Shoto Governor’s Residence sells for 4.3 billion Yen

The former Tokyo Governor’s Residence in Shibuya’s high-end Shoto neighbourhood has been sold to Sumitomo Realty & Development for 4.368 billion Yen (36 million USD), or approximately 1,968,000 Yen/sqm based on the land size.

The residence was offered for sale by the Tokyo Metropolitan Government via public bidding from December 15 ~ 19. Sumitomo and another major real estate company were the only two bidders. The second bidder had tendered approximately 4 billion Yen for the property.Read more

2020 Olympics Athletes Village Plans Revealed

The Tokyo Metropolitan Government announced the model plan for the 2020 Summer Olympics Athletes’ Village in Harumi, Chuo-ku, Tokyo.

There are plans for 22 residential buildings ranging from 14 ~ 17 stories. After the games, the apartments will be sold off as either rental apartment or condominiums. Two 50-storey high-rise apartment towers will also be built after the games, along with a school and retail facilities. A total of 6,000 apartments will be supplied.Read more

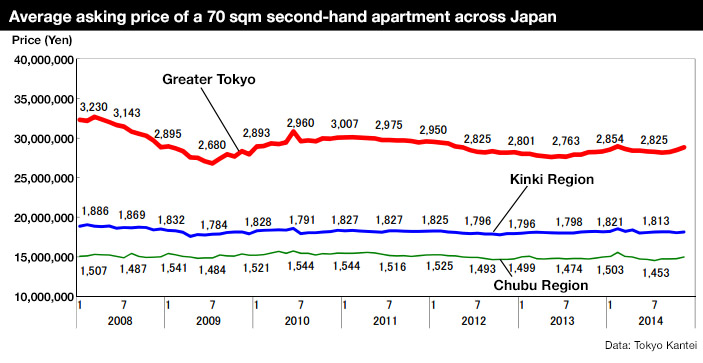

Secondhand apartment prices in November 2014 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 43,300,000 Yen in November, up 1.7% from the previous month and up 6.6% from last year. The average building age was 22.3 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 61,280,000 Yen, up 1.8% from the previous month and up 12.0% from last year. The rate of increase has been expanding since August 2014. The average building age was 21.6 years.Read more

New apartment prices in Tokyo up 10.3%

According to the Real Estate Economic Institute, 3,337 brand new apartments were released for sale in greater Tokyo in November, up 6.8% from the previous month but down 33.3% from last year. This is the 10th month in a row to see a year-on-year decline. It is also lower than the Institute’s forecast of 4,000 apartments. This is the lowest level for November since 2008 and is thought to be due to developers postponing sales in major projects until the new year.

2,617 apartments were sold, making the contract rate 78.4%, up 15.1 points from the previous month but down 1.2 points from last year.

The average new apartment price was 52,240,000 Yen, up 14.6% from the previous month and up 5.2% from last year. The average price per square meter was 737,000 Yen, up 15.5% from the previous month and up 6.2% from last year.Read more

November rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,560 Yen/sqm in November, down 1.6% from the previous month but up 0.3% from last year. This is the first time in five months to see a month-on-month decline in rent. The average apartment size was 59.90 sqm and the average building age was 19.5 years.

The average monthly rent in Tokyo’s 23-ku was 3,199 Yen/sqm, down 1.1% from the previous month but up 2.8% from last year. The average apartment size was 56.76 sqm and the average building age was 17.7 years. Although rents across all areas within Tokyo have started to weaken, they are still hovering around the 3,200 Yen/sqm range.Read more

Tokyu Plaza Shibuya to be redeveloped

The Tokyu Plaza Shibuya building to the west of Shibuya Station will be demolished in 2015 and replaced with a larger mixed and retail development.

The 9-storey multi-tenant retail building, which was originally called the Shibuya Tokyu Building, opened in 1965. In celebration of its 50 year history, a number of stores will be holding special sales from January to March 2015, while some of the restaurants which have been in operation since the building opened will prepare special menu items. A temporary gallery with photos of the Shibuya area over the past five decades is also scheduled to open from the end of January.Read more

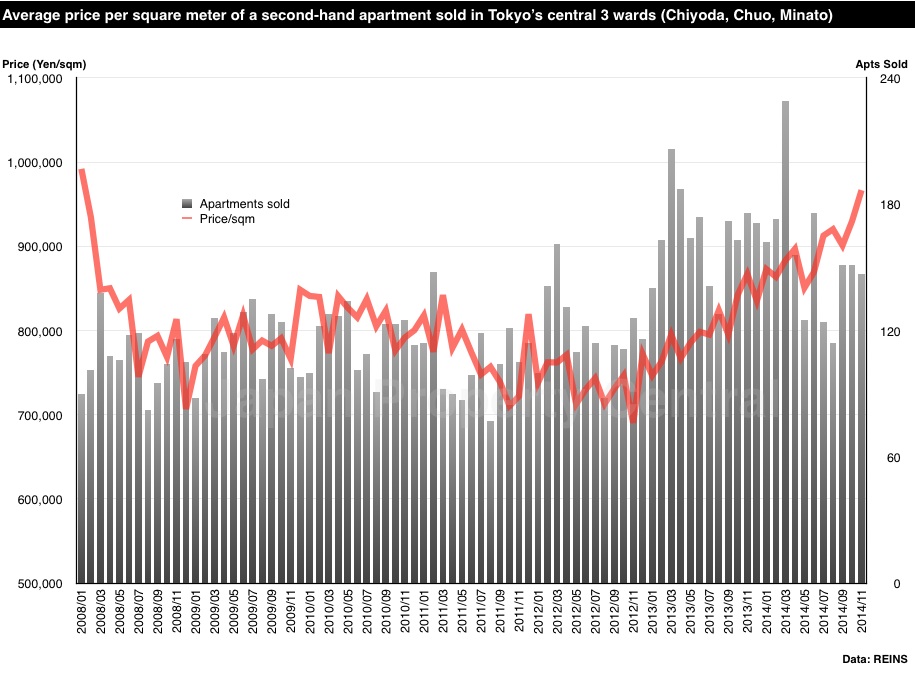

Central Tokyo apartment sale prices reach highest level in 7 years

According to REINS, 2,830 second-hand apartments were sold across greater Tokyo in November, up 6.6% from the previous month but down 9.3% from last year. This is the 8th month in a row to see a year-on-year decline. The average apartment sale price was 28,080,000 Yen, down 0.1% from the previous month but up 5.6% from last year. The average price per square meter was 441,500 Yen, up 1.4% from the previous month and up 7.1% from last year. This is the 23rd month in a row to see a year-on-year increase. The average building age was 20.04 years.

1,431 second-hand apartments were sold in the Tokyo metropolitan area, up 10.2% from the previous month but down 7.1% from last year. This is also the 8th month in a row to see a year-on-year decline. The average sale price was 34,080,000 Yen, down 2.0% from the previous month but up 5.2% from last year. The average price per square meter was 575,800 Yen, down 1.5% from the previous month but up 6.3% from last year. The average building age was 19.20 years.

In central Tokyo's 3 wards (Chiyoda, Chuo and Minato), the average sale price was 966,600 Yen/sqm, up 4.0% from the previous month and up 11.5% from last year. This is the highest price seen since January 2008 when prices were 991,900 Yen/sqm.Read more