Shinagawa office sells for 5.5 billion Yen

A J-REIT has sold a 33-year old office building in Shinagawa for 5.57 billion Yen (approx. US$37 million), 215% above its approximate book value and 15% above its appraisal.Read more

250m tall tower to transform Yaesu's office market

Developer Tokyo Tatemono announced the official name of its new skyscraper under construction on the Yaesu side of Tokyo Station. TOFROM Yaesu is a 250-meter tall, 51-story office tower due for completion in early 2026. Redevelopment discussions began in 2000.Read more

Japan's land prices rise for four consecutive quarters

For the past four quarters, land prices rose across all surveyed locations in major cities, according to the latest quarterly LOOK report published by the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) on February 21.Read more

180m tall office tower completed in Toranomon

Construction of Toranomon Alcea Tower was officially completed on February 14, though tenant move-ins are expected to begin towards the end of the year. The 38-story office building was built on the former site of Toranomon Hospital, which was recently rebuilt next-door as part of a larger block redevelopment.Read more

Tokyo apartment rents increase 1.6% y-o-y

The average advertised rent of condo-type apartments in Tokyo’s 23 wards reached 4,332 Yen/m2 in January, according to Tokyo Kantei. This is a 0.9% increase from the previous month and a 1.6% increase from January 2024.Read more

Toyota acquires office building near Tokyo Tower

Toyota Fudosan is acquiring the trust beneficiary rights to Shiba NBF Tower in central Tokyo. The tenant office building is walkable distance from three stations and six train lines.Read more

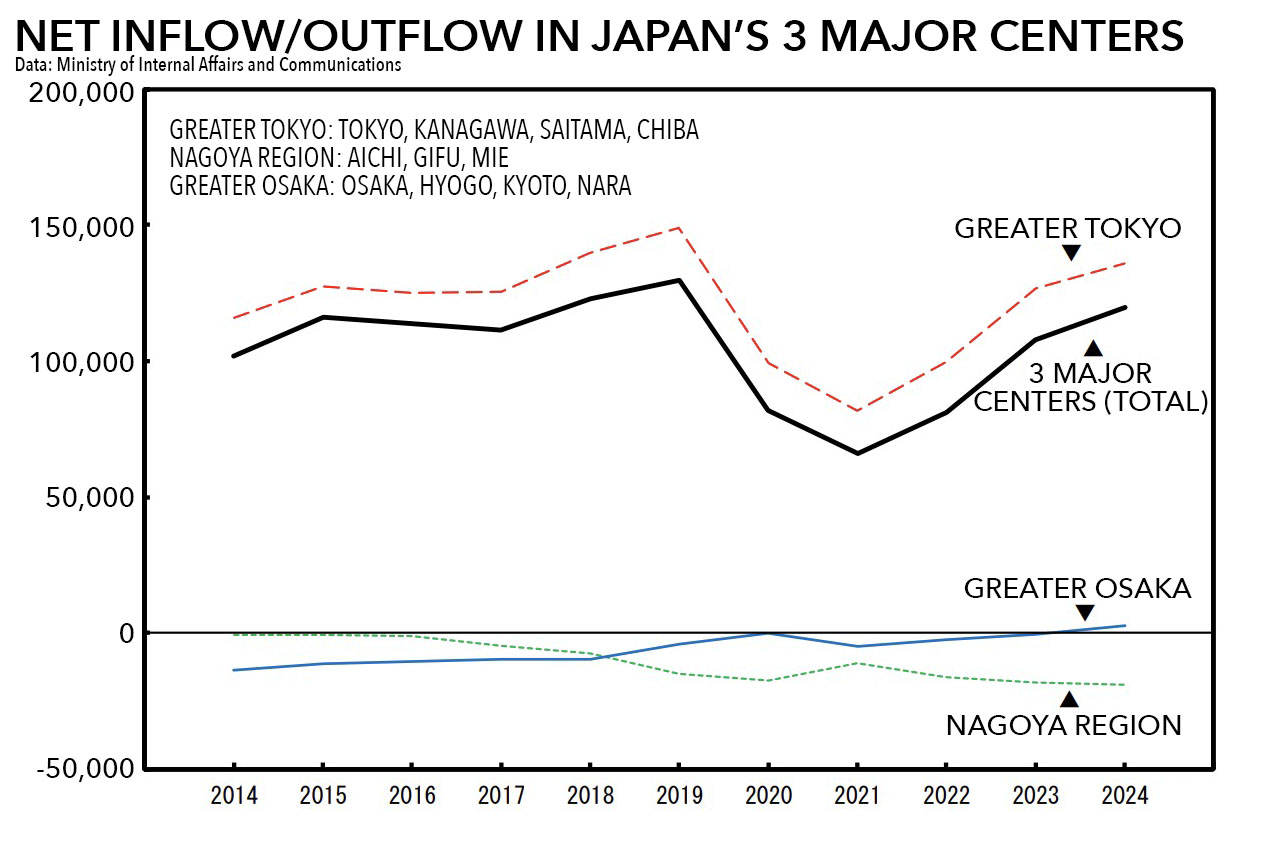

Greater Tokyo’s population sees net increase for 29th year in a row

Greater Tokyo (Tokyo, Saitama, Chiba, and Kanagawa prefectures) saw a net inflow of 135,843 residents in 2024, up 7.4% from 2023’s figures and the 29th year in a row to see a net increase. In Tokyo’s 23 wards, the net inflow in 2024 was 58,804 residents, up 9.1% from 2023 and the third year in a row to see an increase.Read more