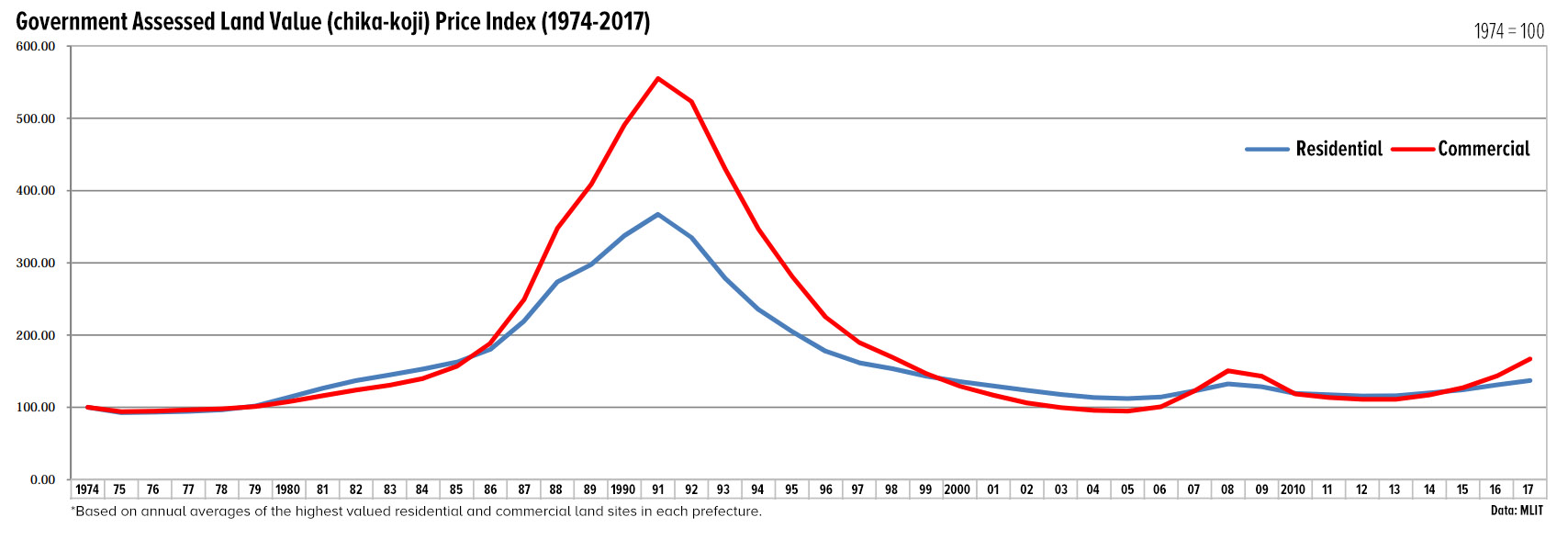

Earlier this year, rosenka tax values at a section of ultra-prime commercial land in Tokyo’s Ginza district increased by 26% from the previous year to a record high of 40,320,000 Yen per square meter, exceeding the previous high of 36,500,000 Yen/sqm in 1992 and causing some to warn of an impending bubble and overheating of the property market in the nation’s capital.

There is valid cause for concern in some sectors of the investment-property market due to potential over-construction and over-lending to landowners to build small blocks of 'apaato' type rental flats in suburban areas with low rental demand.

But are current conditions mimicking previous bubbles?

This time around Japan is getting more foreign tourists than ever before, boosting revenues for both hotels and retails shops, making the increase in commercial real estate values much more pronounced than the residential market which relies more on real domestic demand.

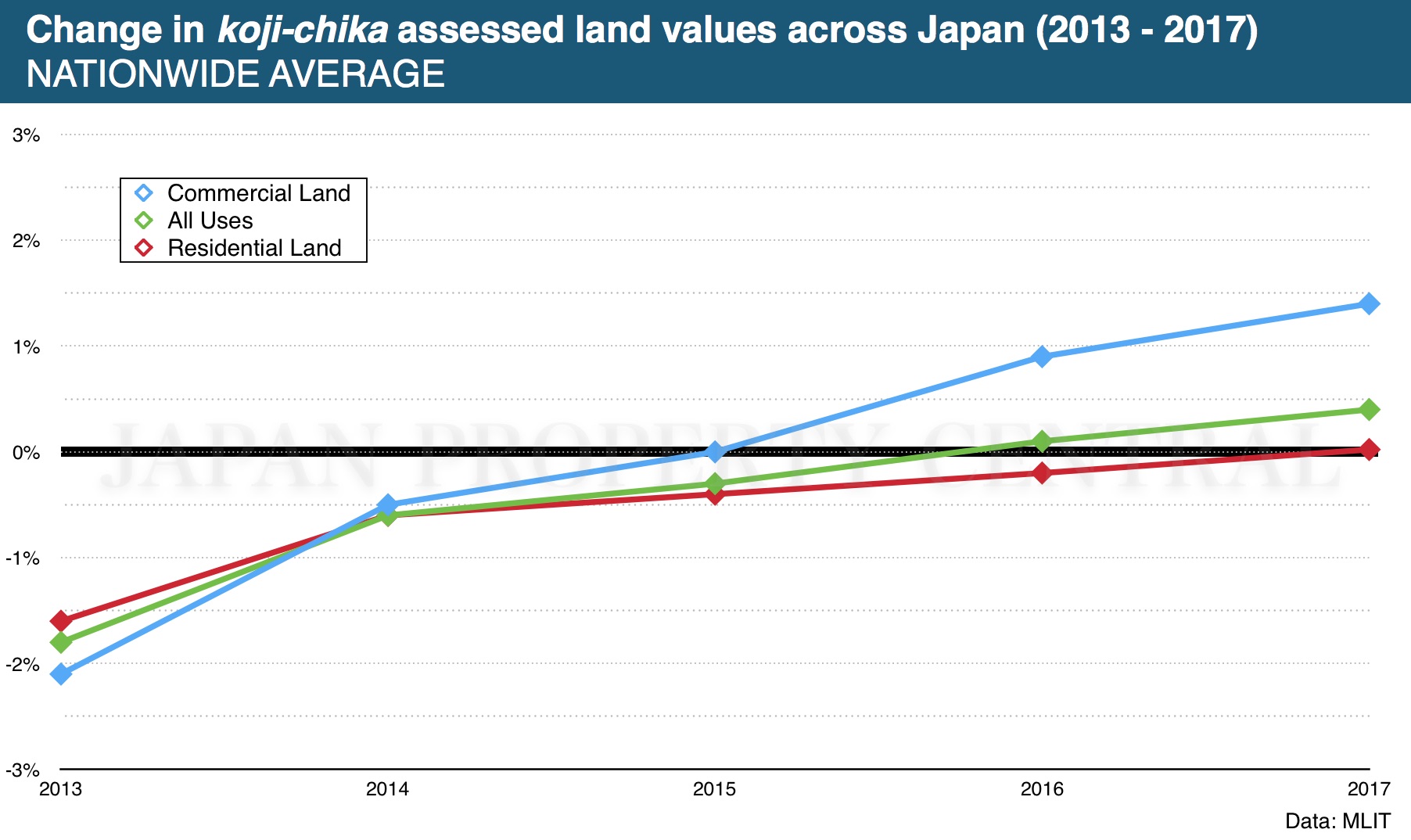

Japan’s residential land prices increase for first time in 9 years

For the first time in 9 years the nationwide koji-chika assessed land value for residential land across Japan increased from the previous year. In 2017, the residential land value increased by 0.022% from 2016. This is in contrast to a 0.2% decrease reported in 2016.

Of the 17,909 residential survey sites nationwide, 34% reported an annual increase in land values while 43% reported a decrease. The difference was particularly noticeable for land that was within walking distance to transport and shops compared to land that was further from the station and generally considered to be inconvenient. Residential land prices in regional areas decreased by 0.4%. This was the 25th year in a row to record a decrease, although the rate of decline has been shrinking for the past 7 years.Read more

Rosenka land values up in urban areas, but down nationwide

According to the National Tax Agency, rosenka land values across Japan in 2015 fell for the 7th year in a row, although the decline appears to be bottoming out. This year nationwide land values dropped by 0.4%, which is an improvement from 2014 which saw values drop by 0.7%. In Tokyo, rosenka values increased by 2.1%, after seeing a 1.8% rise in 2014. In Osaka, values increased by 0.5%.

A rapid increase in foreign tourists and a boost in investment in central Tokyo from foreign funds has helped to pull up property values and retail rents.

Midosuji Boulevard in front of Osaka’s Hankyu Department Store saw rosenka land values rise by 10.1% from last year to 8,320,000 Yen/sqm, while Meieki Dori Avenue in front of Nagoya Station saw values increase by 11.5% to 7,360,000 Yen/sqm.Read more