Office vacancy rates in July 2014 - Miki Shoji

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 6.20% in July, down 0.25 points from the previous month and down 2.09 points from last year. This is the lowest level seen since March 2009 when vacancy rates were 6.05%.

The vacancy rate in brand new buildings was 17.41%, down 0.68 points from the previous month but up 4.69 points from last year.

The following office buildings were completed in July:

- Mercros Building, Nihonbashi, Chuo-ku: 9 floors; 6,980 sqm floorspace.

- Tamachi Front Building, Shiba, Minato-ku: 9 floors; 5,730 sqm floorspace.

- PMO Shiba Koen, Minato-ku: 8 floors; 3,500 sqm floorspace.

New apartment prices in greater Tokyo at 22-year high

According to the Real Estate Economic Institute, 4,222 brand new apartments were released for sale in greater Tokyo in July, up 20.5% from the previous month but down 20.4% from last year. This is the 6th month in a row to see a year-on-year decline in supply. Developers are taking caution to limit supply amidst a drop in demand following the increase in consumption tax and a steep rise in construction costs. According to Nomura Securities, the average cost of construction in May 2014 was 187,000 Yen/sqm - the highest level seen since 1993.

3,532 apartments were sold, making the contract rate 83.6%. This is 7.1 points higher than the previous month and 2.1 points higher than last year.

The average new apartment price was 55,320,000 Yen, up 14.5% from the previous month and up 7.9% from last year. This is the first time that prices have exceeded 55 million Yen since November 1992.

The average price per square meter was 771,000 Yen, up 12.9% from the previous month and up 6.1% from last year.

1,533 apartments in 18 high-rise buildings (over 20-storeys) were offered for sale, up 241% from the previous month but down 1.8% from last year. The contract rate was 93.5%.

Approximately 2,500 new apartments are expected to be released for sale in August. The institute has revised its estimated downwards and now expects between 46,000 ~ 48,000 apartments to be supplied in 2014. Read more

Secondhand apartment transactions down for 4th month in a row

According to REINS, 2,532 second-hand apartments were sold across greater Tokyo in July, down 10% from the previous month and down 14.6% from last year. This is the 4th month in a row to see a decline from one year prior.

The average apartment sale price across greater Tokyo was 26,250,000 Yen, down 4.3% from the previous month but up 2.1% from last year. The average price per square meter was 410,100 Yen, down 3.6% from the previous month but up 4.3% from last year. The average building age was 19.71 years.

1,227 apartments were sold in the Tokyo Metropolitan Area, down 11.2% from the previous month and down 12.7% from last year. This is also the 4th month in a row to see a decline from one year prior. The average apartment sale price was 31,990,000 Yen, down 6.3% from the previous month and showing no change from last year. The average price per square meter was 544,700 Yen, down 3.3% from the previous month but up 4.9% from last year. The average building age was 18.59 years.

The average sale price in central Tokyo’s 3 wards (Chiyoda, Chuo and Minato) was 44,950,000 Yen, down 9.4% from the previous month and down 0.9% from last year. The average price per square meter was 912,600 Yen, up 5.0% from the previous month and up 14.8% from last year. The average building age was 16.36 years.Read more

Tokyo apartment re-sale rankings by station in 2014

Tokyo Kantei released their 2014 report on price-to-book ratios (PBR) for apartments in greater Tokyo. Their data is ranked by train station.

Apartments around Omotesando Station saw the highest gain in re-sale value for the second year in a row with apartments worth 1.33 times their original price when new. When combining capital gains and rental revenue, the total annual gross yield of an apartment was 9.0%.

Top stations by apartment re-sale value:Read more

Residential yields and vacancy rates in Minato-ku - August 2014

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in August was 5.3%, up 0.1 points from last month but down 0.4 points from August 2013. The average gross yield across Tokyo was 7.0%, down 0.1 points from last month and down 1.1 points from last year.

The vacancy rate remains unchanged at 9.9% in Minato-ku and 11.0% across Tokyo.

The average asking price of a secondhand apartment in Minato-ku was 792,143 Yen/sqm as of August 1, up 0.79% from last month. The average asking price for land was 1,276,970 Yen/sqm, up 2.1% from last month.Read more

Suginami-ku may soon have powers to forcibly widen roads

The local government in Suginami-ku, Tokyo, is considering amending local regulations which would give them the powers to carry out the road widening and street levelling on privately owned setback land. If the plans are approved, this would be the first local government in Japan to have these legal powers.

Approximately 30% of the roads in Suginami are less than 4 meters wide and pose a hazard to the local community in the event of a disaster, such as an earthquake, as emergency vehicles cannot navigate the narrow roads and lane ways.

Under the Building Standards Act, owners of buildings that front onto a road less than 4m wide are required to shorten their block land in order to widen the road when the building is redeveloped.

Suginami’s local government currently provide financial assistance to help owners with the cost of removing any obstacles such as walls and gates in order to complete the required setback. Although landowners are required to make the setback portion of land level with the road, many owners leave the raised curbing as is with garden beds and other objects still blocking vehicle access.

Inheritance tax changes, not Abenomics, behind recent rise in apartment rent?

According to the Real Estate Economic Institute, the average price of a brand new apartment in greater Tokyo was 49,290,000 Yen in 2013, up 8.6% from the year before and higher than the average of 47,750,000 Yen seen during the ‘mini bubble’ in 2008. Sales of apartments priced over 100 million Yen have also increased, as has investment from domestic and foreign funds.

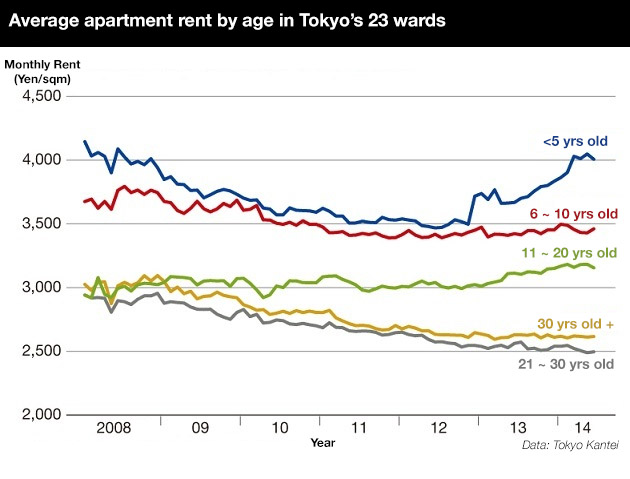

Apartment rent, however, has not shown the same trajectory. According to Tokyo Kantei, the average monthly rent of a family-sized apartment less than 5 years old in Tokyo’s 23 wards was 4,007 Yen/sqm in June 2014, up 9.2% from the previous year. For apartments between 6 ~ 10 years old, the average monthly rent was 3,461 Yen/sqm, showing almost no change from 12 months prior. For apartments aged between 21 ~ 30 years old, average rents dropped by 2.6% to 2,496 Yen/sqm, while rents for apartments over 30 years old had fallen by 0.5% to 2,616 Yen/sqm. Masayuki Takabashi, a researcher from Tokyo Kantei, said that the recent increase in the consumption tax rate has reduced the real income of consumers, which has made conditions difficult for landlords who want to achieve strong rental returns.Read more