Apartment transactions down for 6th month

According to REINS, 2,938 apartments were sold across greater Tokyo in September, up 38.7% from the previous month but down 5.9% from last year. This is the 6th month in a row to see a decline from one year prior. The average apartment sale price across greater Tokyo was 27,500,000 Yen, down 2.5% from the previous month but up 3.6% from last year. The average price per square meter was 424,600 Yen, down 2.8% from the previous month but up 3.7% from last year. The average building age was 19.81 years.

1,425 apartments were sold in the Tokyo metropolitan area, up 42.1% from the previous month but down 8.6% from last year. This is the 6th month in a row to see a decline from one year prior. The average apartment sale price was 33,780,000 Yen, down 3.1% from the previous month but up 5.7% from last year. The average price per square meter was 568,200 Yen, down 3.3% from the previous month but up 7.6% from last year. The average building age was 18.72 years.Read more

Office vacancy rates in September 2014 - Miki Shoji

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.65% in September, down 0.37 points from the previous month and down 2.25 points from last year. This is the first time since February 2009 that vacancy rates had dropped to the 5% range.

The 5% range is considered to be the tipping point between supply and demand. As a result, real estate companies have started to raise rents. Mitsubishi Jisho have begun seeking an increase of rent of around 5 ~ 10% in the 30 buildings they own in the Marunouchi and Otemachi business district in front of Tokyo Station. Mori Building have also started negotiating with tenants in relatively new buildings for higher rents. Mitsui Fudosan are also setting higher rents for new leases.

Meanwhile, office tenants continue to seek ways to control costs and mid-size and regional building owners are hesitant to raise rents. While vacancy rates have fallen sharply, rents are not increasing at the same speed.Read more

Residential yields and vacancy rates in Minato-ku - October 2014

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in October was 5.0%, down 0.6 points from the previous month and down 0.8 points from last year. The average gross yield across Tokyo was 6.9%, down 0.1 points from the previous month and down 0.8 points from last year.

The vacancy rate remains unchanged at 9.9% in Minato-ku and 11.0% across Tokyo.

The average asking price of a secondhand apartment in Minato-ku was 797,243 Yen/sqm as of October 1, down 0.9% from the previous month but up 15.9% from last year. The average asking price for land was 1,278,181 Yen/sqm, down 0.07% from the previous month but up 22.4% from last year.Read more

Tokyo apartment sales in September 2014

The following is a selection of apartments that were sold in central Tokyo during the month of September 2014:Read more

Singapore developer buys Seiko Estate, plans to build luxury residences

Singapore-based City Developments (CDL) and an US investment firm have purchased the historic and expansive estate of Seiko founder Kintaro Hattori in Shirokane for approximately 30.5 billion Yen (279 million USD).

CDL plan to develop luxury condominiums on the 16,815 sqm site and also plan to conserve the historic residence of Mr. Hattori which was built in 1933.Read more

3-Bedroom apartment for sale in Roppongi Hills

Become part of the exclusive Roppongi Hills Tribe.

| Price: SOLD | Size: 121.93 sqm (1,312 sqft) |

*This apartment sold in early December 2014 and is no longer available. It was listed for 67 days and sold at a 0% discount*

A 3-Bedroom apartment on the 41st floor in Roppongi Hills Residence B was listed for sale yesterday. This is a rare corner apartment located on the north-west corner of the building. The estimated rent on this apartment is approximately 1,100,000 Yen/sqm*. It is currently occupied by the owner and inspections are available by advance appointment only.

At the moment this is the only apartment available for sale in Residence B. Since 2012, there have only been 6 apartments listed for sale in this building and only 3 of them were over 100 sqm in size. The most recent sale was a 3-Bedroom 150 sqm apartment on a lower floor which sold for approximately 371 million Yen (2,473,000 Yen/sqm) earlier this year.

While we have recently seen prices skyrocket in other high-rise buildings around central Tokyo, apartment prices in Roppongi Hills have remained at consistently high levels for the past 10 years.Read more

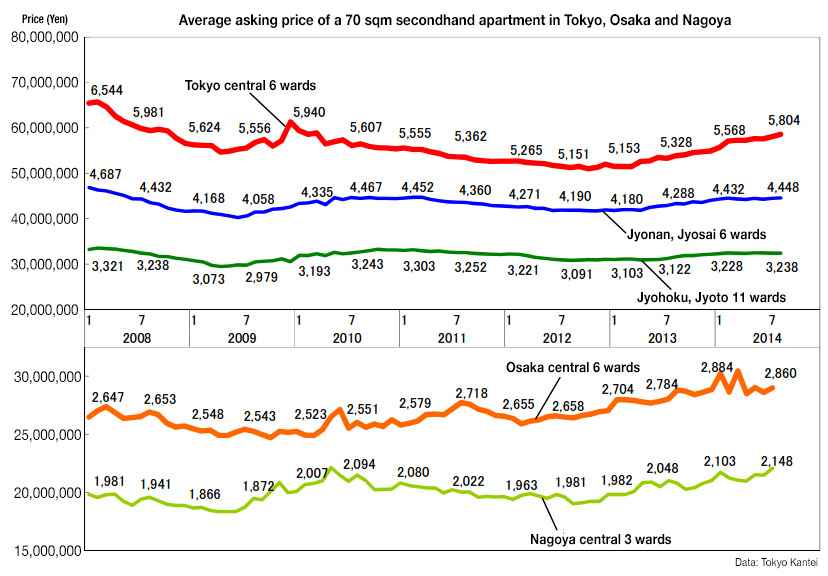

Secondhand apartment prices in August 2014 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 41,930,000 Yen in August, up 0.5% from the previous month and up 3.9% from last year. The average apartment age was 22.4 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 58,570,000 Yen, up 0.9% from the previous month and up 8.7% from last year. The average apartment age was 24.4 years.

The average price across greater Tokyo was 28,140,000 Yen, down 0.4% from the previous month but up 0.9% from last year. The average building age was 21.7 years.Read more